Options prices and putcall parity

Post on: 11 Июль, 2015 No Comment

Although references to the basic underlying principles have been highlighted by authors long before the advent of the 20 th century, the modern concept of put-call parity in options pricing was first identified by Stoll in his ground breaking work in 1969.

What the put-call parity principle in fact says is that the value of a put option at a certain strike price also implies the fair price of the corresponding call option and vice versa. The argument behind this theoretical price relationship is that if, for example, call options with a specific strike price and expiration date were more expensive (or cheaper) than the put options with a similar strike price (distance from the money) and expiration date, an arbitrage opportunity would arise. Arbitrageurs would be able to cash in on this opportunity to make a profit with a completely risk-free trade, regardless of what the market price of the underlying asset does.

The 3-way relationship

One can easily illustrate the principle by referring to the 3-way relationship that exists between call options, put options and the price of the underlying asset. In theory it is possible to use a combination of two of these components to create the third. If price disparity arises between any 2 of them and the third, an arbitrage opportunity will arise.

A simple example is that of the synthetic call. Even beginner options traders are familiar with the concept of a long call. The maximum loss a trader can sustain with this trade is the cost of the call options and the maximum profit is the increase in the price in the underlying asset less the premiums paid for the call option.

What many novice traders do not know is that one can also create a synthetic call by purchasing a put option and simultaneously buying the underlying asset. Both trades should have exactly the same risk/reward profile – unless an arbitrage opportunity exists. The second alternative is commonly known as a Protective Put.

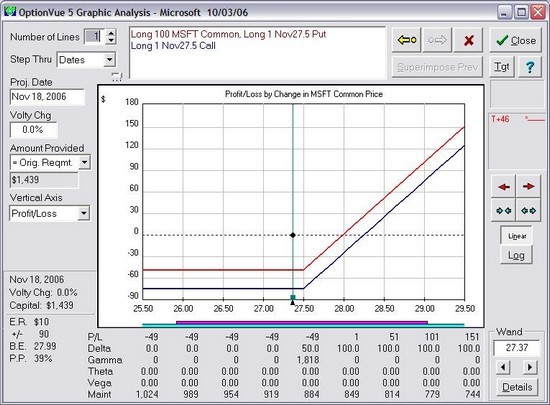

Fig. 9.10(a) represents the risk/reward graph for both a hypothetical long call and a protective put.

Fig. 9.10(a)

A trader who is lucky enough to stumble upon a situation where there is a significant difference between the price of a call option and its put counterpart can make a risk-less arbitration trade by executing either a conversion or a reverse conversion strategy.

A conversion simply involves:

- Buying the underlying asset.

- Simultaneously buying a put option.

- Selling a call option.

Barring commissions and the costs involved in the spread this will result in a profit if the amount of the disparity was big enough.

A reverse conversion consists of the following steps:

a) Shorting the underlying asset.

b) Buying a call option.

c) Simultaneously selling a put option.

Once again this will result in a profit if the amount of disparity was large enough – otherwise the trader will simply be ‘locking in’ a loss.

Although market makers attempt to at all times ensure put-call parity, disparities do arise from time to time. In a rising market, call options sometimes become significantly more expensive than their put counterparts with the same expiration date and at the same distance from the money. The extent of the disparity is seldom large enough to warrant a conversion/reverse conversion if one takes the trading costs into account – but that does not say a diligent trader will never encounter such a risk-less profit opportunity!