Options Calculator

Post on: 8 Апрель, 2015 No Comment

Options Calculator Putting The Odds In Your Favor

Posted on May 22, 2011, 8:09 pm, by admin, under Options Calculator.

If you’re new here, you may want to subscribe to my RSS feed. Thanks for visiting!

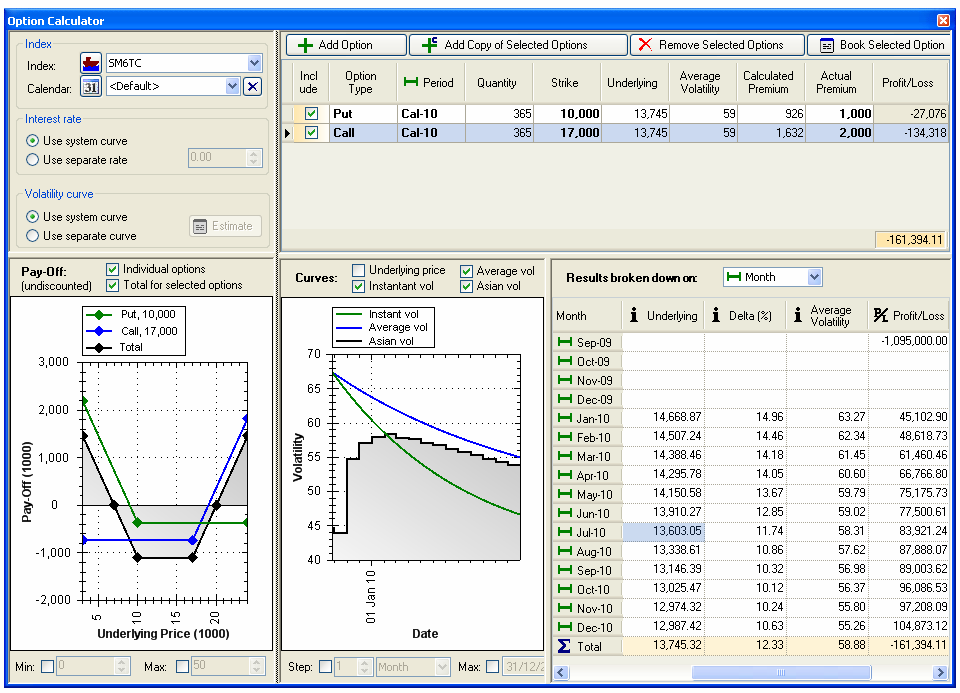

There are actually quite a few places online where you can find options calculators to help in determining which options to buy or sell when investing in this manner. Many of the major online options related educational sites provide a variety of different calculators one can use including the CBOE OptionsEducation.org as well as many of the more option friendly brokers.

Options Calculator Gamma Scalping

Posted on October 28, 2010, 8:37 pm, by admin, under Options Calculator.

A great way for option traders to generate consistent income in extremely volatile markets is called Gamma Scalping. When the market / underlying instrument is making huge moves and swinging around wildly, this is a strategy that thrives unlike the traditional monthly income strategies such as iron condors, calendars, credit spreads, etc.

One way to think of gamma scalping is to compare it to day trading where the trader is looking to capture profits from quick little moves however the difference here is that due to this strategy set up most of the risk that is normally associated with day trading has been removed. An options calculator can be used to help in determining how to go about setting up these trades, such as which strikes to use, when to place the trade, etc however it can also be done with other criteria such as vol levels, deltas, etc. Also, the set up for this trade can profit regardless of what the stock or index being used winds up doing. If it moves up, a gain is made. If it moves down, a gain is made. And then, when a profit has been realized, the trader can immediately lock in that profit and re-set the position so that it will profit again regardless what happens from that point forward.

When gamma scalping the trader doesnt care which way the market will be heading. The trade is set up to profit either way. Up or down its all good. And the bigger the moves, the better.

After a predetermined profit has been realized from a move in either direction, a quick adjustment is made to the trade to lock that profit in forever. Again, an options calculator can help in making these adjustments however other option related criteria can also be used. And, this same adjustment re sets the position to kick out even more gains no matter what the stock being used ends up doing, even if it just moves right back to the same spot it started from when the trade was first put on. The best part is that this simple technique can be used over and over again on the same trade constantly chipping out cash from the same position.

One of the most frustrating things to directional traders is when a trade actually goes in their direction, making them profit, only to immediately revers and go the other way, wiping out their gains, and perhaps even then dipping lower putting them into losses. Gamma Scalping is a strategy that can erase that frustration because it immediately locks in those realized gains while repositioning itself to once again be profitable if the underlying instrument moves either way.

Once a gain is showing on the trade through gamma scalping you can lock that in. And once again, the method used to lock that profit in, positions the trade back to its starting point where if the underlying continues moving in the same direction or stops and returns back to where it came from MORE profits can continue.

During wild crazy times, especially like the extremely volatile markets we are currently experiencing in the markets, Gamma Trading should be considered a must have method for option traders to learn how to use correctly.

And last but not least its a really fun way to trade as well.