Option Speads How to Use Spreads to Manage the Costs of Trading

Post on: 4 Июнь, 2015 No Comment

Introduction

Many investors are attracted to the options market as it gives traders leverage. and the ability to generate robust returns on capital. For example, most stock options contracts provide the option buyer with control of 100 shares of the underlying stock, without posting capital equal to the market value of the shares.

The problem that many option buyers face is that option premiums that are at the money or in the money are expensive and are a function of a number of inputs which includes time. This means that for an option to be “in the money” the underlying shares not only have to move above the strike price of a call option but it also means that the price needs to move there before the option expires.

Options are a decaying asset. With no change in any of the underlying security, an option will lose part of its value every day until it expires worthless. Time value only as it relates to an option only declines in value, so as an option buyer one must overcome the effects of time decay in order to make money.

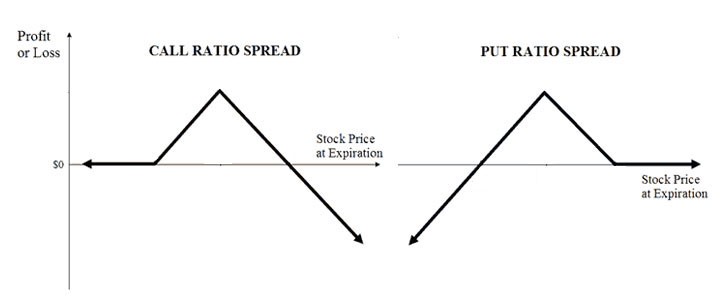

In an effort to manage the costs of option premiums investors can use spreads to create option structure that has specific payout profiles.

Spreads option trades require two or more option positions, which can have expensive transaction costs for investors who are not educated in the process of understanding how to place a spread trade. Many brokers quote the trades as a spread, which will allow and investors to mitigate the bid offer spread that could occur if each option were purchased separately.

Vertical Spreads

Vertical spreads involve trading two options of the same type (two calls or two puts), with the same expiration, but with different strike prices. One of the options is purchased and the other option is sold. For example:

A bullish call spread on Apple stock is when an investor purchases a 600 call and simultaneously sells a 650 call.

There are a number of types of vertical spreads which include both credit and debit spreads, which can be further categorized as bullish debit/credit spreads or bearish debit/credit spread.

Debit Spread

A debit call spread is one in which an investor places a vertical option spread trade and is willing to pay cash to the seller in order to initiate a position. For example, the January 600-650 vertical call spread with 15 days to expiration would cost an investor $2.20 cents per contract. The debit is calculated by subtracting the price of the more expensive, closer to the money call (2.80) when Apple stock is at $530 from the less expensive $650 call (.60), to create a debit of $2.20.

The payout profile for a vertical call spread is as follows:

If the price of Apple stock rises above $602.20, the investors will break even on the vertical debit spread. Any price movement above that level will generate a profit for the investor. The payout profile reflects a loss until the stock price reaches the break-even level and then profits until the price of the underlying stock reaches the sold call level at $650.

Investors should always attempt to purchase a debit spread as a unit and not as two legs. Markets are constantly moving and an investor is more likely to leg into a spread with negative cost ramifications than gaining from purchasing one option and then selling another.

A bullish debit spread is a vertical spread in which an investor purchases a call, and simultaneously sells a higher prices call option. A bearish debit spread is a vertical spread in which an investor purchases a put and simultaneously sells a lower priced put option.

The two most common ways to determine the strike prices to be used in the debit spread is for an investor to determine his profit goals. For example, if an investor believes the market will move only a relatively small amount then would want to purchase an “at the money” strike and sell an “out of the money” strike.

An alternative method would be to purchase and “out of the money” call, and sell an even further “out of the money” call. The latter type of debit spread would reduce the cost of the premium for the debit spread. By moving the strikes of the spread further away from the current underlying value of the security, an investor reduces the cost of the spread.

Advantages and Disadvantages

The advantages of trading a debit spread are that your risk is limited to the premium debit made to place the trade. The debit spread provides a trader with an opportunity to generate a robust risk reward profile. For example, the risk associated with the APPL 600-650 Call spread is the premium of $2.2, while the potential reward is $50 a share (the difference between the bought and sold strike prices).

The debit spread will also mitigate the costs of taking a directional view on an underlying security using options.

The disadvantages of a long vertical call spread (also known as a bullish call spread), is that your upside reward is capped by the higher call that is sold. Taking profit requires patience, in an effort to avoid paying a bid offer spread on both sides of the vertical option spread.

Vertical spreads will also incur skew risk. This type of risk occurs if there is more or less demand for an out of the money option (read more about different types of risks in options here). For example, there will be times when a 10% out of the money put option has a higher implied volatility than an at the money option. If this is the case, a debit spread is beneficial as the sold option has a higher relative value than the at the money option. If on the other hand, the out of the money option has a negative skew, a debit spread option will be selling an out of the money option that has a lower volatility than an at the money option.

Credit Spreads

A credit spread is a vertical spread were the investors receives credit in the form of premium from the simultaneous sale and purchase of the same option type with different strikes that expire on the same date. The goal of an investor who trades credit spreads is to capture income by speculating that a security will remain within a specific range.

The bull put spread option strategy is used when the options trader thinks that the underlying stock will move upwards before the expiration date. Typically, to implement this strategy, the trader must simultaneously sell a put option while purchasing a lower striking put option of the same underlying asset and expiration date. The options traders goal is to start off with a net gain, and hope that both options expire worthless.

The breakeven point for the bull put spread strategy occurs when the difference between the stock price on expiration and strike price of the short put matches the premium received for the option strategy.

Breakeven Point = Strike Price of Short Put Net Premium Received

Advantages and Disadvantages

The advantage of using a credit spread is that an investor can garner income from the trade as long as the security does not rise (or fall) more than the strike +- the premium.

This disadvantages of a short vertical call spread (also known as a bearish calls spread) is that the risk reward profile is not advantageous. Similar to debit spreads, credit spread investors are subject to skew risk (discussed earlier) in which the implied volatility of the purchased option can be greater (or less than) the strike price of the option that is sold.

When to Use Debit or Credit Spreads

Vertical spreads either credit or debit, can be used to increase returns by taking directional views on an underlying security. There are bullish debit and credit spreads, along with bearish credit and debit spreads.

One of the key components that can assist in driving an investor’s decision of which spread to use is the current implied volatility of the security, along with the skew. Implied volatility is the market’s estimate of how much as security will move over a specific period on an annualized basis. Implied volatility is a component in determining the price of an option, and is generally high when fear is pervasive in the marketplace. Implied volatility is generally low when market participants become complacent.

A debit spread produces a positive exposure to implied volatility, which means as implied volatility increases the value of the debit spread will generally increase (read more about options volatility here). With this in mind, investors should look for relatively low levels of implied volatility when purchasing debit spread.

On the other hand, a credit spread produces negative exposure to implied volatility, which means that as implied volatility declines; the value of a credit spread will increase. Investors should look for relatively high levels of implied volatility when purchasing credit spreads. As discussed early the skew also can play a role in determining which type of spread to purchase.

Vertical spreads are dynamic structures that allow investors to finely tune their trading strategy and initiate risk that is in line with current market conditions.

The chart of time decay (Theta) shows that as time moves toward expiration the value of an option erodes.

Options spread strategies allow an investor to minimize risk and time decay, by creating structures that mitigate exposure by using two or more options to offset some of the risks associated with a single option position.