Option Greeks

Post on: 4 Июль, 2015 No Comment

What are option greeks? More importantly, how do they affect the way I trade?

Because options are a derivative product, the pricing of the options is much more complex. The factors that can influence their pricing are also much more varied than than their stock or ETF counterpart.

Factors than can influence the pricing of the option include:

- Price of the underlying stock or ETF

- Time until expiration

- Volatility of the underlying stock or ETF

- Current interest rates

There are complex formulas to model and determine an options’ theoretical price. The above components are considered as factors in the formula and together are called ‘the option greeks’. It is important to understand each of these factors as well as how to use them in trading.

Option Greeks One-By-One

Let’s take a look at each of the option greeks one by one before considering how to take advantage of them.

If I owned 100 shares of XYZ stock and XYZ moved up $1, the value of my position would have increased by $100 ($1 times the number of shares I own). If I owned 1 contract of a call option for the same XYZ stock and the same stock moved up $1, my position would not move up the same amount. One of the reasons is related to the option greek called ‘delta’..

Delta measures the rate of change of the option for a $1 move of the underlying stock or ETF. If I owned a call option and the underlying stock moved up, I’d expect the value of the option to increase by some amount. Likewise, if I bought a put option and the underlying stock move down, I’d expect the value of the option to increase, which is an inverse relationship. It isn’t surprising then that a long call has a positive delta and a long put has a negative delta.

Delta, like most of the other option greeks can be applied to an overall portfolio. As a result, if I had a portfolio delta of 100, then I’d expect the value to increase by $100 for a corresponding movement of the underlying. In this way, delta can be used to measure or indicate the overall portfolio risk. It can also indicate to me the bias I have in my portfolio. A positive delta would indicate a bullish bias in my portfolio. Likewise, a negative delta would indicate a bearish bias in my portfolio.

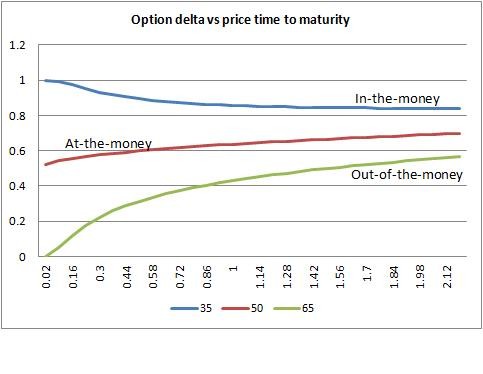

Another way in which delta can be used in relation to an individual option is to indicate the approximate probability that the option would expire in the money by a penny or more. In that respect, it wouldn’t be surprising then to find that an option that was exactly at the money would have close to a .5 delta indicating a 50% probability of the option expiring ITM. The deeper ITM the option is at a given point in time, the higher the delta (or probability of expiring ITM). Likewise, the farther OTM the option is, the lower the delta and the lower the probability of expiring ITM.

Given that the delta is an approximation of probability, it isn’t surprising that time would be a factor in the calculation of delta. One way to see this is to look at a delta of a given strike price across different option months. The closer to expiration the option is while deep in the money, the closer to 1 the delta will be (i.e. 100% probability of expiring ITM).

Given that delta is a representation of probability, it would be expected that the delta of an option would not remain the same as the price of the underlying changes.

Gamma is the measurement of the rate of change of delta as the price of the underlying moves. As an example, let’s say that the initial delta of a call option is .30 and the gamma is .03. As the underlying moves up $1, the option will increase by $.30 per share. At the same time, the delta becomes .33. As a result, if the underlying moves up an additional $1, the option will now increase by $.33 per share.

Since gamma is related to delta and therefore related to probability, gamma also will change with time. This becomes interesting as one considers what happens as the time until expiration approaches. At several months out, the gamma will be relatively small and will vary only a small amount as strike prices move farther away from the current price. However in the last week or so of an option month, the characteristic of gamma changes. Notice how the strikes ATM and nearby become quite large while the gamma drops significantly as the strikes move away from the ATM price.

This has the affect of causing the ATM options to change dramatically with relatively small changes in the underlying. This is one reason I don’t hold options into the last week of the option cycle.

Options are often referred to as wasting assets. If I buy an option (call or put) and nothing changes, I will find the value of the option losing value day by day. This time value effect is an option greek called ‘theta’. As a result, a long call or put will have negative theta and a short call or put will have positive theta.

The thing about theta is that time decay does not happen consistently as this image illustrates.

Options that are farther out in time will tend to decay slower than options that are closer to expiration. This factor is why calendar spreads work so well.

This time decay is the bane of the option buyer since an option you buy will have negative theta. However, what is the bane of the option buyer is the bread and butter of the option seller. Most of the options strategies I employ are some form of option selling strategy, all of which are positive theta trades.

If you think about how options are priced, probability plays a factor. Given that volatility (i.e. the amount of price fluctuation) can affect potential price outcome, it makes sense that volatility would affect the probability of a given price being hit. This effect of volatility on the price of an option is called vega.

The effect of vega is an important factor to consider, both in the case of an individual option and for spreads. Here’s just one example. I buy an out of the money call option with volatility elevated after a bit of a market sell-off. Because of the elevated volatility, the cost of the option is also elevated. As a bounce takes place, the stock moves up as I have anticipated but volatility drops. As a result, my option is still worth pretty much what is cost me when I bought it even though the stock went in the direction I expected. Why?

Long calls have positive vega. That means I can expect the value of the option to generally increase with a rise in volatility and decrease with a drop in volatility. As the underlying moves up, the volatility decreases and extrinsic value begins to drop out of the option. Unless the momentum and magnitude of the move can overcome this, the option may stay the same or even drop in value.

By the way. for those who know their Greek alphabet, vega is not an actual Greek letter like the others but is still considered one of the option greeks.

Rho is one of the lesser known and understood option greeks. The reason for this is that it doesn’t have the impact on option pricing that the factors do.

Rho measures the sensitivity of an option price to changes in the interest rates. Without getting into a complicated analysis, I’ll just say that the reason interest rates affect the option price is due to the comparative value of simply holding cash and earning interest. When it becomes more attractive to buy a call when interest rates are higher for example, we’d say that a call has positive rho.

If you take the time to look at the values of rho in the option chain, you’ll see that this number is typically very small relative to a 1% change in interest rate. This explains why rho isn’t referenced much and why I don’t reference it as a rule.

Additional trivia

There are some other lesser known option greeks, such as lambda — an alternative real Greek letter for volatility, omega — a measure of leverage of an option, and beta — which isn’t an option greek but measures the relationship between price movement of a stock and the broader market. You may run across them at some point but don’t be too put off. The greeks listed above are the primary ones that an options trader will deal with from day to day and that’s the most important thing.

Putting it all together

By now, you may have gotten the idea that there are a knobs to turn that affect option price. The difficult thing to illustrate is how these option greeks all interact. No one of these components is independent of the others. Time affects delta. Volatility affects delta. Time affects gamma. You get the picture. I’ve discussed these as individual and independent components but realize they all work together as these factors change.

The good news is that it isn’t important to know the details of each of these factors. Let me boil it down to a simple table that help things make a little more sense.