Operational risk concerns concentrate on due diligence

Post on: 3 Июль, 2015 No Comment

Issues surrounding the evaluation and monitoring of operational risk in hedge fund investments are becoming increasingly important. Stephen Quigley discusses challenges and options facing hedge funds and explores some of the concerns of investors.

Operational risk is thought by some in the industry to exceed even the risks related to the investment strategy. Investors need to know that all the risk processes of a hedge fund are sound before they make the crucial decision of whether to put money into it or not.

Stenham, the independent wealth management group, has been advising on and managing multi-manager hedge fund portfolios for over 20 years. Managing risk by diversifying geographically is a major part of its philosophy.

Nicola Rendall, operational due diligence analyst at Stenham, has a checklist of risk areas she views with rigorous attention.

As an investor into single manager funds, we look at the entity’s structure, systems capacity, people, the team, legal areas, risk management, trade processes, reconciliation reporting, cash, pricing of valuations, counterparties, business continuity processes and financial statements. We are also looking for an independent administrator to verify the valuation on the portfolio, she says.

Since over half of hedge fund collapses are related to a failure of one or several operational processes, paying attention to these areas should give a good indication of the fund’s internal controls and procedures.

Operational risk has come into its own in the last two or three years, Rendall says. Many hedge funds have failed due to operational weaknesses. For example, they were not looking at exposures and collapsed due to liquidity issues surrounding their internal controls and risk processes. A few years ago operational risk was not deemed as an important function. Now this has changed to the extent that managers view operational risk as important as market and credit risks, she says.

She believes a segregation of duties is vital when looking at the risk management process. Ideally a fund should have an independent chief risk officer who looks at risk monitors and has the authority to stop the portfolio manager from trading if they reach a risk limit.

Liquidity is also important for Stenham. The company looks for any large lock-up periods within the fund that could restrict liquidity and redemptions. In the present climate of tight liquidity, Stenham wants to know how funds hold excess cash and manage cash processes.We want to see if they are holding cash with one or multiple prime brokers or whether they are investing in money market funds. If this is the case, we need to know underlying instruments in those funds, for instance are they US government-backed treasuries and bonds.

Rendall believes constant communication with funds is vital. We like to monitor assets under management each month to ensure funds are not losing assets, especially in the current climate. We perform on-site visits every year and we read each fund’s monthly investor report to ensure any changes within the fund are recorded, she adds.

Three-way reconciliations between the prime broker, the fund and the administrator should identify trade breaks, while independent, third-party valuations are important because they detect pricing problems, Rendall adds.

Managers have got to make sure collateral management is up to date so you know where the margin calls might be. We have to make sure the transparency is there from the prime broker, she says.

Stenham also looks to see if the fund has sufficient staff and resources to support capacity. It looks at the fund documentation and the corporate organisation. In addition Stenham wants to see if the company makes it a priority to review legal documentation. We will look at the risk management processes to see if they are implementing stop-losses and to see how that links with their front-to-back systems. We want to see who is monitoring what and where the monitoring is occurring, explains Rendall.

Penny Cagan, managing director of the operational risk content business at Algorithmics, takes a similar view. She believes it is important to put good-quality operational risk practices into place during less challenging times in order to protect the fund when it faces difficult circumstances.

As hedge funds become larger and have a broader base of exposures, there is a demand for operational risk and due diligence from all sides. It is not just investors who are interested in operational risk, Cagan says.

First duty to investors

She thinks a hedge fund’s first duty is to its investors. One of the biggest risks a hedge fund investor faces is a run on the fund. They can protect themselves against this by looking at the due diligence processes to see how funds are managing their growth and asset portfolios. Investors want the hedge fund to be able to demonstrate that it has independent valuations and run scenarios of stress testing in different market conditions, she says.

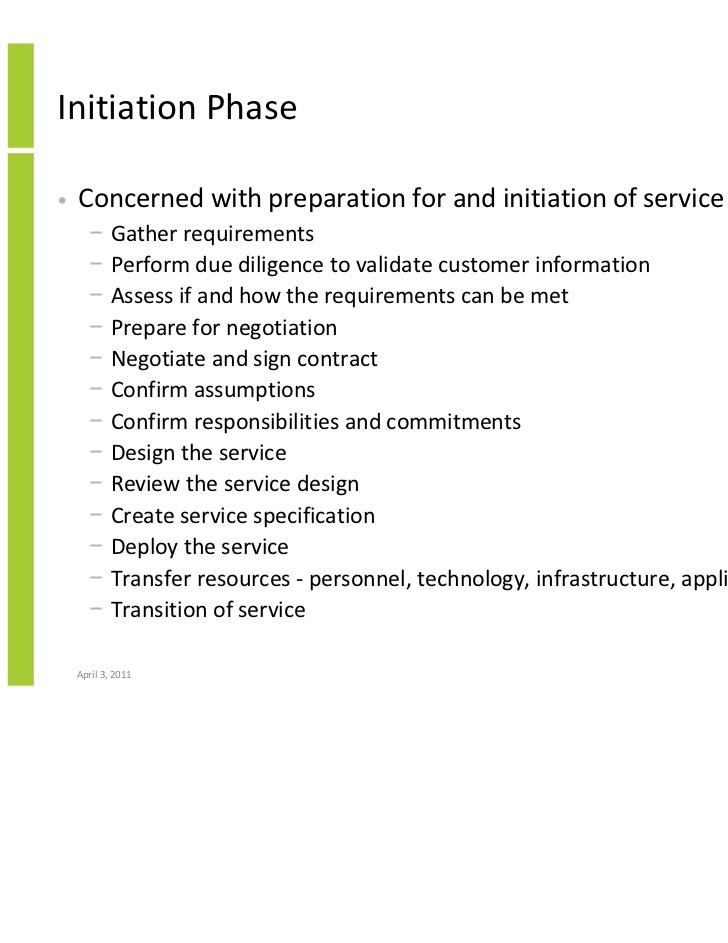

Rajiv Jaitly, chief operating officer of the fund of fund platform at AXA Investment Managers, thinks it is essential for investors to understand the nature of the investment and the structures into which they put their money. This should ensure there is nothing from a business structure perspective that places the investment in jeopardy.

As part of the operational risk review, Jaitly tries to assess the extent to which the investment manager can become distracted by structural problems that could hamper investment decisions. We want to make sure the management structure is appropriate for the strategy that is conducted. If there are different strategies operating within those structures, we want to make sure the structures are adequate and that we are protected from those structural weaknesses, Jaitly says.

AXA IM wants to ensure the valuation process is both robust and independent.

We want to see how an investment manager organises itself, how it trades, who makes the trades and what risks the fund may face as a consequence of legal agreements with service providers. We also want to see who the service providers are, says Jaitly.

The head of operational risk reports directly to Jaitly. He believes operational risk reviews need to take into account the people behind the positions and the extent of segregation of duties. Risk can never be fully eliminated, says Jaitly, but covering the obvious areas where the risks might occur can give some indication of the problems that could occur.

Independent review is important. It is vital to have different people involved in the identification and rectification of problems, believes Jaitly. This determines who can make, identify and rectify a mistake. Quite often, you have a hedge fund manager who has a lot riding on day-to-day decisions and a well-meaning correction of an issue can be wrong, he says.

In future he thinks cross-class liability will be an issue in operational risk processes because everything can be contaminated by it. The industry is trying to deal with cross-class liability by segregating different portfolios that are in single structures which helps give protection to investors, although this has not been tested through any multi-jurisdiction cases, he adds.

Tony Swei, chief executive officer of Tradar, runs a portfolio management systems company for hedge funds. He believes as executions are made by traders, funds must have good procedures in place. A lot of hedge fund failures have come about due to operational risk. Traders can make incorrect trades and they may misunderstand the trades because of poor recording and poor internal procedures. They wind up overexposed and this is a problem, Swei says.

He promotes an operating model where data is maintained properly. He thinks hedge funds must have the correct infrastructure and accounting procedures in place to deal with any problems. Without proper accounting, hedge funds do not have a complete picture of their liabilities or positions. There are also other risks. There are longer settlement periods for illiquid instruments like over-the-counter (trades) and their illiquidity can lead to problems. For illiquid items, investors are looking for more transparency and pricing is a key issue. There is also now a demand for third-party validation of risk, confirms Swei.

Protiviti, a specialist in technology and business risk and internal audit, has similar concerns. If firms realise they are not managing their risks as well as they could, we often combine the maturity model with our six elements of infrastructure model to take them through what they should do. The six elements we use link business strategy to business process to systems to help achieve outcomes that firms want from their business, explains Stuart Campbell, associate director at Protiviti.

Elements of operational risk are commonly found in business strategy, policy and processes, people and organisation and the methodologies and systems that the business runs on, he says.Investors are looking at the business model of the hedge fund and the hedge fund manager to see what shocks could knock it over. They should, for example, see what the processes and controls are for managing a large redemption with the end investor and for running the liquidity management of the business, he says.

Historically, institutional investors have focused on performance and investment strategy and less so on the organisation, control environment and infrastructure supporting it and those who review and monitor it.

Campbell says due to increased media and political attention on hedge funds combined with difficult market conditions and increased regulation, institutional investors are increasingly looking at what is happening behind the scenes. Specifically this means looking at the quality of people. He thinks this is particularly true in an outsourced environment. Outsourcing is linked heavily with the risk appetite. As your organisation grows and becomes more complex, investment in operational risk management must go up, he says.

Campbell says outsourcing just delegates the risk rather than eliminates it. If there is a problem with the outsourcer, it is the fund’s and fund manager’s business reputation that will be affected. People focus on the financial risks of not managing risk properly but reputational damage can be quite extreme. Reputation can be so easily lost and to be caught out as result of a material operational risk arising can really affect a business’s sustainability going forward, Campbell adds.

Risk-reduction solutions

Nolan Gesher, senior product manager at CheckFree, offers solutions focusing on the opportunities for hedge funds to reduce risk. His company offers verification and reporting functions. He says the goal of most hedge funds is to reduce risk by establishing and improving operational controls. Within the reconciliation process, the key to mitigating risk is the ability to identify exceptions that are the manifestations of transactional risk, he explains.

Once you identify these, there is a workflow process that the financial institutions will put in around the research and the resolution of this risk. That process needs to be as automated and as audited as possible in order to sufficiently resolve the problems in those exceptions, says Gesher.

From an operational standpoint, he believes funds have to ensure their reconciliation and exception management solutions are as efficient and effective as they can be. The verification process is a major factor and a bigger player than it has been in the past and there is now more interest in this area, he adds.

An organisation needs to certify it has identified transaction risks and is able to execute a plan to manage the risks. Reporting is also important and Gesher says there are three levels. The first is an end-user perspective that is operational and involves real-time information that helps users understand where they need to focus their attention.

The second level of reporting is more operational based and more like traditional reporting. It looks at the outstanding items, the ageing of these items, the value of the exceptions and, therefore, the risk. The day-risk level is important so that managers can see the risk daily and focus their efforts, says Gesher. The third level is a strategic-reporting level. This is the ability to take operational reporting information at the tactical level and consolidate, measure and compare it against performance and risk indicators.The goal is to evaluate the health of the business so that managers have an idea what their risk looks like at a macro level, which allows them to focus their organisation to deal with it, Gesher adds.

Judith Graham, chief operating officer at Optial, says correct operational risk procedures are key to running a proper business. A fund must have a very structured approach and ensure they have proper controls in place to see the risks that involve looking at people, processes and systems. She believes an investor needs a good sense that the people they are dealing with are working in a professional manner and can deal with operational situations when they arise.

An investor’s worst nightmare is not getting information. They want to have access to clear information about the fund in times of market turmoil. Funds can demonstrate to investors that they are being responsible if they have proper operational risk due diligence procedures up front, says Graham.

Her view on outsourcing is similar to Campbell’s. She thinks a fund can outsource procedures but not risk. Even if they do outsource functions, it is still the hedge fund who carries the risk so they still need to carry out due diligence.

The Alternative Investment Managers Association (AIMA) recently sent due diligence questionnaires to its members to see if hedge funds were providing the kind of transparency stakeholders in the industry want.

FSA calls for more disclosure

In the last few months the UK’s Financial Services Authority (FSA) has been looking for more disclosure, citing its disclosure rules on the shorting of banks during a rights issue as an example. There is a great deal of pressure on the FSA to be seen to be doing things, which is good, but it adds to the amount of regulation that the hedge fund is subject to, says Graham.

From a vendor point of view, the main things that can go wrong in operational risk are human error, system error, workflow errors and technical errors, according to Callum Runcie, head of sales for hedge funds in the UK, Ireland, Nordics and South Africa for Sophis. System integration issues are often a problem. Problems can occur also when there are limitations on straight-through processing and these risks can affect trades and how they are processed, says Runcie.

Although there is often a high level of integration, there is sometimes no crossover and little communication between the front office and middle/back office. It can be hard to pinpoint where or how an error has been make.

Some funds implement workflow checks. They will send it back to the front office to see if trades were entered correctly or back to the middle/back office to see if trades were matched correctly. However, often market participants do not do these multiple checks and build trade workflow with operational risk in mind, he adds.

When there is an error, a fund needs to find out what caused the error so system audit trails are very important. They can show when the trade was entered, who entered it, what process it went through, whether it was matched and what checks were made. Functionality and user rights mean some users are prevented from touching certain areas.

Investors are looking for reporting and are looking for information which can be sliced and diced. Having a flexible database is very important and most investors are looking for funds to have automated systems in place to deal with problems, Runcie concludes.

Although Campbell points out there are no formal benchmarks on operational risk — mainly because it is unique and tailored to the individual company — having a one-size-fits-all approach will be difficult if not impossible. While there are some initiatives that may make this a little easier, for example, AIMA’s notes helping funds identify and deal with risks, individual asset managers and investors will need to keep a close eye on this area.

Judith Graham is COO of Optial (www.optial.com), a UK technology company delivering operational risk management systems to financial services companies around the globe.

This article was published by Hedge Funds Review in September 2008.