Online Tutorial #1 How Do We Calculate Present Value

Post on: 21 Июль, 2015 No Comment

Online Tutorial #1: How Do We Calculate Present Value?

What Does Present Value Mean?

Present Value is the value today of tomorrow’s cash flows. A dollar today is worth more than a dollar in the future, because you invest today’s dollar and earn a positive rate of return, a process called compounding. The reverse of compounding is discounting, which converts a future cash flow into its equivalent present value.

How Do We Calculate Present Value?

Specifically, three factors govern the present value of any given cash flow:

1. How large is the cash flow. The size of the cash you expect to receive is the Future Cash Flow. The larger the future cash flow, the larger the present value.

2. How risky is that cash flow? As uncertainty rises, the investor expecting to receive a future cash flow has to assume more risk—which lowers the value that you should pay today for that future cash flow. Riskiness is measured by the rate of return that you would require from an alternative investment that would generate a cash flow with the same level of risk.

3. How long do we have to wait for the cash. The longer you have to wait, the less valuable the cash flow. The length of the wait—the Number of Years—lowers the present value of a cash flow for two reasons. First, you could always invest that money in alternative investments that would earn interest during those years. Second, if you’re not 100% confident that you will indeed get that cash flow, the more time passes, the more risk you will have to assume—which lowers the value that someone would pay today for that future cash flow.

The formula for calculating present value incorporates these three factors:

Present Value = Future Cash Flow / (1 + Required Rate of Return) Number of Years You Have To Wait For The Cash Flow

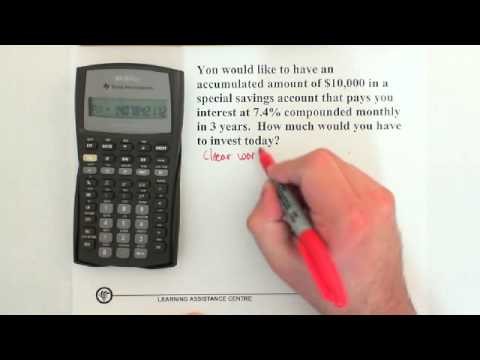

A Simple Example Of A Calculation

Let’s say you expected to receive a dividend of $200 in 5 years from a fairly stable company. To calculate the present value of that dividend, you would first answer the 3 questions presented above:

1. How large is the cash flow. It’s $200.

2. How risky is that cash flow. In this hypothetical case, investors of companies similar to our dividend-paying company require a 10% return.

3. How long do we have to wait for the cash. We have to wait five years.

Thus, the present value equals:

Present Value = $200 / (1 + 10%) 5 = $124.18.

Put another way, if you auctioned off the right to receive this $200 dividend in a public market, another investor would buy it from you for roughly $124.