One Unique Hedge Against The S&P 500 That You Never Heard Of iShares Barclays 20 Year Treasury

Post on: 23 Май, 2015 No Comment

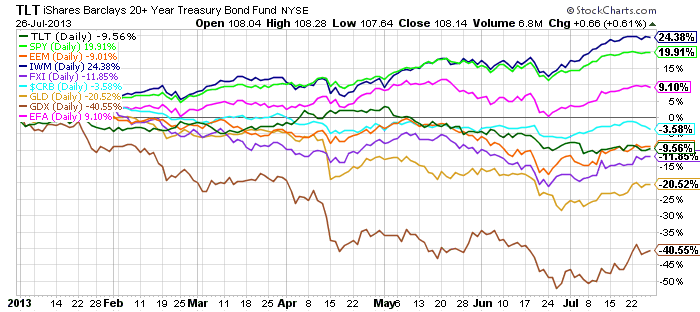

Most ‘hedges’ against equity positions within a portfolio simply don’t work. The vast majority of market-neutral /absolute return funds, option strategies, inverse funds/etfs, and structured note products simply are far less productive as a hedge than simply buying treasuries or leaving funds in cash. And some of these products are almost guaranteed to lose you money if you hold for an extended period of time. All the aforementioned products can carry fees of 2% or more, have ‘caps’, or do not perform as expected when you need them the most. Treasury securities however usually perform wonderfully when equities are swooning (i.e. 2008), and pay you for holding the hedge. Treasuries are the true benchmark to compare all other hedge products as the Ishares 20+ Year Treasury ETF (NYSE: TLT ) increased 34% in 2008 while sporting a fee of only 15 basis points and paying 4%+ in interest. 99% of other hedge products fail against this comparison.

traphagen-financial.com ) believes we have found one, and over the past year we have implemented this for our clients.

In the past (prior to approximately the late 1990s) the S&P 500 and most other equity markets around the world exhibited fairly predictable ‘trajectory/trend’ patterns through time. Some select individuals during this time could make very good profits by recognizing these technical trends and trading off of them. Tradable market/economic information was slower getting to the market and therefore the S&P 500 would trade in slower ‘smoother’ trends (up and down) with minimal day to day volatility.

Over time however as information began to stream constantly into the market with vastly increased investor accessibility, a shorter term trading focus, and short term computer algorithm trades more common these ‘trends’ in the market began to disappear.

This ‘technical trend’ phenomenon was then replaced with a ‘mean reverting’ tendency within the S&P 500. This ‘mean reversion’ is what Emerald (the hedge product) profits from.

Mean reversion reflects the fact that all available information at any given time is being priced into the market and in the very short term this means if the market has been up in the recent past it tends to go down and vice versa. If you can take advantage of this ‘up and down’ short term reversion to the ‘mean’ over the short term you can ‘collect’ return from constantly trading this movement. Emerald does just that.

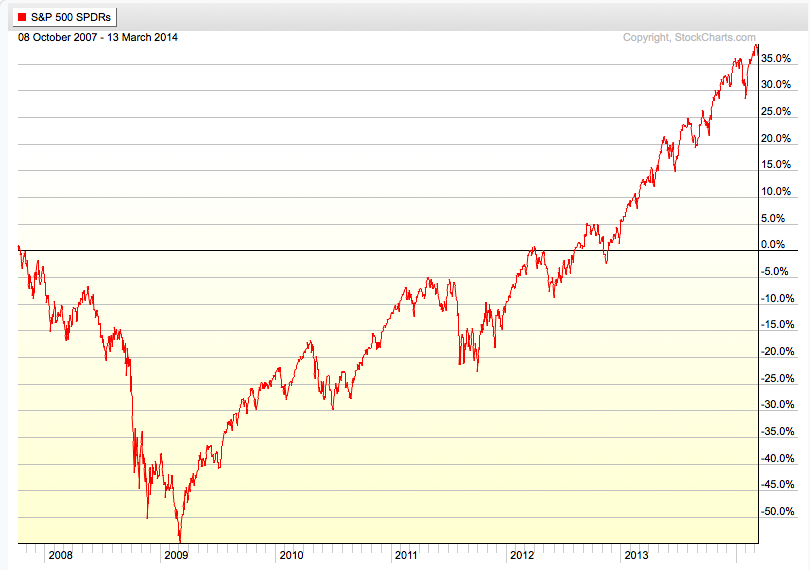

The kicker is, during times of extreme market stress, volatility tends to increase dramatically and mean reversion goes into overdrive. In 2008 for instance huge swings both up and down (even though the overall index decreased by 38%) created great fodder for Emerald. During this period the Emerald index was up 35% effectively negating the S&P 500 equity losses. And since this mean reversion is present during all periods, when the market is tame Emerald still tend s to produce positive returns (albeit much less than in stressful times).

This pattern of increased positive returns during extreme market stress has been repeated with Emerald since 2000, while not giving back those positive returns during calmer periods.

Importantly Emerald offers a great hedge without being dependent on interest rates falling further. In conjunction with a combination of other hedges (including treasuries) our clients enjoy superior cost effective protection against large market declines without giving up significant upside potential and not being dependent on constant market timing. And that is the mark of a great hedge.

traphagen-financial.com ).

2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.