Oil and Gas Industry 2014 Outlook Deloitte CFO

Post on: 3 Июль, 2015 No Comment

Oil and Gas Industry: 2014 Outlook

As North America’s energy renaissance gains further momentum, John England, vice chairman and U.S. Oil & Gas leader for Deloitte LLP, discusses some of the opportunities and challenges the oil and gas industry could see in the year ahead and areas where it may be focusing its investments and resources.

Q: Where is the oil and gas industry headed in 2014, and what will be among its major challenges?

John England: As we move further into 2014, investments in the energy renaissance will continue to shift from the upstream exploration and production (E&P) sector to midstream infrastructure, refinery operations and petrochemical facilities. Upstream operators will focus on harvesting value from recent discoveries and acquisitions through more efficient operations and the application of new technologies. Evidence of this spending shift already appears in company capital expenditure budgets. According to Oil & Gas Journal, upstream E&P capital spending in North America stayed flat over the past year, rising only slightly from $354.4 billion in 2012 to $354.8 billion in 2013. Meanwhile midstream capital spending surged 263% to $46.4 billion in 2013¹ from just $12.8 billion in 2012. Downstream capital spending has also been ramping up, with spending rising 11% in 2013 to $24.7 billion² over 2012.

In terms of challenges, five stand out: execution of capital projects, finding capital to finance growth and making capital work efficiently, securing talent ahead of an expected wave of retirements, reducing costs and last, but very important, managing the industry’s public perception. Also, this year will be critical for many companies as they attempt to successfully deliver major capital projects, and the result of the projects could significantly influence their stock price, as well as their liquidity.

Q: How can the North American oil and gas industry finance its plans to grow in 2014?

John England: First, for the industry overall, competition for financing will be stiff, as the number of players in the industry continues to increase with the influx of independents. The industry will likely require more complex financing structures to meet the level and breadth of investment forecast and to complete megaprojects, which are consuming a larger portion of annual company cash flows. Even with additional financing, however, the industry will want to keep a close eye on the uncertain government and regulatory landscape. Many incentives and taxing regimes that can significantly affect the economics of these investments remain in flux. Companies investing capital in oil and gas plays will need to navigate government and regulatory uncertainties to maximize their investments, including areas such as:

- Development of unconventional plays in states that have little experience regulating the oil and gas industry.

- Federal and state tax regimes aimed at collecting a portion of the economic value generated by the oil and gas extracted from shale formations.

- Delays caused by the rising tide of permitting requests resulting from the increased number of wells needed to develop an unconventional reservoir.

- The impacts of existing trade restrictions such as those causing delays in the approval of the Keystone XL pipeline and the ability to export domestic crude supplies.

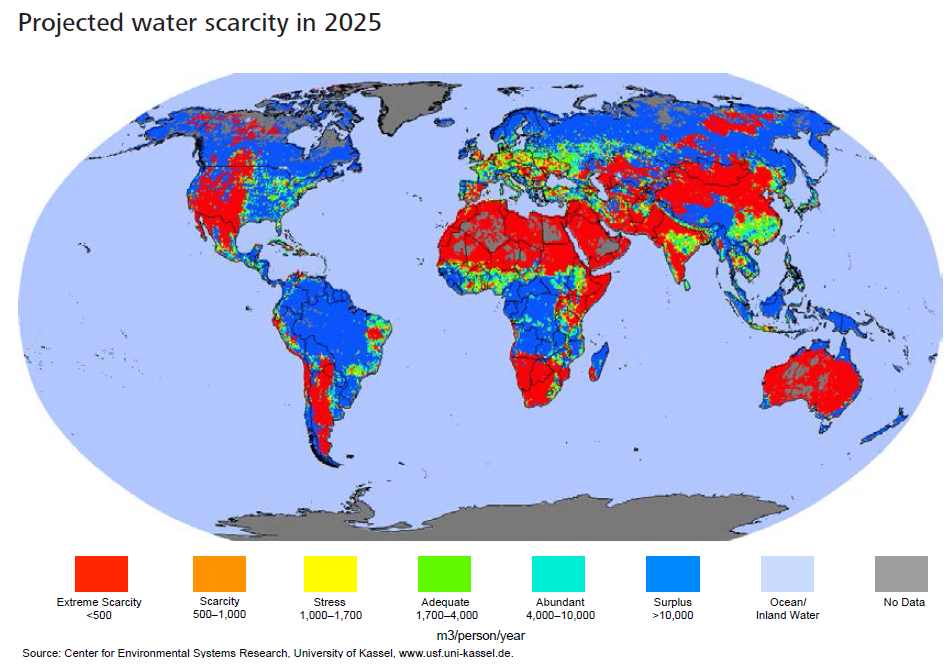

There is also the potential for more environmental regulations to address concerns over drilling processes, possible water contamination related to shale development, drilling moratoriums and offshore regulations regarding production safety systems and equipment.

Q: What is your expectation for merger and acquisition (M&A) activity in industry in the year ahead?

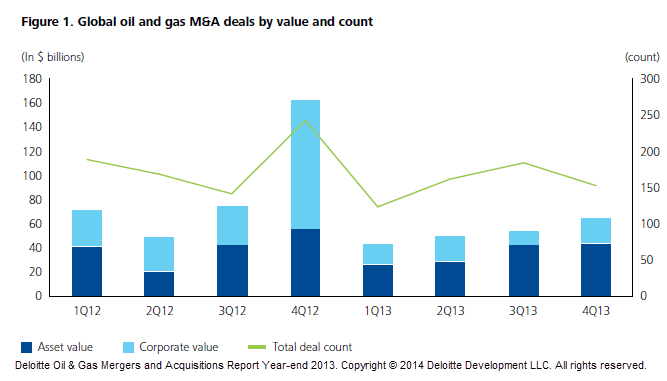

John England: I expect the industry to continue taking a cautious approach. This is consistent with findings from Deloitte’s recent CFO Signals™ survey. CFOs from the Energy/Resources sector responding to the survey indicated their organizations are biased toward limiting risk, and this sector is among the most focused on contracting/rationalizing (along with the Technology sector). In 2013, M&A activity in the oil and gas industry declined 29% both in deal value and deal count, indicating companies are focused on project operations rather than inorganic growth.³ Part of the decline in M&A activity was a result of companies seeking to complete transactions in 2012 ahead of possible tax increases in 2013. As we know, those didn’t happen.

Furthermore, companies that have acquired large-acreage positions are now focused on optimizing production, streamlining operations and maximizing the return on assets of their holdings. Natural gas prices have also firmed over the past year, giving potential sellers incentive to hold on to their assets and focus on production. As companies see rising liquefied natural gas export approvals, a revitalization of the U.S. petrochemicals industry, increased demand from power generation, and growing adoption of natural gas for vehicle fleets, many natural gas-focused companies may hold on to their stakes waiting for prices to rise further.

Q: What are your expectations for engineering, procurement and construction (EPC) resource capacity?

John England: EPC spending in North America will continue to rise in 2014, which may cause further backlogs for planned megaprojects. Although the growth in orders is generally good for the EPC industry, backlogged EPC companies will face hiring challenges and will find their technical capabilities stretched thin as they try to maximize the talents of their best people. Given the reliance of the oil and gas industry on EPC companies for megaproject execution, it will be critical to the success of the North American energy renaissance to effectively address the challenges the EPC industry will face.

Q: Why will talent be a challenge for the oil and gas industry?

John England: Consider this: The U.S. Department of Labor estimates that 50% of the oil and gas industry’s workforce will be eligible for retirement within the next five to ten years.⁴ That means there will be a significant number of vacancies that will need to be filled. Competition for skilled talent will put upward pressure on wages, which will pinch project margins. Already, the industry has been hiring at a rate that far outpaces the rest of the economy. According to Bureau of Labor Statistics data, private sector employment has risen 7% since January 2010, while employment in the oil and gas industry has risen more than 25%.⁵ As a result of rising industry employment, hourly wages for the oil and gas industry are up 27.3% since the beginning of the shale revolution in 2006. That outpaces wage increases in the general economy, which are up just 17.8% over the same period.⁶ So controlling fixed costs for projects, including wages, will increasingly be important for the industry as companies look ahead to the ‘big shift change.’ This is an area where talent analytics could be useful in workforce planning.

Q: 2013 saw some earnings declines compared to 2012. What does 2014 hold ?

John England: Clearly, reducing the cost of operations will be key if companies expect to maximize value. Many shareholders are pressuring oil and gas companies to cut back on expenditures and focus on buying back shares and increasing dividends. Several of the supermajors have already announced their capital spending may currently be at a peak. This renewed focus on lowering spending could put oilfield services companies and equipment manufacturers under pressure to control costs. As oil and gas companies squeeze contractors to lower costs, oilfield services companies will need to increase operational efficiency as well.

Q: With respect to public perception, what can the industry do to enhance its image?

John England: While public perception is beginning to turn around with positive perception of the industry rising, according to Gallup Poll research,⁷ public perception remains an overarching challenge for the industry. Public perception influences public policy and regulatory scrutiny, as well as impacts the industry’s ability to recruit the best and brightest talent. In the era of the 24-hour news cycle and pervasive Internet connectivity where individuals have their own Twitter feeds, YouTube channels, and blogs, technology provides an amplifying effect for industry critics. In order for oil and gas companies to maintain the social license to operate, they must communicate a clear commitment to environmental care, safety and community engagement, all of which will benefit the long-term growth of the industry.

As can be seen in the industry’s effect on U.S. employment, the oil and gas industry is creating jobs, moving thousands of workers back into the workforce, and increasing wages and standards of living. The industry should continue to brand itself as a high-tech, innovative industry that cares about people and the environment, and is critical to the U.S. economy.

Endnotes

www.ogj.com/articles/print/volume-111/issue-3/s-p-capital-spending-outlook/capital-spending-in-us-canada-to-rise.html.

2. Ibid.

3. PLS Inc. and Derrick Petroleum Services Global M&A Database.

www.worldoil.com/September-2012-Making-informed-human-resources-decisions-based-on-workforce-outlook.html.

www.bls.gov/news.release/empsit.toc.htm.

6. Ibid.

www.gallup.com/file/poll/164099/130823IndustryRatings.pdf.

Related Resources