Nuverra Bonds Say Broke Stock Clinging To Hope

Post on: 5 Май, 2015 No Comment

- Article Comments (0)

Dear Nuverra Investor,

It has been a while since you last heard from me. Nuverra Environmental Solutions’ (NYSE:NES ) results have continued to disappoint, the company continues to mislead investors about future opportunity and the stock continues to go down. No real update was needed. Even long-term supporters of the stock, like StoneFox. have thrown in the towel and have articulated why NES should be avoided and is potentially doomed.

We don’t need to rehash the bearish arguments, but since 85% of the stock is held by retail investors, I’d like to provide some updates on NES that Google finance can’t provide.

With 2.5 weeks left in the year, it’s not too late to lock in a tax-loss for 2014. It’s also never too late to sell a stock going to $0.

Did you know?

- That NES bonds trade at 60c on the dollar (i.e. their $400mm of bonds only have $240mm of value)? Aren’t bond investors ‘smart money ‘? That means NES bonds have a yield to maturity (in 2018) of

30%. Why buy the equity when you can buy bonds, which are much safer, that will compound 30% per year? That’s a 120% return! Clearly the bond market thinks Nuverra is a bankrupt and the remaining $180mm of equity is worthless.

Did you know?

- That short interest continues to rise and institutional investors are paying a short rebate of 30% to bet against NES? That’s the equivalent of paying a 30% annual dividend, charged daily, to bet Nuverra’s stock declines. Clearly there are some confident short sellers. In addition, short interest continues to rise and there are no shares available to short. Don’t believe me? Call your broker and ask.

So that is the outlook that ‘smart money’ has for the company. What about the business fundamentals?

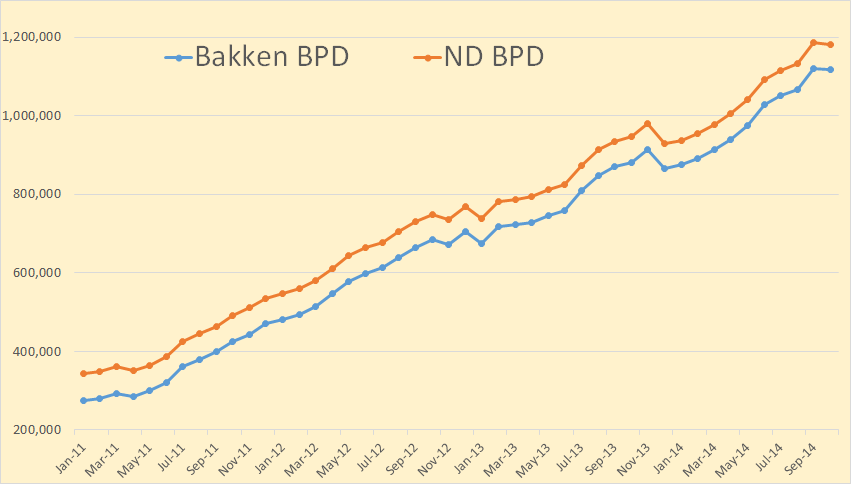

Bakken crash coming.

With oil sub $70 (WTI is currently $57 and the Bakken has been dipping under $50 ), almost all new drilling activity in the Bakken is uneconomic. This means E&P companies are going to slash their budgets and new activity could fall 50-75%. Several companies have already adjusted their plans. Oasis Petroleum recently announced that it will go from operating 16 rigs to 6 by the end of March and cut spending by 50%. Others, like Emerald Oil, are cutting their budgets by 70+% ).

Nuverra is extremely levered to new activity in the Bakken. The company generates a majority of its revenue by trucking in fresh water for new completions and hauling away flowback water from recent completions (before the well is connected to a pipe for long-term water disposal). The business has a high fixed cost structure and is very vulnerable to a decline in revenue. That makes them most exposed when the boom turns into bust.

TFI sale still uncertain.

NES management has yet to come through on divesting TFI. With equity valuations for oil re-refiners crashing (see VTNR. HCCI ) and credit spreads widening for energy and junk debt, it may be very difficult for an acquirer to get a deal done. That leaves NES dangerously levered with earnings and cash flow set to precipitously decline.

XTO Pipeline is uncertain and dangerous. Maxing out borrowing capacity is reckless to equity holders and bond holders.

With the recent crash in oil prices, XTO might choose to defer this project for a later date. Even if they don’t, decreased activity from all operators will result in much lower utilization and ebitda than initially expected on the project. And most importantly, in the face of a crash in activity, why would NES use ALL of their available liquidity in an uncertain pipeline that won’t generate any positive ebitda for well over a year?

Financing this pipeline into declining activity is like hitting the accelerator as the car approaches the cliff. No wonder the unsecured bonds are trading at 60c!

Insider activity?

So why is the CEO, Mark Johnsrud buying. Maybe because he’s facing securities lawsuits for previously misleading investors about Nuverra’s outlook. He also received $125mm of cash when his company was bought, so spending $5-10mm on additional stock as NES heads to bankrupcty helps him avoid looking complicit. Regardless, if he was serious about the long-term outlook he should do a large equity infusion ($50-100mm?) at current prices to help recapitalize the struggling company or buy the bonds to show long-term support. Instead, with his regular small purchases it appears he is just trying to paint the tape.

Even the CFO, who was making seven figures, quit to distance himself from this debacle of a company.

Conclusion: Nuverra is headed for a restructuring in 2015 or 2016 and the equity will be worthless. The writing is, and has been, on the wall, and the debt market is sending a strong signal. Unlike other energy companies, analysts have yet to update estimates for the coming decline in activity. And without an uninformed investor base, NES’s stock chart would likely look very similar to its competitor, KEG. (see below)

Investors are much better off taking their tax losses and buying a higher-quality energy company that is on sale and can weather the downturn. (HAL, PXD, NBR, CJES)

Disclosure: The author is short NES. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.