Now then Is the Great Recession so different from the Great Depression

Post on: 13 Июль, 2015 No Comment

Related

This story is being co-published with The Philadelphia Inquirer and New America Media.

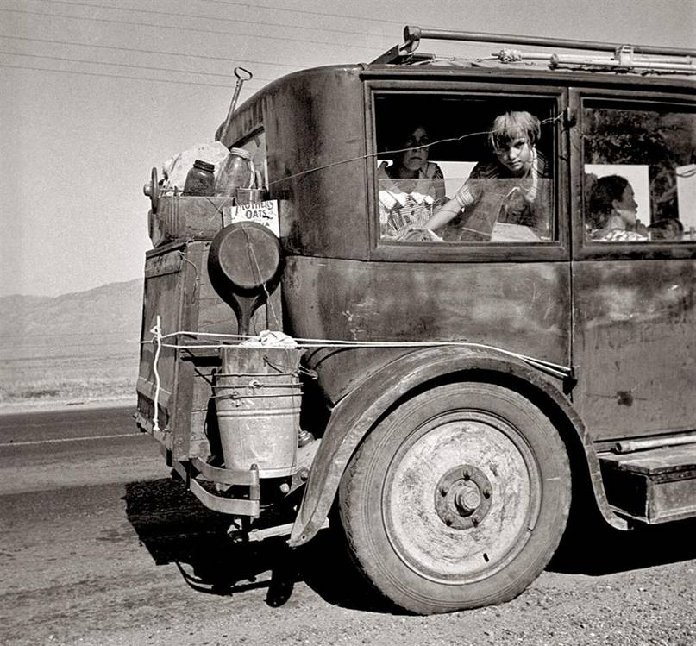

Some call this moment the Great Recession. As the hardship has lingered, others have begun calling it the Little Depression. But equating the hard times of the 1930s and with the hard times of today is mostly overblown rhetoric. Or is it?

On the surface, the comparisons are obvious: a period of great wealth and exuberance, followed by a stock market crash. After the crash, widespread economic pain. Millions of people out of work, thousands of homes lost. Families going hungry.

But much has changed. There is social security, unemployment insurance, Medicare and Medicaid, none of which existed when the Depression hit. Breadlines and shantytowns, emblems of the Depression, are nowhere to be seen. Today, though, there is great hardship out of view. Behind closed doors, apartments and shelters are overcrowded, and cupboards are bare.

In interviews with dozens of people who lived through the Great Depression, both similarities and differences between the eras emerge.

People have so much more now than people had during the Depression, says Luanne Durst, who was born in 1931 in Rice Lake, Wis. But, she says, I think its relative. I think its a different level of want, but its there nonetheless.

I think its a scary time for people, Durst says. I think its got to be pretty much like it was then.

I think it was much worse, says Martha Rutherford, who was born in Portland, Ore. in 1935. Well, she clarifies, overall, I think it was much worse. I think some people are in terrible straits now. But back then it was pretty much everybody, I think.

There were certainly more people unemployed during the Depression than today, although its hard to make direct comparisons because the Bureau of Labor Statistics didnt start tracking unemployment as we know it until the 1940s. What we do know that is unemployment rose from 3.2 percent in 1929 to a staggering 20.9 percent in 1933, according to a research paper from the Federal Reserve Bank of Dallas. The high-water mark of unemployment in this recession is 10.1 percent, in October of 2009.

During the Depression, many people made their own work, or tried.

Guys would be coming around from different neighborhoods, knocking on doors, says Saul Coplan, who was born in Philadelphia in 1932. ‘Can we mow your lawn? Would you like us to clean your windows? Is there anything we can do? Want us to shovel coal into the coal furnace?’ And it was sad.

Rutherford’s house was near train tracks and she remembers hoboes knocking on the back door. Maybe they didnt look clean, but they were always humble. Never scary, she says. And they would ask for work, and, of course, my parents didnt have any extra money to give them work. They were barely scraping by.

Paul Rees, who was born in 1929, grew up in Weymouth, Mass. where his father ran a small mechanic shop and gas station. He credits his father’s entrepreneurship with their relative stability during the Depression and thinks that self-reliance is out of reach for many today.

So many people dont work for themselves and cant because of the governmental regulation and the inability to cope with the taxation problems and sale taxes, he says. None of that affected people during the Depression.

Both during the Depression and today, the unemployment numbers understate the problem. There are far more people not working, or working less than they want to be, than are counted among the unemployed. In November of 2011, some 7 million people had either given up looking for work, or were working part time but seeking full-time jobs on top of the 8.6 million officially unemployed. By all accounts, the same was true during the Depression.

‘What’s wrong with me’ was and is common

For those who couldn’t find work, the sense of shame was profound.

People had been encouraged to kind of look down on the poor, and think that they were responsible for their own troubles during the boom years of the ’20s, says McElvaine. That had been sort of internalized by people who had been doing reasonably well.

And so when the bottom fell out, he says, their reaction was to think that there must be something wrong with me.

That embarrassment often led to social isolation, McElvaine says. Especially after a long time of being unemployed, people would cut off some of their social contacts, not want to see other people because they were kind of ashamed of their own situation.

The same is true today, says David Eliott, communications director for US Action, a left-leaning advocacy organization. He compiled a recent report featuring quotes from dozens of unemployed workers, and asked some of those quoted if they would be willing to speak with reporters. A lot of people were so stigmatized that they’re saying no, there’s no way I could talk to the media, he says. There was a sense of shame and embarrassment at being unemployed, even though theyre unemployed through no fault of their own.

Then, as now, the pain of unemployment was not spread equally. Communities of color were hit particularly hard.

More black people than white lost their jobs. More black people than white became underemployed, says Cheryl Greenberg, a professor at Trinity College who has written two books about African-Americans and the Depression. In New York City, for example, the unemployment rate was 25 percent in 1932, Greenberg says. In Harlem, it was 50 percent. In every city and at every stage of the Depression, whatever the white unemployment rate was, she says, the black unemployment rate was always higher.

Today, the unemployment rate for blacks is 15.5 percent. For whites, it is 7.6 percent.

In part, the higher unemployment rate for blacks during the Depression was attributable to increased competition for even low-paying jobs. Jobs at the bottom, which had always been bad, were at least black jobs. Because white people could get better jobs. Suddenly in the Depression, every job became open to white people, Greenberg says. When jobs became available, many white business owners prioritized hiring white worker over blacks. For blacks, their hold on even those terrible jobs declined, she says.

Despite that, some felt that the black community suffered less than whites during the Depression because they were already used to making do with little.

I think it is true that for black people, the Depression was less of a change than for many whites, she says. But that’s because they had been in Depression all along, she adds. Many African-Americans had been struggling for decades, she notes, leaving them with few resources and savings to fall back on. But its not like they had gone from riches to rags. They had gone from rags to fewer rags, Greenberg says.

The erosion of the middle class for blacks is different than for whites because there were some things blacks never had, agrees Paul Ingram. Ingram, who is black, lived in Detroit during the Depression.

Scraps. That was all that was left for our ancestors. And they learned to take their food, and transfer it into a decent meal. As a kid growing up, my mother would take neck bones and boil them in a pot, get potatoes and boil them. Get some celery and make a gravy and eat it with biscuits, he says. The nickname was puzzle bones because you had to reach all in and tear them apart to find the meat.

For all Americans, the Depression was particularly bitter after a period of optimism and prosperity a story familiar to many whose homes shot up in value during the early 2000s. But in the 1920s as in the 2000s, that wealth was not evenly distributed.

The concentration of income at the very top peaked in 1928, ’29 and peaked again in 2007, 2008. It seems like its more than coincidence that both times that was followed by the collapse of the economy, says Robert McElvaine, a professor of history at Millsaps College and the author of two books on the Great Depression. Whatever you think about such a concentration of income as a moral question and I happen to think that its bad, morally economically, it just doesnt work in a consumption-based economy to have it so concentrated.

Living off the land and helping neighbors

Unable to consume goods through the cash economy, many people provided for themselves during the Depression.

Far more people were farming then than now, which meant that more people were able to grow their own food. Even people who lived in towns often had farming relatives who could provide staples in a pinch. That produce was often essential to their survival.

The farmers were in a good position because they could raise their own food. Including animals, not just the gardens. My mother and my aunts, everybody canned a lot before they had the frozen food, says Margaret Deitrich, who lived in rural Colorado during the Depression.

And there used to be a lot of farmers, says Deitrich, who was born in 1934. There are the big corporations, but the individual farmers arent near as many as there were when I was growing up. You dont have a grandparent nearby with a farm.

In 1930, there were 6.5 million farms, with 12.5 million working farmers, according to the U.S. Department of Agriculture. By 2000, there were just 2.1 million farms, with just under 3 million farmers. (2010 figures are not yet available.)

The population was also far more rural in the 1930s, with 44 percent of Americans then living in rural areas. As people moved off the farms and into cities, their ability to grow food for themselves diminished. Now, just 23 percent of Americans live in a rural area, according to the U.S. Census Bureau.

City dwellers did grow food where they could, forebears of today’s urban agriculture movement. Many new city dwellers were African-American former farmers who had come North as part of the Great Migration.

They grew groceries in their backyard, if they had backyard. They would grow beets and cabbages, says Joseph Jackson, who is black and was born in 1924 in Detroit.

People werent so concerned as much about how their grass looked as much as how their greens looked, agrees Ingram.

What people had, they shared.

My parents felt very blessed. They werent religious people, but they felt very blessed, for their economic security, although it was very small. They never turned anyone away hungry, never, ever. I remember that as a little kid, says Rutherford. And there were a lot of hungry people.

In 2010, nearly one in six American households was food insecure, according to the USDA, meaning that people were unable to afford enough food for everyone in their household.

People also shared housing. Then as now, doubling up was common. Rees and his family had rooms in the home of a widower and his sons; Rees’s mother took care of the house and children.

That was not uncommon in the New England area, Rees says. A lot of families did that with relatives. In our case they were not relatives, but it was a way to survive until we could afford to get something on our own.

During the current recession, the number of doubled-up households has risen by more than 18 percent, according to the U.S. Census Bureau. In 2011, 69.2 million adults were living in a combined household more than 21 percent of all households nationwide.

The years of joblessness and underemployment, the crowded homes, the persistent hunger: All took an emotional toll.

It was called a depression for a reason, says Coplan. People were depressed. It was hard to see people smile. Kids smiled. Kids were always having fun. We didnt know how bad it was until much later.

The federal government knew just how bad things were and launched aggressive spending programs to boost the economy. The Works Progress Administration and the Civilian Conservation Corps hired millions of workers directly, engaging in everything from photography to construction to forestry. The Depression also saw the development of a core social program now being contested: Social Security. The program was created by the 1935 Social Security Act, which also introduced unemployment insurance and aid to dependent children.

The era also ushered in the Federal Deposit Insurance Corporation, offering a government guarantee on bank deposits. The creation of the FDIC followed a period of massive turmoil in the banking sector, with a run on banks, a government-imposed bank holiday, and widespread bank failures.

The banking troubles hit store owners, like Saul Coplans father in Philadelphia. One day in late 1928, Coplan says, his father went to his furniture store and found it padlocked, along with the third-floor apartment he lived in. He went to the bank, his son says, and confronted the teller. The teller, a friend from high school, told him that the board of directors thought you werent going to be able to make the payments, so they called the whole note, Coplan recalls. His father, who had never missed a payment, lost his home, his store and its entire inventory. He was frosted at banks from that point on, Coplan says.

Even children were affected by the bank failures.

They took my Christmas savings when the bank crashed, says Jackson. I had to be 5 or 6. I had a little savings account and Id put a nickel or a dime in the account and I went to the bank and the bank was closed.

That bank never did open, he adds.

Between the fall of 1929 and the end of 1933, some 9,000 banks suspended operations, according to the FDIC. To date, 412 banks have failed since the start of the 2007 recession, although today all deposits up to $250,000 are insured against loss.

Ultimately, though, it wasnt banking reforms, unemployment payments or the WPA that ended the Depression. It was World War II.

The Depression’s legacies

In New England, the economic impact hit before war was formally declared. Roosevelt was building up along the coast, in military establishments, in the Navy and the Army, says Rees. My dad worked in Camp Edwards, which was the new jumping-off place to go to Europe in World War II, and that was built before we went into the war.

In Philadelphia, the boost came later. Until the war started, there wasnt much change. People were still out of work, says Coplan.

Frank Luke, who was born in Honolulu in 1935, remembers the wartime boost to his grandfathers restaurant.

He had a little hole in the wall: a couple of tables, a counter, a kitchen in the back. But the location was opposite Fort DeRussy, says Luke, who is Chinese-American. Soldiers kept business booming, he says. It was sweet-and-sour spare ribs that sent me and my sisters to college.

While it was war spending that lifted America into prosperity, both those who have studied the Depression and those who lived through it say the social programs mattered, and matter still.

For one thing, McElvaine says, social supports made it clear that joblessness was a societal-wide, economy-wide problem and not just a personal failing. More broadly, he says, the social programs of the Depression make it easier for people to survive but also keep the economy from getting worse. Because they are the programs that put some buying power into the hands of people who are going to spend it and keep stimulating the economy.

Thats a matter of controversy today. The notion of giving money directly to poor people, through jobs programs or benefits, is by no means universally supported. Unemployment insurance is being cut in many states and federal unemployment insurance extensions are slated to expire at the end of this year. Cuts to Social Security and Medicare, long politically untouchable, are now being considered.

Rutherford, who lived through the Depression, now depends on one of its key legacies.

I cant imagine what would happen if we didnt have Social Security because we dont have a lot of savings, she says.

But the legacy of the Depression-era programs goes beyond individual survival. The spending lay the foundation for future growth, Greenberg says.

Our whole infrastructure was rebuilt during the Depression, thanks to the New Deal. We had airports and highways and post offices and schools that were built because we took unemployed people and put them to work, she says. Now, what worries me is that because those programs dont exist, not only are we not giving those people skills, or feeding them, were not even prepared for the recovery once it happens.

With deficits dominating the discourse in Washington, a massive outpouring of federal cash is all but unimaginable today. President Obama proposed his American Jobs Act in early September, but neither the bill as a whole nor its component parts have gained traction in Congress.

We need somebody like Roosevelt to say I dont care what you think, Im going to push this through and I have the people behind me, says Coplan. But he thinks thats unlikely. Now, he says, money has become the ruler. And I fear for our country.

Reporter Michael Lawson contributed to this story.

This story was produced with help from sources in the Public Insight Network from American Public Media.

The original version of this article incorrectly stated that Medicaid was part of the 1935 Social Security Act. The program was enacted as part of a 1965 addition to the legislation.