NonTraded REITs Offer Stability and Portfolio Diversification

Post on: 4 Май, 2015 No Comment

by Michael Black

I nvestment portfolio diversification and risk management always have been key factors in reducing loss of asset value in the face of historically volatile markets. Of course, these strategies need not be limited to the traditional stock and bond markets. Several classes of direct investments also are available, and prominent among these are real estate investment trusts.

Usually when financial planners and industry analysts refer to REITs, they are talking about publicly traded REITs; however, another class of REITs exists that generally are called non-traded REITs.

Non-Traded REITs While non-traded REITs have relatively limited liquidity, they offer the same benefits as their publicly traded counterparts. By definition, the key benefit of non-traded REITs is that they are not yet publicly traded. Subsequently, they offer the reasonably predictable cash flow of publicly traded REITs without the volatility incumbent in the public markets.

Additionally, non-traded REITs receive the same tax benefits as publicly traded REITs. That is, by meeting certain requirements for taxable income distribution to shareholders, the REIT itself is not taxed, thereby reducing tax on the potential return on the investment, unlike traditional stock investing.

Life Before Listing In addition to their investment value and tax benefits, non-traded REITs also offer commercial real estate professionals another option for buying, selling, and managing real estate.

When a commercial real estate professional has several investors with common real estate investment objectives, a REIT offers the opportunity to achieve economies of scale and the benefits of diversification.

For example, one investor with a million dollars and some measure of leverage might be able to afford one commercial property. But 20 investors with a million dollars each may be able to acquire multiple properties — distributed among several geographic markets and many real estate sectors — at a lower cost per square foot.

Private vs. Public

The REIT structure is simply a method of allowing common ownership of multiple properties. The compelling difference between publicly traded and non-traded REITs is the balance between liquidity and market volatility.

Assuming the REIT remains non-traded, the investor incurs a lack of liquidity since the primary outlet for selling shares is the REIT company itself (although one could find another investor to buy one’s shares). However, as noted, reduced exposure to market volatility is an offsetting benefit. The reverse is true of publicly traded REITs: Investors gain increased liquidity, but increased volatility exposure as well.

As mentioned above, a counterbalance to the lack of market liquidity, most non-traded REITs offer repurchase agreements if an investor wants out prior to public listing. Typically, the repurchase agreement will specify a discount to the investor’s initial purchase price in consideration of acquisition and organizational costs. The specified discount rate oftentimes is scheduled to diminish over time as the appreciation in property value supersedes the start-up costs.

Of course, commercial property values are not static. But property value changes are glacial compared to price changes in public trading markets. Therefore, both publicly traded and non-traded REITs have relatively stable net asset values. However, publicly traded REIT share prices can fluctuate wildly based on the rate of return afforded by alternative investment opportunities, and they rarely reflect the true NAV.

For example, during the dot-com craze, investment dollars flooded the technology sector of the securities market, while publicly traded REITs traded at prices as much as a 40 percent discount to their actual NAV. As the mania faded from the technology revolution, publicly traded REIT prices have rebounded to levels in the 0 percent to 6 percent discount range. Even though the price/NAV still is slightly negative, this rebound has resulted in high returns for investors who bought and sold at the right time.

In concert with this resurgent demand driving up publicly traded REIT prices, the demand for new issues also is on the upswing. As the REIT market price/NAV approaches positive ground, the opportunity is ripe for non-traded REITs to consider listing their shares. Doing so gives investors increased liquidity via the public market — potentially at a premium to NAV — without enduring volatility along the way. Any appreciation in the underlying real estate before the REIT is listed should be reflected in the REIT’s price once it begins trading.

Conversely, if the public markets retreat, resulting in a negative price/NAV environment, the non-traded REIT is not obligated to list. In other words, non-traded REITs offer investors reasonably predictable upside potential with less downside risk as compared to publicly traded REITs that face market fluctuations.

Also, as with publicly traded REITs, non-traded REITs face the issue of recession. But it is important to note that the listing status has less impact on a REIT’s NAV than the particular real estate sector in which the REIT invests.

Given the liquidity of the public markets, investors in publicly traded REIT shares usually attempt to anticipate the future market. Therefore, if particular sectors benefit from a recession, such as discount retailers or grocery stores, the mere hint of a downturn can drive up the market value of publicly traded REIT shares, even though the NAV may not change.

However, the market value of recession-sensitive real estate sectors’ REIT shares, including office properties and hotels, may drop in anticipation of a recession relative to NAV.

Non-traded REITs’ lack of liquidity mitigates share price volatility. So, while both publicly traded and non-traded REITs reflect the effects of recession, REIT NAV generally will fluctuate less than market price.

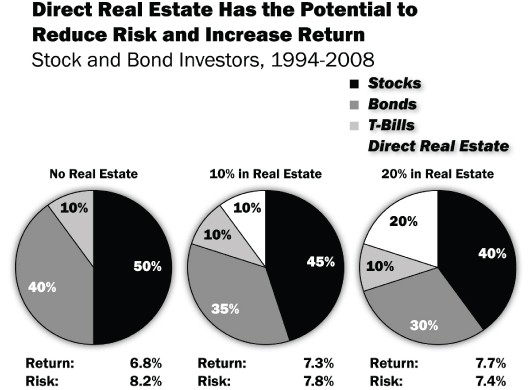

For investors seeking ways to diversify traditional stock and bond portfolios, REITs offer an attractive alternative. But diversification is only part of a well-designed financial plan. Risk management, or reducing portfolio volatility, is just as important. Non-traded REITs can achieve both of these goals.