Next big thing equalweight index funds

Post on: 11 Июнь, 2015 No Comment

Story Highlights

- Fund industry offers 148 S&P 500 index funds Apple largest S&P 500 holding Schwab & Co. has rolled out five fundamentally weighted funds

Periodically, people come up with new and revolutionary ways to look at the world. They may argue, for example, Emily Dickinson was actually one of Mark Twain’s practical jokes, or that the Romans built Australia.

Needless to say, most of these turn out to be desperate cries for attention. But every so often, a revolutionary idea turns out to be quite true. Most people, for example, now believe that low-cost index funds can often clobber a high-cost, actively managed mutual fund.

Now there’s a new twist on indexing, called fundamental indexing, that’s rattling the mutual fund universe. Although the jury is still out on fundamental indexing, it does seem promising — and certainly a far better development than the recent spate of highly specialized index funds that have plagued the industry.

The theory behind index funds is fairly simple. It’s extremely difficult to outperform a stock index, such as the Standard & Poor’s 500, with any regularity. It’s even harder if you’re charging 1.5 percentage points a year for active management. It’s like carrying a couple of barbells during a marathon. The guy without the barbells is probably going to win over the long run.

No surprise, then, that the two largest stock mutual funds are index funds. (SPDR S&P 500 and Vanguard Total Stock Market, measuring by single share class.) From a fund company’s perspective, however, indexing has one big problem: a relatively limited universe. How many funds do you need that track the S&P 500?

The fund industry’s answer is 148, according to Lipper. Leaving that aside, however, the number of useful, broad-based indexes is relatively small. The fund industry’s response has been to create a number of silly — and often expensive — funds based on narrowly defined indexes. Just this year, for example, we’ve seen the rollout of the ATMP — Barclays ETN+ Select MLP ETN, which tracks midstream U.S. and Canadian master limited partnerships, according to its fact sheet. And let’s not forget the U.S. Equity High Volatility Put Write Index Fund. OK, actually, let’s forget it.

Amid all this fund clutter comes fundamental indexing. Let’s start with a little background. Most index funds give greater weight to stocks with the largest market capitalization — number of shares outstanding multiplied by share price. Currently, for example, Apple (AAPL) is the largest holding in the S&P 500, and accounts for 3.07% of its value. ExxonMobil (XOM) is the second-largest holding, weighing in at 3.02% of the index. The 10 largest holdings in the S&P 500 account for 18.88% of the index.

One criticism of weighting by market cap is that the very largest stocks can be overvalued. For example, at the peak of the dot-com bubble in March 2000, Microsoft (MSFT). Cisco (CSCO) and General Electric (GE) were the three largest holdings in the S&P 500. Their performance since March 31, 2000, including reinvested dividends:

• Microsoft: -40%

• GE: -25%

• Cisco: -78%

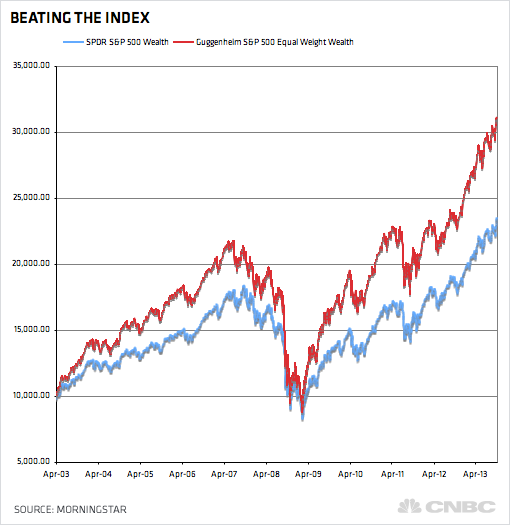

A simple solution would be to weight each stock equally — a strategy that does best when most stocks, rather than a few, are rising. The Invesco Equally-Weighted S&P 500 Index fund, for example, has beaten the regular S&P 500 by 2.62 percentage points a year for the past 15 years, according to Morningstar. The fund carries an unfortunate 5.5% sales charge, but investors can get the Guggenheim S&P 500 Equal Weight ETF at a discount brokerage for a much smaller commission.

Fundamental indexing is another way of addressing the problem. It would weight stocks by different criteria than market cap — dividends, for example, or sales or earnings. A few fundamental index funds now have five-year records, and the results are mixed.

For example, the WisdomTree 500 Earnings fund (EPS) follows an index of the 500 largest earnings-producing stocks in the U.S. and weights those companies by the dollar value of their earnings. By this measure, Apple and ExxonMobil are still the top two holdings, but Chevron (CVX) pushes aside General Electric for the No. 3 spot.

For the past three years, the fund has lagged behind the S&P 500 by 0.49 percentage points a year, Morningstar says. A similar WisdomTree fund, the LargeCap Dividend Fund (DLN). weights holdings by the total dividends paid out. It has beaten the S&P 500 by 1.72 percentage points a year the past three years.

Charles Schwab & Co. has rolled out five fundamental index funds, using the methodology first advanced by Rob Arnott, head of Research Affiliates, and a founder of fundamental investing. These funds use a combination of retained operating cash flow, adjusted sales and dividends plus buybacks to weight stocks.

Vanguard, the leader in indexing, has generally dismissed it as a way to tilt portfolios toward a particular investment style, such as value investing. And they have a point: Dividend funds will tend to outperform in periods of low interest rates. On the other hand, cap-weighted indexes do very well when a handful of red-hot stocks lead the market — as they did in 2000.

You can safely dismiss most extremely narrow-based indexes, unless you simply have a hankering to trade ETFs. But fundamental indexes aren’t in the same category as, say, Indonesian Small-Company Value indexes. Adding a fundamental index or two to your portfolio might not hurt — and could actually help.