New Study Reveals Three 401k Strategies More Important than Asset Allocation

Post on: 2 Апрель, 2015 No Comment

F or nearly twenty years, financial service providers have claimed the secret to retirement success lies in asset allocation, not security selection. Both professional and academic careers have been made on this premise, but a new study offers an alarming assessment of the fruits of the debate – and has the real-life numbers to back up its conclusions. Moreover, this new study also suggests the current debate surrounding a popular but controversial 401k product may amount to nothing more than arguing how many angels can dance on the head of a pin.

In the newly published “How Important Is Asset Allocation To Americans’ Financial Retirement Security? ” (Pension Research Council Working Paper. The Wharton School, University of Pennsylvania, August, 2012), authors Alicia H. Munnell, Natalia Orlova, and Anthony Webb, using real-world data, may have just turned the 401k world upside down. By analyzing data from the RETIRE project at Georgia State University, the Social Security Administration and the Health and Retirement Study, these researchers conclude asset allocation has a much smaller impact on the success in attaining retirement goals than popular opinion – and many marketing programs of large financial service firms – would have us believe. Indeed, they identified three factors that can influence retirement outcomes more favorably – and with far greater control and predictability – for employees.

Many experienced financial planners and investment advisers may already be familiar with at least two of these three “levers,” as the paper calls them. Astute 401k plan sponsors, who focus more on employee education than the plan’s investment menu, may also recognize these levers. The three behavioral strategies shown in the paper to be more important than asset allocation are: 1) controlling spending (i.e. investing early); 2) delaying retirement; and 3) taking out a reverse mortgage.

Anthony Webb, a senior economist at the Center for Retirement Research who holds a Ph.D in economics from the University of California, San Diego and one of the paper’s authors, told FiduciaryNews.com. “I am sure that, when drawing up a financial plan, reputable financial advisors would ensure that the savings rate and planned retirement age were consistent with the planned retirement age. Many on-line tools illustrate the impact of early retirement, but few households avail themselves of such advice.”

The authors’ use of practical financial and return targets rather than historic market returns differentiates this paper from others like it. This “goal-oriented targeting” approach more closely mimics the factors and decisions retirement investors need to consider. As a result, the paper concludes “starting to save at age 25, rather than age 45, cuts the required saving rate by about two-thirds.” Similarly, it says “delaying retirement from age 62 to age 70 also reduces the required savings rate by about two-thirds.” Just how dramatic is the impact of saving early and retiring later? The paper shows someone who begins saving at age 25 and retires at age 70 need only save 7% of his income. Contrast that to the individual who begins saving at age 45 and wishes to retire at age 62. That person will need to save an unrealistic 65% of his salary. On the other hand, that same “late” 45-year old saver would “only” have to defer 18% of his annual salary if he delayed retirement until age 70.

The above results assume a rate of return of 4%. The paper also looked at varying the annual return rate because, as we all know, higher returns allow for smaller annual savings deferral rates. This is where the first surprise came. The study showed a wide (for the typical multi-decade period associated with retirement investing) swing in annual returns can easily be made up for by deferring retirement. The paper concludes “an individual can offset the impact of a 2% return instead of a 6% return by retiring at 67 instead of 62.”

“The paper’s findings are actually quite hopeful,” says Webb. “While recognizing that ill health or unemployment will prevent a minority of older households from delaying retirement, the message is that the remainder have a powerful lever at their disposal to get back on track.”

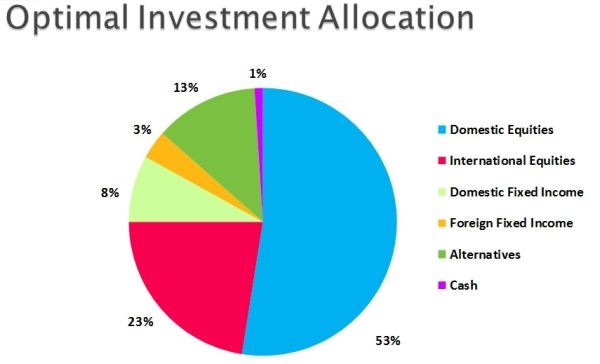

The paper then gets into the nitty gritty of asset allocation. It looks at typical wage earners and high wage earners and compares retirement outcomes using two different asset allocations – a “typical” and an “optimal” asset allocation. This is where we discover the second shocking conclusion. The difference in real-life impact between a “typical” and an “optimal” asset allocation is merely a few months’ salary. In other words, working an addition few months makes up for any ground lost as a result of using a sub-optimal asset allocation.

“We are not suggesting asset allocation be totally disregarded, only that getting it right will have only a modest impact on retirement outcomes for most households,” says Webb. He adds, “It is certainly not something to be ignored. Households need all the help they can get. But it has a second order effect, relative to working longer. Our research shows that the great majority of households (70+%) will be able to maintain their pre-retirement standard of living if they delay retirement till age 70.”

Webb also told FiduciaryNews.com the results of the paper may hint to HR implications for plan sponsors. He says, “Given the amounts most households have accumulated in their 401k plans, few will be able to maintain their pre-retirement standard of living in retirement. Many of those who are able to will likely choose to delay retirement. Plan sponsors need to ensure they are able to make productive use of these workers.”

He also points out the folly of the current “to” or “through” glide debate regarding target date funds. He says, “which target date fund you choose matters less than the other three levers.” Plan sponsors and employees confused and concerned about the target date fund controversy might be relieved to hear that. Large mutual fund companies counting on target date funds to help them accumulate more assets and increase revenues might be a bit disappointed by this new reality.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D96&r=G /%

7 responses to New Study Reveals Three 401k Strategies More Important than Asset Allocation

I agree with the comment that none of these findings are shocking to any thoughtful financial advisor. I do think, however, that many plan advisors give short shrift to participant education and guidance and focus more on the areas more easily controllable, like asset allocation. I think the importance of this is that advisors need to concern themselves more with outcomes, that is total participant savings rather than just investment performance. And that means focusing more on participant guidance. A lot of advisors wont do this because its hard work and because they arent comfortable engaging with participants in am in-depth manner that could lead them to areas of fiduciary responsibility.this is sad but largely true of plan advisors

August 18, 2012 at 11:31 am | Permalink

The findings in this article and the power of asset allocation are mutually exclusive.

Retirement Plan Advisors have long known the power of starting early, delaying retirement, AND increasing deferral rates play an enormous role in participant outcomes.

BUT, one cannot also ignore the fact that 80% (Im being kind) of people have little to no business determining and managing their investment allocation strategy.

Therefore, helping people determine their desired level of risk and then plugging them into a strategy vs. leaving security selection 100% up to the individual is very important as well.

October 3, 2012 at 2:33 pm | Permalink

The first paragraph of this article is misleading in that the study is not comparing or contrasting asset allocation to security selection. The article does correctly state that the study ranks 401k success drivers such as saving, delayed retirement and reverse mortgages ahead of investment selection. The study uses investment returns of various asset allocations to confirm its findings. It does not suggest that when you do consider proper investment inside a 401k account that you should not use asset allocation. It doesnt mention security selection at all.

October 6, 2012 at 4:46 pm | Permalink

Saving enough is more important than investing. All cash works just fine if you’ve saved enough. But it would appear that employers and their advisors don’t understand this fundamental truth when it comes to target date funds (TDFs). They’ve drunk the cool-aid that fund companies are serving up.

Fund companies say the appropriate objective for TDFs is to make up for inadequate participant savings, so they advocate high risk, which is easy & profitable for them to say because they are not fiduciaries, and they get paid more for taking more risk. It’s all upside (profit) with no downside (fiduciary responsibility). The truth is that the best remedy for inadequate savings is to save more – change participant behavior. Duh!

The fiduciary objective should be the Hippocratic Oath of TDFs: Dont lose participant money, especially near the target date. It’s what the participants need and want – it’s what they think they are getting.

January 22, 2013 at 11:29 am | Permalink

[] New Study Reveals Three 401k Strategies More Important Than Asset Allocation For nearly twenty years, financial service providers have claimed the secret to retirement success lies in asset allocation, not security selection. Both professional and academic careers have been made on this premise, but a new study offers an alarming assessment of the fruits of the debate – and has the real-life numbers to back up its conclusions. Source: Fiduciarynews.com []