New Markets Tax Credit

Post on: 16 Март, 2015 No Comment

Provide America’s taxpayers top quality service by helping them understand and meet their tax responsibilities and by applying the tax law with integrity and fairness to all.

Congressional Intent

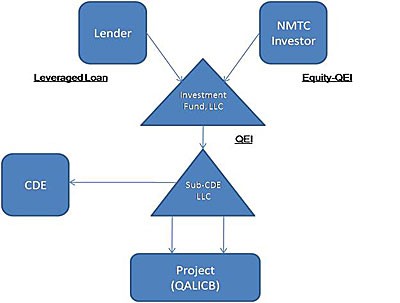

The New Markets Tax Credit (NMTC) Program, enacted by Congress as part of the Community Renewal Tax Relief Act of 2000, is incorporated as section 45D of the Internal Revenue Code. This Code section permits individual and corporate taxpayers to receive a credit against federal income taxes for making Qualified Equity Investments (QEIs) in qualified community development entities (CDEs).

These investments are expected to result in the creation of jobs and material improvement in the lives of residents of low-income communities. Examples of expected projects include financing small businesses, improving community facilities such as daycare centers, and increasing home ownership opportunities.

A “low-income community” is defined as any population census tract where the poverty rate for such tract is at least 20% or in the case of a tract not located within a metropolitan area, median family income for such tract does not exceed 80 of statewide median family income, or in the case of a tract located within a metropolitan area, the median family income for such tract does not exceed 80% of the greater of statewide median family income or the metropolitan area median family income.

As part of the American Jobs Creation Act of 2004, IRC §45D(e)(2) was amended to provide that targeted populations may be treated as low-income communities. A “targeted population” means individuals, or an identifiable group of individuals, including an Indian tribe, who are low-income persons or otherwise lack adequate access to loans or equity investments.

“Targeted population” also includes the Hurricane Katrina Gulf Opportunity (GO) Zone, where individuals’ principal residences or principal sources of income were located in areas that were flooded, sustained heavy damage, or sustained catastrophic damage as a result of Hurricane Katrina.

See Notice 2006-60, [2006], 2006-2 C.B. 82, for additional guidance on targeted populations.

Taxpayers’ Qualified Equity Investment (QEI)

Qualified Equity Investment (QEI) Defined

The actual cash investment made by the investor to the CDE, which is referred to as the equity investment, is the first step in defining a QEI. This cash investment eventually qualifies for the NMTC provided that the CDE makes qualified low-income community investments (QLICIs).

A QEI is, in general, any equity investment in a CDE if:

Such investment is acquired by the investor at its original issue (directly or through an underwriter) solely in exchange for cash,

Substantially all (at least 85%) of the cash is used by the CDE to make qualified low-income community investments (QLICI), and

The investment is designated by the CDE as a QEI on its books and records using any reasonable method.

The term equity investment means any stock in an entity which is a corporation, and any capital interest in an entity which is a partnership.

Allocation Limitation

The amount of QEIs designated by a CDE may not exceed the amount allocated to the CDE by the CDFI Fund. The term QEI does not include:

Any equity investment by a CDE in another CDE, if the CDE making the investment has received an allocation under IRC §45D(f)(2). This prevents a CDE with an allocation from investing in another CDE with an allocation, and thereby doubling up credits on a single investment.