New impairment testing guidance for indefinitelived intangible assets

Post on: 20 Май, 2015 No Comment

New impairment testing guidance for indefinite-lived intangible assets

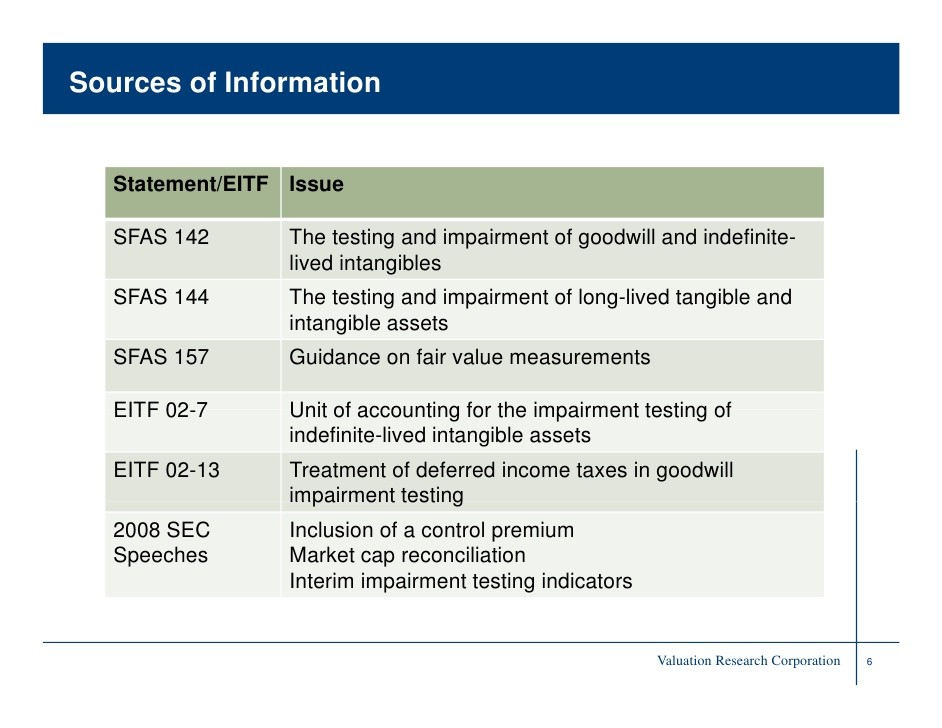

The Financial Accounting Standards Board (FASB) has issued revised standards for public and private companies on how to test indefinite-lived intangible assets, other than goodwill, for impairment. The amendments wont change how a company measures an impairment loss, but they could allow some companies to skip the performance of the quantitative impairment test on assets such as trademarks, licenses and distribution rights when the likelihood of impairment is low.

The amendments, found in Accounting Standards Update (ASU) No. 2012-02, Intangibles Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment. permit companies to make a qualitative assessment to determine whether its necessary to perform the quantitative impairment test. The new amendments generally follow the approach of those found in last years ASU No. 2011-08, Intangibles Goodwill and Other (Topic 350): Testing Goodwill for Impairment. and are similarly intended to reduce the cost and complexity of impairment testing.

The old testing requirements

Under the amendments in ASU 2011-08, a company was required to test an indefinite-lived intangible asset for impairment at least annually. Quantitative testing involved comparing an assets fair value with its carrying amount.

If the indefinite-lived intangible assets carrying amount exceeded the fair value, the company was required to recognize an impairment loss on its financial statements in an amount equal to the difference. After an impairment loss was recognized, the adjusted carrying amount of the intangible asset was the assets new accounting basis.

The new testing requirements

The amendments in ASU 2012-02 provide the option for a company to make a qualitative evaluation to determine whether it must perform the annual quantitative test for the impairment of indefinite-lived intangible assets. If it chooses this option, the company must assess whether relevant events and circumstances affect the significant inputs used to determine fair value and whether its more likely than not that the indefinite-lived intangible asset is impaired. More likely than not means a likelihood of more than 50%.

If the company concludes that it indeed is more likely than not that the indefinite-lived intangible asset is impaired, it must perform the quantitative testing, calculating the fair value and comparing that amount with the carrying amount to determine the amount of impairment loss to recognize. And, as before, the adjusted carrying amount becomes the indefinite-lived intangible assets new accounting basis.

If the company concludes that it isnt more likely than not that fair value is less than the carrying amount, no further action is necessary. The company must, however, make a positive assertion about its conclusion and the events and circumstances taken into consideration to reach that conclusion.

As mentioned, the qualitative assessment is purely optional. A company can choose to bypass the assessment and proceed directly to calculating an indefinite-lived intangible assets fair value for the quantitative impairment test. It may prove more cost effective for a company to skip the qualitative assessment when it believes its highly likely that the indefinite-lived intangible asset is impaired. Companies that do so can still conduct the qualitative assessment in any future period.

Notably, FASB stressed that it doesnt intend to change the practice of how a company evaluates indefinite-lived intangible assets for impairment on an interim basis. Such assets should be tested at least annually and evaluated on an interim basis to consider whether any changes in events and circumstances have occurred that indicate its more likely than not that the indefinite-lived intangible assets are impaired.

Relevant events and circumstances

When making the more-likely-than-not assessment, a company must consider all relevant events and circumstances that could affect the significant inputs used to determine the fair value of the indefinite-lived intangible assets. The amendments replace the previous indicators of potential impairment with a nonexclusive list of events and circumstances that a company should consider, including:

- Cost factors, such as increases in raw-material, labor or other costs that have a negative effect on future expected earnings and cash flows,

- Financial performance, such as negative or declining cash flows or a decline in actual or planned revenue or earnings compared with actual and projected results of relevant prior periods,

- Legal, regulatory, contractual, political, business or other factors, including asset-specific factors,

- Other relevant company-specific events, such as litigation, contemplation of bankruptcy, or changes in management, key personnel, strategy or customers,

- Industry and market considerations, such as a deterioration in the environment in which the company operates, an increased competitive environment, a decline in market-dependent multiples or metrics, or a change in the market for the companys products or services, and

- Macroeconomic conditions, such as deterioration in general economic conditions, limitations on accessing capital, fluctuations in foreign exchange rates or other developments in equity and credit markets.

FASB notes that none of the examples listed above represents a standalone event or circumstance that automatically requires an entity to perform the quantitative impairment test. Also, companies can identify other relevant events and circumstances, including, for public companies, a sustained drop in share price.

If a company has made a recent fair value calculation for an indefinite-lived intangible asset, the difference between that fair value and the carrying amount at that time should be included as a factor. FASB observes, though, that the more time that has passed since the company last calculated fair value, the more difficult it may be for the company to draw a conclusion about whether an indefinite-lived intangible asset is more likely than not to be impaired based on a qualitative assessment of relevant events and circumstances.

The company must consider the extent to which the adverse events and circumstances identified could affect the significant inputs used to determine the fair value of the indefinite-lived intangible asset, both individually and in aggregate. It must also consider whether there have been any changes to the indefinite-lived intangible assets carrying amount, as well as any positive and mitigating events and circumstances. The existence of mitigating events, however, doesnt trigger a rebuttable presumption that the company shouldnt perform the quantitative test.

Effective date

The amendments are effective for annual and interim impairment tests performed for fiscal years beginning after Sept. 15, 2012, and early adoption is permitted.