Neural Networks Forecasting Profits_3

Post on: 1 Июль, 2015 No Comment

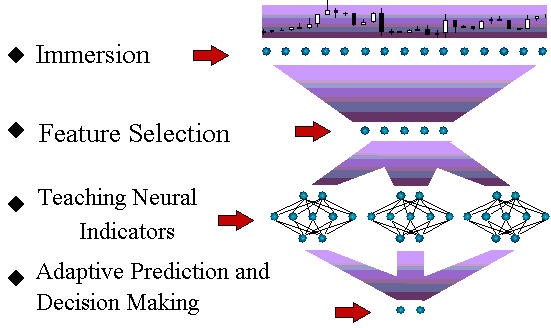

Our trading strategy is based on artificial neural networks.

Artificial neural networks are non-linear statistical data modeling tools.

They are applicable in virtually every situation in which a relationship between the predictor variables (inputs) and predicted variables (outputs) exists, even when that relationship is very complex. The other key feature of neural networks is that they learn the input/output relationship through training.

A network user assembles a set of training data which contains examples of inputs together with the corresponding outputs, and the network learns to infer the relationship between the two. Training data might include previous exchange rates and technical indicators. The neural network is then trained using one of the learning algorithms, which uses the data to adjust the network’s weights so as to minimize the error in its predictions on the training set. If the network is properly trained, it has then learned to model the (unknown) function that relates the input variables to the output variables, and can subsequently be used to make predictions where the output is not known.

Literature

We collected links to articles on application of neural networks to financial time series forecasting. Hopefully, these articles will be useful in developing your own profitable trading systems.

A New Computational Method of Input Selection for Stock Market Forecasting with Neural Networks

Wei Huang, Shouyang Wang, Lean Yu, Yukun Bao, Lin Wang

2006

Abstract: We propose a new computational method of input selection for stock market forecasting with neural networks. The method results from synthetically considering the special feature of input variables of neural networks and the special feature of stock market time series. We conduct the experiments to compare the prediction performance of the neural networks based on the different input variables by using the different input selection methods for forecasting S&P 500 and NIKKEI 225. The experiment results show that our method performs best in selecting the appropriate input variables of neural networks.

A Hybrid Time Lagged Network for Predicting Stock Prices

S.C.Hui, M.T.Yap, P.Prakash

Abstract: Traditionally, technical analysis approach, that predicts stock prices based on historical prices and volume, basic concepts of trends, price patterns and oscillators, is commonly used by stock investors to aid investment decisions. Advanced intelligent techniques, ranging from pure mathematical models and expert systems to neural networks, have also been used in many financial trading systems for predicting stock prices. In this paper, we propose the Hybrid Time Lagged Network (HTLN) which integrates the supervised Multilayer Perceptron using temporal back-propagation algorithm with the unsupervised Kohonen network for predicting the chaotic stock series. This attempts to combine the strengths of both supervised and unsupervised networks to perform more precise prediction. The proposed network has been tested with stock data obtained from the main board of Kuala Lumpur Stock Exchange (KLSE). In this paper, the design, implementation and performance of the proposed neural network are described.

EMBEDDING TECHNICAL ANALYSIS INTO NEURAL NETWORK BASED TRADING SYSTEMS

TIM CHENOWETH, ZORAN OBRADOVIC, SAUCHI STEPHEN LEE

1996

Abstract: We have recently proposed a promising trading system for the S&P 500 index, which consists of a feature selection component and a simple filter for data preprocessing, two specialized neural networks for return prediction, and a rule base for prediction integration. The objective of this study is to explore if including additional knowledge for more sophisticated data filtering and return integration leads to further improvements in the system. The new system uses a well-known technical indicator to split the data, and an additional indicator for reducing the number of unprofitable trades. Several system combinations are explored and tested over a 5-year trading period. The most promising system yielded an annual rate of return (ARR) of 15.99% with 54 trades. This compares favorably to the ARR for the buy and hold strategy (11.05%) and to the best results obtained using the system with no technical analysis knowledge embedded (13.35% with 126 trades).

A Study on Training Criteria for Financial Time Series Forecasting

JingTao YAO, Chew Lim TAN

Abstract: Traditional backpropagation neural networks training criterion is based on goodness-of-fit which is also the most popular criterion forecasting. How ever, in the context of financial time series forecasting, we are not only concerned at how good the forecasts fit their target. In order to increase the forecastability in terms of profit earning, we propose a profit based adjusted weight factor for backpropagation network training. Instead of using the traditional least squares error, we add a factor which contains the profit, direction, and time information to the error function. This article reports the analysis on the performance of several neural network training criteria. The results show that the new approach does improve the forecastability of neural network models, for the financial application domain

A Trading System for FTSE-100 Futures Using Neural Networks and Wavelets

D.L.Toulson, S.P.Toulson

1997

Abstract: In this paper, we shall examine the combined use of the Discrete Wavelet Transform and regularised neural networks to predict intra-day returns of the LIFFE FTSE-100 index future. The Discrete Wavelet Transform (DWT) has recently been used extensively in a number of signal processing applications. In this work, we shall propose the use of a specialised neural network architecture (WEAPON) that includes within it a layer of wavelet neurons. These wavelet neurons serve to implement an initial wavelet transformation of the input signal, which in this case, will be a set of lagged returns from the FTSE-100 future. We derive a learning rule for the WEAPON architecture that allows the dilations and positions of the wavelet nodes to be determined as part of the standard back-propagation of error algorithm. This ensures that the child wavelets used in the transform are optimal in terms of providing the best discriminatory information for the prediction task. We then examine how the predictions obtained from committees of WEAPON networks may be exploited to establish trading rules for adopting positions in the FTSE -100 Index Future using a Signal Thresholded Trading System (STTS). The STTS operates by combining predictions of the future return estimates of a financial time series over a variety of different prediction horizons. A set of trading rules is then determined that act to optimise the risk adjusted performance (Sharpe Ratio) of the trading strategy using realistic assumptions for bid/ask spread, slippage and transaction costs.

ANN-Based Forecasting of Foreign Currency Exchange Rates

Joarder Kamruzzaman, Ruhul A. Sarker

2004

Abstract: In this paper, we have investigated artificial neural networks based prediction modeling of foreign currency rates using three learning algorithms, namely, Standard Backpropagation (SBP), Scaled Conjugate Gradient (SCG) and Backpropagation with Bayesian Regularization (BPR). The models were trained from historical data using five technical indicators to predict six currency rates against Australian dollar. The forecasting performance of the models was evaluated using a number of widely used statistical metrics and compared. Results show that significantly close prediction can be made using simple technical indicators without extensive knowledge of market data. Among the three models, SCG based model outperforms other models when measured on two commonly used metrics and attains comparable results with BPR based model on other three metrics. The effect of network architecture on the performance of the forecasting model is also presented. Future research direction outlining further improvement of the model is discussed.

Application Of Neural Network To Technical Analysis Of Stock Market Prediction

Hirotaka Mizuno, Michitaka Kosaka, Hiroshi Yajima

Statistical Arbitrage Stock Trading using Time Delay Neural Networks

FORECASTING FINANCIAL MARKETS USING NEURAL NETWORKS: AN ANALYSIS OF METHODS AND ACCURACY

FORECASTING PRICE INCREMENTS USING AN ARTIFICIAL NEURAL NETWORK

FILIPPO CASTIGLIONE

2000

Abstract: Financial forecasting is a dicult task due to the intrinsic complexity of the financial system. A simplified approach in forecasting is given by black box methods like neural networks that assume little about the structure of the economy. In the present paper we relate our experience using neural nets as financial time series forecast method. In particular we show that a neural net able to forecast the sign of the price increments with a success rate slightly above 50% can be found. Target series are the daily closing price of dierent assets and indexes during the period from about January 1990 to February 2000.

Neural network-based prediction of the USD/GBP exchange rate: the utilisation of data compression techniques for input dimension reduction

Leonidas Anastasakis, Neil Mort

Abstract: Financial prediction is a research active area and neural networks have been proposed as one of the most promising methods for such prediction. In this paper we simulate an MLP network in order to perform one step ahead prediction of the USD/GBP exchange rate. Four different input vectors are tested and the best network architecture determined. In addition, an autoassociator MLP network has been applied to reduce input data dimension. It is shown that the generalisation performance of the network is improved when the reduced input vector is used.

Noisy Time Series Prediction using a Recurrent Neural Network and Grammatical Inference

Lee Giles, Steve Lawrence, Ah Chung Tsoi

Neural Networks For Financial Time Series Prediction: Overview Over Recent Research

Dimitri PISSARENKO

2002

Abstract: Neural networks are an artificial intelligence method for modelling complex target functions. During the last decade they have been widely applied to the domain of financial time series prediction and their importance in this field is growing. The present work aims at serving as an introduction to the domain of financial time series prediction, emphasizing the issues particularly important with respect to the neural network approach to this task. The work concludes with a discussion of current research topics related to neural networks in financial time series prediction.

ARE FOREIGN EXCHANGE RATES PREDICTABLE? A SURVEY FROM ARTIFICIAL NEURAL NETWORKS PERSPECTIVE

LEAN YU, SHOUYANG WANG, WEI HUANG, KIN KEUNG LAI

2007

Abstract: This study presents a survey on the applications of artificial neural networks (ANNs) in foreign exchange rates forecasting. With their ability to discover patterns in nonlinear systems, ANNs have been widely used as a promis- ing alternative approach to predict foreign exchange rates. In this paper, the predictability of foreign exchange rates is first investigated from neural networks perspective. We examine 45 journal articles about exchange rates prediction with ANNs between 1971 and 2004 in detail, and compare the performances of ANNs and those of other forecasting methods, finding mixed results. Subsequently, the main reasons leading to the inconsistent results are explored by literature analysis and inference. Meanwhile the study summarizes the general situations in which foreign exchange rates are predictable with ANNs in view of previous literature analysis. Finally, some implications and interesting research topics are presented as future research directions in foreign exchange rates forecasting with ANNs.

A case study on using neural networks to perform technical forecasting of forex

Jingtao Yao, Chew Lim Tan

2000

Abstract: This paper reports empirical evidence that a neural network model is applicable to the prediction of foreign exchange rates. Time series data and technical indicators, such as moving average, are fed to neural networks to capture the underlying `rulesa of the movement in currency exchange rates. The exchange rates between American Dollar and other major currencies, Japanese Yen, Deutsch Mark, British Pound, Swiss Franc and Australian Dollar are forecast by the trained neural networks. The traditional rescaled range analysis is used to test the `e$ciencya of each market before using historical data to train the neural networks. The results presented here show that without the use of extensive market data or knowledge, useful prediction can be made and significant paper prots can be achieved for out-of-sample data with simple technical indicators. A further research on exchange rates between Swiss Franc and American Dollar is also conducted. However, the experiments show that with efficient market it is not easy to make profits using technical indicators or time series input neural networks. This article also discusses several issues on the frequency of sampling, choice of network architecture, forecasting periods, and measures for evaluating the model’s predictive power. After presenting the experimental results, a discussion on future research concludes the paper.

Guidelines for Financial Forecasting with Neural Networks

JingTao YAO, Chew Lim TAN

2001

Abstract: Neural networks are good at classification, forecasting and recognition. They are also good candidates of financial forecasting tools. Forecasting is often used in the decision making process. Neural network training is an art. Trading based on neural network outputs, or trading strategy is also an art. We will discuss a seven-step neural network forecasting model building approach in this article. Pre and post data processing/analysis skills, data sampling, training criteria and model recommendation will also be covered in this article.

NEURAL NETWORKS FOR TECHNICAL ANALYSIS: A STUDY ON KLCI

JINGTAO YAO, CHEW LIM TAN, HEAN-LEE POH

1998

Abstract: This paper presents a study of artificial neural nets for use in stock index forecasting. The data from a major emerging market, Kuala Lumpur Stock Exchange, are applied as a case study. Based on the rescaled range analysis, a backpropagation neural network is used to capture the relationship between the technical indicators and the levels of the index in the market under study over time. Using dierent trading strategies, a significant paper profit can be achieved by purchasing the indexed stocks in the respective proportions. The results show that the neural network model can get better returns compared with conventional ARIMA models. The experiment also shows that useful predictions can be made without the use of extensive market data or knowledge. The paper, however, also discusses the problems associated with technical forecasting using neural networks, such as the choice of time frames and the recency problems.

Designing a neural network for forecasting financial and economic time series

Iebeling Kaastra, Milton Boyd

1995

Abstract: Artificial neural networks are universal and highly flexible function approximators first used in the fields of cognitive science and engineering. In recent years, neural network applications in finance for such tasks as pattern recognition, classification, and time series forecasting have dramatically increased. However, the large number of parameters that must be selected to develop a neural network forecasting model have meant that the design process still involves much trial and error. The objective of this paper is to provide a practical introductory guide in the design of a neural network for forecasting economic time series data. An eight-step procedure to design a neural network forecasting model is explained including a discussion of tradeoffs in parameter selection, some common pitfalls, and points of disagreement among practitioners.

Modelling and Trading the EUR/USD Exchange Rate: Do Neural Network Models Perform Better?

Christian L. Dunis, Mark Williams

Neural Networks in Business Time Series Forecasting: Benefits and Problems

Neural network modeling for stock movement prediction: A state of the art

Using a Financial Training Criterion Rather than a Prediction Criterion

Yoshua Bengio

1998

Abstract: The application of this work is to decision taking with financial timeseries, using learning algorithms. The traditional approach is to train a model using a prediction criterion, such as minimizing the squared error between predictions and actual values of a dependent variable, or maximizing the likelihood of a conditional model of the dependent variable. We find here with noisy time-series that better results can be obtained when the model is directly trained in order to maximize the financial criterion of interest, here gains and losses (including those due to transactions) incurred during trading. Experiments were performed on portfolio selection with 35 Canadian stocks.

An Online Learning Algorithm with Adaptive Forgetting Factors for Feedforward Neural Networks in Financial Time Series Forecasting

Lean Yu, Shouyang Wang, Kin Keung Lai

2005

Abstract: In this study, an online learning algorithm for feedforward neural networks (FNN) based on the optimized learning rate and adaptive forgetting factor is proposed for online financial time series prediction. The new learning algorithm is developed for online predictions in terms of the gradient descent technique, and can speed up the FNN learning process substantially relative to the standard FNN algorithm, while simultaneously preserving the stability of the learning process. In order to verify the effectiveness and efficiency of the proposed online learning algorithm, two typical financial time series are chosen as testing targets for illustration purposes.

Design and implementation of NN5 for Hong Kong stock price forecasting

Philip M.Tsang, Paul Kwok, S.O.Choy, Reggie Kwanb, S.C.Ng, Jacky Mak, Jonathan Tsang, Kai Koong, Tak-Lam Wong

2007

Abstract: A number of published techniques have emerged in the trading community for stock prediction tasks. Among them is neural network (NN). In this paper, the theoretical background of NNs and the backpropagation algorithm is reviewed. Subsequently, an attempt to build a stock buying/selling alert system using a backpropagation NN, NN5, is presented. The system is tested with data from one Hong Kong stock, The Hong Kong and Shanghai Banking Corporation (HSBC) Holdings. The system is shown to achieve an overall hit rate of over 70%. A number of trading strategies are discussed. A best strategy for trading non-volatile stock like HSBC is recommended.

Neural Network Models of the Spot Canadian/U.S. Exchange Rate

Peter Kim, Lin Pan, Tony S. Wirjanto

2005

Abstract: This paper proposes several predictive nonlinear transfer function models between short term interest rate spread and daily spot Canadian/US foreign exchange rate, using multi-layer feedforward neural networks with backpropagation learning algorithm. A comparative pre-test of the neural network model is constructed to evaluate the network performance and to select the best model. All of the testing models yield about 55% — 60% accuracy of the directional forecast on the out-of-sample test set. Comparing with the linear predictive models, a 2% to 5% gain is obtained by using neural network models. In particular, one of the models proposed in this paper, namely the separate neural networks model, is able to explore the nonlinear relationship between the spot Canadian/US foreign exchange rate and short term interest rate spread during a period of negative interest rate spread. Furthermore it is able to capture a corrective mean reversion when the Canadian dollar is under or over-valued in the market. The comparative pre-test also demonsrates the impact changes in the interest rate spread have on changes in the spot rate. As an aside the pre-test provides numerical evidence on the stable relationship between the short term interest rate spread and the spot Canadian/US foreign exchange rate.

Jackknife Learning Algorithms for the Neural-Network Model of Exchange Rate

Peter Kim, Lin Pan, Tony S.Wirjanto

2005

Abstract: In this paper, we propose two grouped jackknife algorithms and apply them to a separate multi-layer feed-forward neural-network model of noisy financial time series, such as the spot Canadian/US foreign exchange rate. The integrated method delivers a reasonably reliable forecast of the spot rate along with a large amount of statistical information associated with the historical data.

Bootstrapping Neural-Network Models of Exchange Rate

Peter Kim, Lin Pan, Tony S.Wirjanto

2005

Abstract: In this paper, we provide a framework to quantify a forecast of noisy financial time series through an interval prediction by integrating two computationally oriented methods, namely neural network and bootstrap. In particular, we develop parametric and non-parametric bootstrap cross-validation learning algorithms and apply them to a multi-layer feed-forward neural-network model of the spot Canadian/US foreign exchange rate, exploiting the existence of a stable transmission link between the spot rate and the short-term interest-rate Using the integrated method, we are able to uncover a hidden nonlinear structure between the spot rate and the shortterm interest-rate spread during the period of negative interest-rate spread. Also, using this method, we are able to capture a corrective mean reversion when the Canadian dollar is under or overvalued in the market. Lastly, this method allows us to obtain a reliable forecast of the spot rate along with a large amount of statistical information associated with the historical data.

Predicting Stock Market Index Trading Signals Using Neural Networks

C.D.Tilakaratne, S.A.Morris, M.A.Mammadov, C.P.Hurst

2007

Abstract: This study forecasts trading signals of the Australian All Ordinary Index (AORD), one day ahead. These forecasts were based on the current day’s relative return of the Close price of the US S&P 500 Index, the UK FTSE 100 Index, French CAC 40 Index and German DAX Index as well as the AORD. The forecasting techniques examined were feedforward and probabilistic neural networks. Performance of the networks was evaluated by using classification/misclassification rate and trading simulations. For both evaluation criteria, feedforward neural networks performed better. Trading simulations suggested that the predicted trading signals are useful for short term traders.

Predicting Australian Stock Market Index Using Neural Networks Exploiting Dynamical Swings and Intermarket Influences

Heping Pan, Chandima Tilakaratne, John Yearwood

2005

Abstract: This paper presents a computational approach for predicting the Australian stock market index – AORD using multi-layer feed-forward neural networks from the time series data of AORD and various interrelated markets. This effort aims to discover an effective neural network or a set of adaptive neural networks for this prediction purpose, which can exploit or model various dynamical swings and inter-market influences discovered from professional technical analysis and quantitative analysis. Within a limited range defined by our empirical knowledge, three aspects of effectiveness on data selection are considered: effective inputs from the target market (AORD) itself, a sufficient set of interrelated markets, and effective inputs from the interrelated markets. Two traditional dimensions of the neural network architecture are also considered: the optimal number of hidden layers, and the optimal number of hidden neurons for each hidden layer. Three important results were obtained: A 6-day cycle was discovered in the Australian stock market during the studied period; the time signature used as additional inputs provides useful information; and a basic neural network using six daily returns of AORD and one daily returns of SP500 plus the day of the week as inputs exhibits up to 80% directional prediction correctness.

An Empirical Methodology for Developing Stockmarket Trading Systems using Artificial Neural Networks

Bruce J.Vanstone, Gavin Finnie

2007

Abstract: A great deal of work has been published over the past decade on the application of neural networks to stockmarket trading. Individual researchers have developed their own techniques for designing and testing these neural networks, and this presents a difficulty when trying to learn lessons and compare results. This paper aims to present a methodology for designing robust mechanical trading systems using soft computing technologies, such as artificial neural networks. This methodology describes the key steps involved in creating a neural network for use in stockmarket trading, and places particular emphasis on designing these steps to suit the real-world constraints the neural network will eventually operate in. Such a common methodology brings with it a transparency and clarity that should ensure that previously published results are both reliable and reusable.

Development of Neural Network Algorithms for Predicting Trading Signals of Stock Market Indices

Chandima D.Tilakaratne, Musa A.Mammadov, Sidney A.Morris

2007

Abstract: The aim of this paper is to develop new neural network algorithms to predict whether it is best to buy, hold or sell shares (trading signals) of stock market indices. Almost all the available classification techniques are not successful in predicting trading signals when the actual trading signals are not symmetrically distributed among theses three classes. New neural network algorithms were developed based on the structure of feedforward neural networks and a modified Ordinary Least Squares (OLS) error function. An adjustment relating to the contribution from the historical data used for training the networks, and penalisation of incorrectly classified trading signals were accounted for when modifying the OLS function. A global optimization algorithm was employed to train these networks. The algorithms developed in this study were employed to predict the trading signals of the Australian All Ordinary Index. The algorithms with the modified error functions introduced by this study produced better predictions.

Neural Network Regression and Alternative Forecasting Techniques for Predicting Financial Variables

Christian L.Dunis, Jamshidbek Jalilov

2001

Abstract: In this paper, we examine the use of Neural Network Regression (NNR) and alternative forecasting techniques in financial forecasting models and financial trading models. In both types of applications, NNR models results are benchmarked against simpler alternative approaches to ensure that there is indeed added value in the use of these more complex models. The idea to use a nonlinear nonparametric approach to predict financial variables is intuitively appealing. But whereas some applications need to be assessed on traditional forecasting accuracy criteria such as root mean squared errors, others that deal with trading financial markets need to be assessed on the basis of financial criteria such as risk adjusted return. Accordingly, we develop two different types of appications. In the first one, using monthly data from April 1993 through June 1999 from a UK financial institution, we develop alternative forecasting models of cash flows and cheque values of four of its major customers. These models are then tested out-of-sample over the period July 1999-April 2000 in terms of forecasting accuracy. In the second series of applications, we develop financial trading models for four major stock market indices (S&P500, FTSE100, EUROSTOXX50 and NIKKEI225) using daily data from 31 January 1994 through 4 May 1999 for insample estimation and leaving the period 5 May 1999 through 6 June 2000 for out-of-sample testing. In this case, the trading models developed are not assessed in terms of forecasting accuracy, but in terms of trading efficiency via the use of a simulated trading strategy. In both types of applications, for the periods and time series concerned, we clearly show that NNR models do indeed add value in the forecasting process.

FORECASTING FOREIGN EXCHANGE RATES WITH ARTIFICIAL NEURAL NETWORKS: A REVIEW

WEI HUANG, K.K.LAI, Y.NAKAMORI, SHOUYANG WANG

2004

Abstract: Forecasting exchange rates is an important financial problem that is receiving increasing attention especially because of its difficulty and practical applications. Artificial neural networks (ANNs) have been widely used as a promising alternative approach for a forecasting task because of several distinguished features. Research efforts on ANNs for forecasting exchange rates are considerable. In this paper, we attempt to provide a survey of research in this area. Several design factors significantly impact the accuracy of neural network forecasts. These factors include the selection of input variables, preparing data, and network architecture. There is no consensus about the factors. In different cases, various decisions have their own effectiveness. We also describe the integration of ANNs with other methods and report the comparison between performances of ANNs and those of other forecasting methods, and finding mixed results. Finally, the future research directions in this area are discussed.

A Reliability-Based RBF Network Ensemble Model for Foreign Exchange Rates Predication

Lean Yu, Wei Huang, Kin Keung Lai, Shouyang Wang

2006

Abstract: In this study, a reliability-based RBF neural network ensemble forecasting model is proposed to overcome the shortcomings of the existing neural ensemble methods and ameliorate forecasting performance. In this model, the ensemble weights are determined by the reliability measure of RBF network output. For testing purposes, we compare the new ensemble model’s performance with some existing network ensemble approaches in terms of three exchange rates series. Experimental results reveal that the prediction using the proposed approach is consistently better than those obtained using the other methods presented in this study in terms of the same measurements.

Multistage Neural Network Metalearning with Application to Foreign Exchange Rates Forecasting

Kin Keung Lai, Lean Yu, Wei Huang, Shouyang Wang

2006

Abstract: In this study, we propose a multistage neural network metalearning technique for financial time series predication. First of all, an interval sampling technique is used to generate different training subsets. Based on the different training subsets, the different neural network models with different training subsets are then trained to formulate different base models. Subsequently, to improve the efficiency of metalearning, the principal component analysis (PCA) technique is used as a pruning tool to generate an optimal set of base models. Finally, a neural-network-based metamodel can be produced by learning from the selected base models. For illustration, the proposed metalearning technique is applied to foreign exchange rate predication.

A novel nonlinear ensemble forecasting model incorporating GLAR and ANN for foreign exchange rates

LeanYu, Shouyang Wang, K.K.Lai

2004

Abstract: In this study, we propose a novel nonlinear ensemble forecasting model integrating generalized linear autoregression (GLAR) with artificial neural networks (ANN) in order to obtain accurate prediction results and ameliorate forecasting performances. We compare the new model’s performance with the two individual forecasting models—GLAR andANN—as well as with the hybrid model and the linear combination models. Empirical results obtained reveal that the prediction using the nonlinear ensemble model is generally better than those obtained using the other models presented in this study in terms of the same evaluation measurements. Our findings reveal that the nonlinear ensemble model proposed here can be used as an alternative forecasting tool for exchange rates to achieve greater forecasting accuracy and improve prediction quality further.

Neural-Network-based Metamodeling for Financial Time Series Forecasting

Kin Keung Lai, Lean Yu, Shouyang Wang, Chengxiong Zhou

Abstract: In the financial time series forecasting field, the problem that we often encountered is how to increase the predict accuracy as possible using the noisy financial data. In this study, we discuss the use of supervised neural networks as the metamodeling technique to design a financial time series forecasting system to solve this problem. First of all, a crossvalidation technique is used to generate different training subsets. Based on the different training subsets, the different neural predictors with different initial conditions or training algorithms is then trained to formulate different forecasting models, i.e. base models. Finally, a neural-network-based metamodel can be produced by learning from all base models so as to improve the model accuracy. For verification, two real-world financial time series is used for testing.

Time series forecasting with SOM and local non-linear models — Application to the DAX30 index prediction

Simon Dablemont, Geoffroy Simon, Amaury Lendasse, Alain Ruttiens, Francois Blayo, Michel Verleysen

2003

Abstract: A general method for time series forecasting is presented. Based on the splitting of the past dynamics into clusters, local models are built to capture the possible evolution of the series given the last known values. A probabilistic model is used to combine the local predictions. The method can be applied to any time series prediction problem, but is particularly suited to data showing non-linear dependencies and cluster effects, as many financial series do. The method is applied to the prediction of the returns of the DAX30 index.

Dimension reduction of technical indicators for the prediction of financial time series — Application to the BEL20 Market Index

AMAURY LENDASSE, JOHN LEE. RIC DE BODT, VINCENT WERTZ, MICHEL VERLEYSEN

2001

Abstract: Prediction of financial time series using artificial neural networks has been the subject of many publications, even if the predictability of financial series remains a subject of scientific debate in the financial literature. Facing this difficulty, analysts often consider a large number of exogenous indicators, which makes the fitting of neural networks extremely difficult. In this paper, we analyze how to aggregate a large number of indicators in a smaller number using -possibly nonlinear- projection methods. Nonlinear projection methods are shown to be equivalent to the linear Principal Component Analysis when the prediction tool used on the new variables is linear. Furthermore, the computation of the nonlinear projection gives an objective way to evaluate the number of resulting indicators needed for the prediction. Finally, the advantages of nonlinear projection could be further exploited by using a subsequent nonlinear prediction model. The methodology developed in the paper is validated on data from the BEL20 market index, using systematic cross-validation results.

Non-linear financial time series forecasting – Application to the Bel 20 stock market index

A.LENDASSE, E.DE BODT, V.WERTZ, M.VERLEYSEN

2000

Abstract: We developed in this paper a method to predict time series with non-linear tools. The specificity of the method is to use as much information as possible as input to the model (many past values of the series, many exogenous variables), to compress this information (by a non-linear method) in order to obtain a state vector of limited size, facilitating the subsequent regression and the generalization ability of the forecasting algorithm and to fit a non-linear regressor (here a RBF neural network) on the reduced vectors. We show that this method is able to find non-linear relationships in artificial and real-world financial series. On a difficult task, which consists in forecasting the tendency of the Bel 20 stock market index, we show that this method improves the results compared both to linear models and to non-linear ones where the non-linear compression is not used.

Forecasting financial time series through intrinsic dimension estimation and non-linear data projection

M.Verleysen, E. de Bodt, A. Lendasse

1999

Abstract: A crucial problem in non-linear time series forecasting is to determine its auto-regressive order, in particular when the prediction method is non-linear. We show in this paper that this problem is related to the fractal dimension of the time series, and suggest using the Curvilinear Component Analysis (CCA) to project the data in a non-linear way on a space of adequately chosen dimension, before the prediction itself. The performances of this method are illustrated on the SBF 250 index.

Modelling and Forecasting financial time series of «tick data» by functional analysis and neural networks

S.DABLEMONT, S.VAN BELLEGEM, M.VERLEYSEN

2007

Abstract: The analysis of financial time series is of primary importance in the economic world. This paper deals with a data-driven empirical analysis of financial time series. The goal is to obtain insights into the dynamics of series and out-of-sample forecasting. In this paper we present a forecasting method based on an empirical functional analysis of the past of series. An originality of this method is that it does not make the assumption that a single model is able to capture the dynamics of the whole series. On the contrary, it splits the past of the series into clusters, and generates a specific local neural model for each of them. The local models are then combined in a probabilistic way, according to the distribution of the series in the past. This forecasting method can be applied to any time series forecasting problem, but is particularly suited for data showing nonlinear dependencies, cluster effects and observed at irregularly and randomly spaced times like high-frequency financial time series do. One way to overcome the irregular and random sampling of tick-data is to resample them at low-frequency, as it is done with Intraday. However, even with optimal resampling using say five minute returns when transactions are recorded every second, a vast amount of data is discarded, in contradiction to basic statistical principles. Thus modelling the noise and using all the data is a better solution, even if one misspecifies the noise distribution. The method is applied to the forecasting of financial time series of «tick data» of assets on a short horizon in order to be useful for speculators

Forecasting High and Low of financial time series by Particle systems and Kalman filters

S.DABLEMONT, S.VAN BELLEGEM, M.VERLEYSEN

2007

Abstract: The analysis of financial time series is very useful in the economic world. This paper deals with a data-driven empirical analysis of financial time series. In this paper we present a forecasting method of the first stopping times, when the prices cross for the first time a high or low threshold defined by the trader, based on an empirical functional analysis of the past tick data of the series, without resampling. An originality of this method is that it does not use a theoretical financial model but a non-parametric space state representation with non-linear RBF neural networks. Modelling and forecasting are made by Particles systems and Kalman filters. This method can be applied to any forecasting problem of stopping time, but is particularly suited for data showing nonlinear dependencies and observed at irregularly and randomly spaced times like financial time series of «tick data» do. The method is applied to the forecasting of stopping times of high and low of financial time series in order to be useful for speculators