Net Metering and Market Changes

Post on: 16 Март, 2015 No Comment

The debate over how to value distributed solar is not new. Utilities and solar advocates have been negotiating changes to net metering in California, the leading U.S. solar market, for years.

Consequently, proposed changes to solar crediting policies have spread quickly to other leading states where utilities are starting to deal with a lot more solar on the grid.

But something curious is happening in the industry as 2014 unfolds: states like Kansas, Louisiana and Utah — all of which have extremely small solar markets — are also considering changes to net metering.

So why are lawmakers and utilities worried about the policy if it’s had virtually no impact on ratepayers in these states?

The answer is a mix of local free-market politics and an industry-wide push from utilities worried about declining revenues. In the fall of last year, the Edison Electric Institute, a utility trade group, partnered with the American Legislative Exchange Council (ALEC), a conservative business lobbying group, to help promote model legislation that would require net metering customers to pay fixed charges.

It’s also economics. Even in states with very little PV installed, the price of electricity from solar is becoming increasingly competitive with grid-based electricity (thanks to incentives and policies like net metering), and new markets are opening up where they previously didn’t exist. Some utilities are trying to get out in front of the trend by investing in solar themselves, but others are working on regulatory changes that could stop early growth before it takes off.

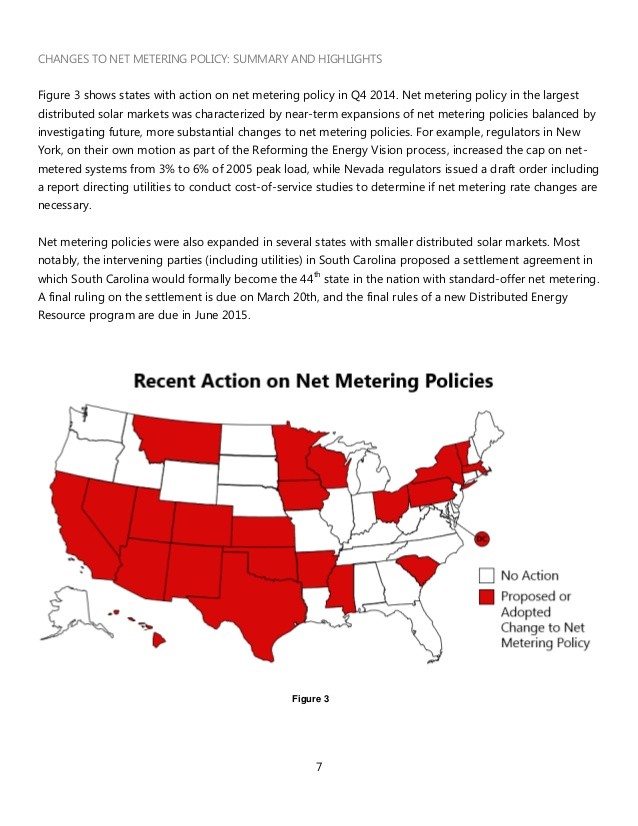

There are currently twenty-two states where net metering changes are being discussed. That’s just over half of the 43 states with net metering currently in place. Many of the efforts to revisit the policy have been well underway for some time, or were expected this year because solar development is increasing at a fast enough rate for utilities to take notice. Those include Arizona, Colorado, Hawaii and Massachusetts.

However, a number of tiny markets have also made their way onto the list. Utah, Idaho, Iowa, Kansas, Louisiana, Nevada and Washington state are all considering regulatory or legislative changes to residential solar policies. None of these states are in the top ten solar markets, and some of them are so small they are barely tracked by the industry.

In Kansas, for example, where utilities are promoting a bill that would reduce net metering payments to below retail rate, KCP&L reported that it added only seven residential solar customers under its net metering program in all of 2013 (PDF ). In total, the utility has 29 residential customers and 13 commercial customers who have qualified for net metering since 2008, representing 407 kilowatts of PV capacity. Compared to KCP&L’s 6.6 gigawatts of total conventional generation, solar doesn’t even register in its energy mix.

The move beyond traditionally solar-heavy states shows how far the battle lines have spread across the country, influenced by the utility industry’s increasingly coordinated effort to get out ahead of solar’s expansion.

It would be wrong to call the current situation an all-out war. It’s more like a chess match that has solar advocates shadowing utilities and offering counter-moves to neutralize their efforts. And if this year’s results are any indication, the solar industry may still be in a strategically good position, even with limited resources to cover every market.

In Washington state, three pieces of legislation that would have added fixed charges to net metering customers and prevented third parties from competing with utilities fizzled out earlier this month. The solar industry said those efforts were inspired by ALEC’s pre-written bills on net metering.

In Utah, a bill supported by utility Rocky Mountain Power that would have required regulators to impose a reasonable fee on net metering customers was successfully changed by solar advocates, and adapted to form a process for studying the value of solar on the state’s grid.

And in Louisiana, where utilities were looking to lower net metering rates or kill the policy altogether, regulators agreed to an evaluation of the costs and benefits of solar as part of a consideration to lift the current 0.5 percent cap on net metered systems.

Influenced by local activists (including some Tea Partiers ), overwhelming public support for solar choice and a seeming willingness to approach the issue objectively, regulators and some lawmakers are consistently opting for an evaluation process, rather than immediately making changes to net metering.

In smaller states, they’re still at the point where they are considering a cost benefit analysis, said Annie Lappé, deputy director of the Vote Solar Initiative. In most cases, these commissions are deciding to undertake the studies.

Assuming regulators remain open to independent studies, the process could, in theory, result in fairer treatment of solar.

That’s what happened in the up-and-coming solar market of Minnesota. Last year, the state created a process for determining a value of solar tariff that would calculate the appropriate rate utilities should pay solar customers based on their generation mix, the environmental attributes and the technology’s ability to offset more expensive forms of generation. A week ago, the Minnesota Public Utilities Commission voted in favor of establishing the tariff. which could actually be higher than current retail rates in some service territories.

Utilities may not like paying even more for solar, but they will have an option of crediting customers under net metering or the new tariff. And regulators can feel comfortable knowing a rigorous analysis was tied to the rate structure.

We’ll be watching closely to see how it’s being used, said Lappé.

At the moment, Minnesota — and value of solar pioneer Austin, Texas — are outliers in the net metering conflict. It’s possible that smaller states could follow Arizona’s lead and impose fixed charges on net metering customers. But as leading states like California and Colorado start undertaking their own comprehensive studies on solar’s true worth, states with smaller markets are considering the same process. And that in itself is a small victory for the solar industry.

We have a consistent message in every state: if you actually look at the full value of solar, we’re sure that regulators will see the benefit, said Lappé.

Greentech Media (GTM) produces industry-leading news, research, and conferences in the business-to-business greentech market. Our coverage areas include solar, smart grid, energy efficiency, wind, and other non-incumbent energy markets. For more information, visit: greentechmedia.com. follow us on twitter: @greentechmedia. or like us on Facebook: facebook.com/greentechmedia .