NAIC Capital Markets Weekly Special Report

Post on: 16 Июль, 2015 No Comment

Securities Lending in the Insurance Industry

Insurance companies engage in securities lending to enhance returns on their investment portfolios, loaning out securities that are not actively traded. For most, securities lending is intended to be a low-risk investment strategy, for insurance companies to earn a modest income through fees charged to borrowers. Additional income may be generated by investing the cash collateral posted by the transactions borrowers. Upon investing the posted collateral, insurance companies must consider credit and liquidity risks, as well as the asset/liability management risks of the potential investments. Insurance companies must also follow the appropriate statutory accounting rules related to securities lending transactions, which are included in the NAIC Accounting Practices and Procedures Manual. Insurance companies individual investment policies should address the types and duration of investments that can be made with the cash collateral.

What is Securities Lending?

Securities lending is the act of loaning a bond, stock or other security to an investor in an over-the-counter market. It requires that the borrower post collateral in the form of cash or security. The securities lending agreement, which is required to complete such a transaction, states the term of the loan, the fee that the lender receives and the amount and type of collateral to be posted, among other items. In general, securities lending transactions have a term of less than one year; however, terms can vary across different agreements. And, in most cases, the borrower may return the borrowed security and request its cash collateral back on relatively short notice, without penalty. The securities lender benefits by receiving a fee for the transaction, as well as a return on investing the collateral (or receiving the collateral if the borrower fails to repay). The securities borrower benefits by profiting from shorting the borrowed securities (that is, borrowing the securities to immediately sell them). Broker-dealers borrow securities to make a market for buying and selling securities and to settle trades for clients.

Securities lending is economically similar to repurchase agreements (repos) and reverse repurchase agreements (reverse repos), but there are some structural differences. Repos are a commitment by a seller to buy a security back from a purchaser at a specified price and at a designated future date. In effect, repos are a collateralized short-term loan, whereby the collateral may be a Treasury security, money market instrument, federal agency security or mortgage-backed security. A reverse repo is transaction where a bank or other financial institution buys securities or another asset from a seller provided that it will resell the same securities or asset to the same seller for an agreed-upon price on a predetermined date (typically the next business day). Reverse repos are usually entered into to raise short-term capital. The reverse repo is effectively the same as a repo but from the buyers perspective.

Securities Lending by Insurance Companies

All types of insurance companies engage in securities lending. Not surprisingly, most activity has been with life companies, because they follow a buy-and-hold investment strategy more so than property/casualty companies. As of year-end 2010, approximately $51 billion of securities lending activity had been recorded on-balance sheet, while about $4 billion was off-balance sheet. In comparison, as of year-end 2009, there was approximately $32 billion of securities lending activity on-balance sheet and about $16 billion off-balance sheet; as of year-end 2008, there was approximately $39 billion on balance sheet and $22.5 billion off balance sheet.

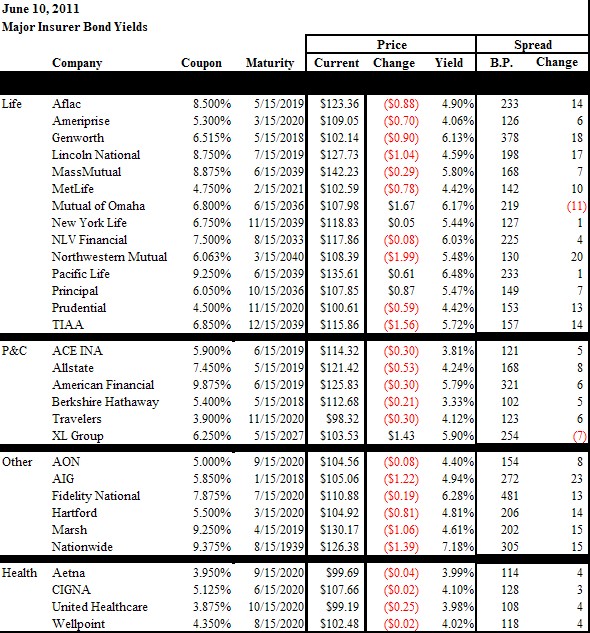

The table below shows a breakdown of the invested cash collateral for the insurance industrys securities lending programs as of March 31, 2011. As the table shows, the majority of securities lending was by life companies (83%), which mostly invested the cash collateral in corporate debt (45.1%).

Depending on risk appetite, a general rule of prudent investment management dictates that for steady income stability, short-term and low-risk (high-quality) is favorable, despite the typically low return. This includes such investments as money market funds and U.S. Treasuries. Conversely, when investing primarily for large gains, longer-term, higher-risk investments are usually considered, such as mortgage-backed securities. In general, securities borrowers post cash in the amount of at least 102% of the fair value of the loaned securities, which, in turn, is invested by the securities lender (i.e. the insurance company).

As we analyze securities lending within the insurance industry, one incident that proved to be an invaluable lesson was with American International Group (AIG). Firm-wide risk management inefficiencies are believed to have played a significant role in AIGs overall financial stress. Although it is most known for the significant losses to AIG Financial Products (AIGFP) credit default swap (CDS) portfolio, the onset of an overwhelming demand for returned cash by AIGs securities lending counterparties compounded the overall firms liquidity constraints.

Through its securities lending program, AIG generally loaned out securities owned by its insurance company subsidiaries. Between 2005 and 2007, rather than invest the cash collateral it received from the borrowers in conservative, short-term securities, AIG changed the direction of its investment strategy (without disclosing such change in its notes or to the U.S. state regulators) and mostly invested the cash in long-term subprime residential mortgage-backed securities (RMBS). AIGs securities lending portfolio had not been included on the companys balance sheet due to a liberal interpretation of the accounting requirements; therefore, there was no transparency with regard to how AIG had invested the borrowers posted cash collateral. U.S. regulators became aware of this change in investment strategy during a financial examination in early 2007. Investing in the RMBS resulted in an asset/liability maturity mismatch, and, as it is common knowledge, these securities experienced significant market value declines as the financial crisis emerged. Due in part to the financial distress brought about by AIGFPs CDS portfolio losses, the borrowers in AIGs securities lending portfolio began to return the borrowed securities, requesting the return of their cash, to reduce their exposure to AIG as a firm. AIG was unable to meet the growing demands for cash by its securities borrowers; to do so meant that they would have to sell the subprime RMBS collateral that was now illiquid due to severe market devaluations. Liquidity constraints that developed due to losses on its CDS portfolio were made worse, therefore, by those developing within AIGs securities lending business.

At its peak, AIGs securities lending program had reached approximately $76 billion of borrowings outstanding. With the assistance of regulators, AIG was able to reduce this exposure to approximately $59 billion before the U.S. government bailout. In November 2008, the Federal Reserve Board and U.S. Treasury announced a restructuring of the U.S. governments financial support to AIG. Consequently, the Federal Reserve Bank of New York created Maiden Lane II LLC (ML II) in November 2008 to alleviate capital and liquidity pressures on AIG associated with the securities lending portfolio of several regulated U.S. insurance subsidiaries of AIG. Funds provided by ML II were used to purchase RMBS from AIGs securities lending portfolio to help raise cash to return to the securities lending borrowers. As of year-end 2008, ML II had an estimated fair value of $20.5 billion (or $39.3 billion par value).

While AIGs losses stemming from its securities lending program did not directly cause the changes in treatment of securities lending by the insurance industry, it did highlight a lack of transparency and varying interpretations of the accounting language related to these investments. After careful review and consideration by a dedicated subgroup, several revisions were made.

Insurance Industry Treatment of Securities Lending

Prior to May 2010, language regarding the treatment of securities lending by insurance companies was not consistently applied. That is, insurance companies reported their securities lending activity on the balance sheet, depending on whether the collateral posted by the borrower was considered restricted or unrestricted, as explained in more detail below. Therefore, how insurance companies invested a borrowers posted collateral was not always transparent. AIG as well as other insurance companies that considered the securities lending cash collateral restricted did not record the details of their securities lending activity on the balance sheet. Instead they included this activity in a one-line summary as a liability.

In general, Statement of Statutory Accounting Principles (SSAP) No. 91RAccounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities previously stated that when securities are loaned as part of securities lending activity, they are to remain assets of the reporting entity and any fees received would be recorded as miscellaneous income. If the collateral pledged on the loaned securities was not available for general use by the lender (i.e. restricted), then the securities lender would not be required to reflect the collateral on the balance sheet as an asset, nor establish a liability on the balance sheet for the return of the collateral to the borrower. However, if the collateral pledged by the borrower is available for general use by the lender (i.e. unrestricted), then the collateral would be recorded as an asset on the balance sheet and a corresponding liability would be included on the balance sheet for return of the collateral. Posted collateral was to be at least 102% of the fair value of the loaned securities as of the lending date (or at least 105% of the fair value of the loaned securities, if they consisted of foreign securities and were denominated in a currency other than the currency of the loaned securities).

Reporting and Accounting Revisions Effective 2010

There were also other insurance companies that kept their securities lending activity off balance sheet, due in part to liberal interpretations of whether cash collateral was considered restricted or unrestricted. Notwithstanding, there were some insurance companies that recorded such activity either on- or off-balance sheet as appropriate.

The NAIC took a closer look at the accounting language, not only to increase transparency but also to create more consistency in terms of reporting and statutory accounting treatment. As of May 2010, several new changes were implemented, including those that require more items to be reported on the balance sheet, thus promoting transparency of the invested collateral. These revisions allow for the ability to compare the fair market value of the invested collateral to the total collateral that is to be returned to the borrower, as well as details about the maturity of the invested collateral and when cash collateral may be called back by counterparties. In addition, a new Schedule DL was implemented that includes a detailed listing of the invested collateral, including separate categories for bonds, preferred stock and common stock. Schedule DL, Part 1 includes a detailed list of collateral invested where the securities lending program is reported in aggregate within the assets page. Schedule DL, Part 2 includes a detailed list of invested collateral where the securities lending program is administered by the reporting entity or an affiliate and not reported in aggregate within the assets page, but instead reported in the investment schedules. Totals of Schedule DL provide on balance sheet reinvested collateral related to securities lending. Collateral posting requirements continue to be at least 102% to 105% of the fair value of the loaned securities. In effect, securities lending transactions are now subject to more defined valuation rules and disclosure requirements.

New Disclosures: Providing More Transparency

To eliminate any misinterpretation of restricted and unrestricted collateral including whether the securities lending transactions should be recorded on the balance sheet the accounting rules within SSAP No. 91R were clarified such that if the collateral can be sold or pledged by custom or contract by the reporting entity or its agent, then the reinvested collateral would be recorded on the balance sheet, which is more consistent with U.S. general accepted accounting principles (GAAP).

Since 2008, to address any mismatch in the maturity of the reinvested collateral and when a borrower can demand return of the cash collateral, summary information has been required on the duration of when the collateral is to be returned to the borrower, including for collateral that is kept off-balance sheet. This allows for identifying potential liquidity constraints by noting when counterparties can demand return of cash collateral. In 2010, a new disclosure was adopted disclosing the maturity dates of the collateral. This duration of the reinvested collateral is categorized into maturity buckets, and to the extent the duration of the reinvested collateral does not match the timing with which the borrower can demand its cash back, the securities lender is required to explain additional sources of liquidity to mitigate this mismatch.

While disclosures on securities lending transactions existed prior to 2010, some have been updated and new ones have been added. This includes disclosures for both on- and off-balance sheet collateral, such as loaned assets, pledged assets, open collateral positions and when cash collateral can be called by the borrower, as well as the current value and maturity of the reinvested collateral.

Lastly, to mitigate the lack of disclosure on off-balance sheet collateral, it is now a requirement that both on- and off-balance sheet invested cash collateral receive the same risk-based capital (RBC) charge. RBC charges for securities lending off-balance sheet collateral were added to the year-end 2008 RBC. Prior to this, there was no credit risk charge for off-balance sheet invested collateral; there had been an additional RBC for the securities loaned, because they could not be disposed at will in the non-controlled assets section of the off-balance sheet risk page (regardless of whether the collateral was held on- or off-balance sheet).

New Reporting Requirements for Securities Lending Transactions

One new reporting requirement includes an additional line on the balance sheet specifically for collateral received from securities lending transactions. To lend support, a new Schedule DL (for securities lending collateral assets) was developed that includes a detailed listing of the reinvested collateral that is owned by an insurance company as of the end of the current reporting year. Securities lending transactions that are included on-balance sheet had already included detail in the investment schedules. This reporting enhancement is intended to promote transparency related to the value and maturity of the reinvested collateral.

Requirements for verification of collateral requirements and whether the securities lending agreement is standard were also added to provide more insight regarding the nature and uses of the securities lending programs.

Impact on Securities Lending Treatment by the Insurance Industry

The revisions to both the reporting and accounting treatment of securities lending transactions were implemented as of the 2010 annual statements. As a result, almost all securities lending portfolios are now reported on-balance sheet, and any cash collateral that is recorded on-balance sheet is subject to valuation rules. The new Schedule DL shows details of the reinvested collateral held, along with the new line added to the liabilities side of the balance sheet (reflecting collateral received by the lender), and the ability to match the fair market value of the reinvested cash collateral to the value of the cash to be returned is more transparent. Thus, the revisions now provide additional transparency regarding whether the industry is overcollateralized or undercollateralized.

Recent analysis completed by the NAIC shows that the insurance industry is undercollateralized by less than 1% of the fair value of total collateral held, which is considered insignificant. This includes securities lending activity across more than 200 insurance companies.

For now, the adopted changes have succeeded in providing more detail and transparency related to insurance industrys securities lending activity. Those parties involved in proposing and implementing these revisions continue to evaluate its success and whether additional disclosures or changes should be considered going forward.

The Capital Markets Bureau will continue to monitor this activity and provide more insightful research as deemed appropriate. As such, we expect to provide some additional detail regarding industry exposure in the near future.