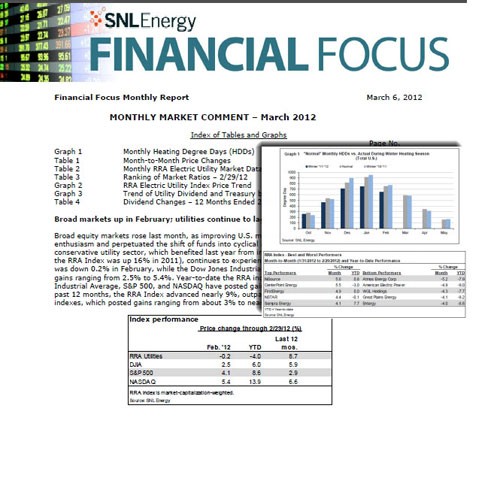

NAIC Capital Markets Weekly Special Report

Post on: 7 Июль, 2015 No Comment

Insurance Asset Management: Internal, External or Both?

Insurance companies, by their very nature, accumulate substantial amounts of cash that are used to purchase invested assets. Assets accumulated by insurers include those associated with the companys policyholders surplus (or capital), as well as assets that support the insurance companys policy reserves, which are used to pay policyholder obligations as they become due.

The nature and size of an insurers invested assets vary substantially depending on the specifics of the insurer. Life insurance companies typically accumulate the largest dollar amount of invested assets, because of the asset intensive nature of their products, such as life insurance and annuities. Assets of life insurers are primarily invested in medium- and longer-term taxable fixed-income investments. Property/casualty insurers typically have a relatively higher percentage of their assets associated with the companys policyholders surplus (capital) a considerably smaller dollar amount of total assets than life insurers and can benefit from use of tax-favored investments such as tax-exempt bonds. Still other kinds of insurance companies (such as reinsurers, title insurance companies and health insurers) have their own set of unique investment-related characteristics and needs. The investment portfolio of every insurer must be tailored to satisfy that specific insurers complex and ever-changing investment requirements.

Types of Investment Managers

Internal managers: The largest insurance companies, those with $3 billion to $5 billion or more in assets, usually enjoy sufficient scale so they can economically rely upon their own investment operation. This investment manager could be directly part of the insurance company. Or, it could be a discrete investment management subsidiary that is a distinct part of the overall group. However, in each case, the investment management organization shares common ownership with the insurer for which it manages the funds.

Reasons for the use of an external investment manager: However, for many insurers, it might not be practical to have their own internal investment operation. According to a survey of insurance companies conducted by the Insurance Asset Outsourcing Exchange, approximately two-thirds of the insurance companies that responded outsource some or all of their asset management. An effective investment operation requires more than just a few knowledgeable people, but instead, in many cases, an extensive, specialized staff and systems. This staff needs expertise covering a broad range of investment disciplines and market sectors that could include, but is not limited to, corporate bonds, residential mortgage-backed securities (RMBS), asset-backed securities, commercial mortgage-backed securities (CMBS), equities, tax-exempt securities and derivatives. An insurer that intends to have a diversified portfolio across different asset classes needs sufficient size in invested assets to economically justify the formation of even a modest size internal investment operation. Without that size, the investment managers operation would be inherently limited in breadth and depth. The internal manager would not be able to economically offer a broad range of investment capabilities covering a wide variety of asset classes.

Special expertise needed for some asset classes: While investment management of any kind relies on expertise, as well as an appropriate supporting infrastructure, this is especially true for certain more complex asset classes. A trained investment professional with a modest amount of supporting analytic tools should be able to manage a high-grade corporate or tax-exempt portfolio.

Agency RMBS does not require special expertise for understanding potential credit issues, but is considerably more complex from a cash flow standpoint. A lack of understanding of prepayment risks can lead to significant problems.

Other asset classes such as structured non-agency RMBS, CMBS and many derivatives can be extraordinarily complex. Even seemingly minor differences could make a major difference in the risk-and-return characteristics of the investments. Without being very active in a specific market, it is unrealistic to expect the investment professional to remain current in the ever-changing nuances in these markets. Possibly even more important, an investment professional is unlikely to be successful in these markets without substantial expenditures in supporting infrastructure, such as analytic systems and databases. Investment professionals are unlikely to be successful in markets such as CMBS if they do not have access to the extensive and expensive analytic tools required to participate in these markets.

While reliance on a qualified outside expert might be the preferred method of operation for some companies in certain markets, the insurer must still retain sufficient internal expertise to set the boundaries of the investment mandate and be able to recognize when something goes amiss. The insurer itself must retain sufficient expertise to be able to recognize a case when corrective action is required, including possible termination of the manager and/or asset class. A clear example of this in recent years was the non-agency RMBS sector, which led to substantial investment losses for some insurers despite the alleged expertise of the sectors portfolio manager.

Development of the External Insurance Company Investment Management Specialist

Consequently, many insurers fall into the category where an investment management outsourcing arrangement is the more desirable alternative. However, properly selected external investment management arrangements can give smaller insurers substantial investment capabilities and expertise, albeit shared with other clients, at a reasonable cost. In response to this need, a number of external investment managers have arisen targeting this market opportunity.

Some external investment managers used by insurers are generalist investment managers that manage assets for a broad range of different types of clients. However, specialist insurance asset managers have developed and have become increasingly prevalent in this market. Such investment managers focus specifically on managing insurance company assets. Consequently, they have become highly acquainted with the unique investment and other needs of insurance companies as investment management clients.

These insurance specialists are often, but not always, part of larger financial services organizations. If the manager is part of a larger organization, it could be affiliated with a bank, an insurance company or an investment management specialist. In any case, the insurance company client can benefit from a dedicated cadre of investment professionals devoted to satisfying the specialized needs of insurance company clients at a moderate and variable cost.

A survey conducted by IFI Insurance Asset Manager in affiliation with Patpatia & Associates. Inc. identified 64 North American investment managers managing third-party insurance company general account assets. These 64 investment managers manage in excess of 90% all outsourced general account insurance assets. Figure 1 lists the leading 34 insurance company external general account investment managers, ranked by assets under management as of year 2009, according to the surveys results.

The managers on this list can be classified in several categories. BlackRock, Wellington Management, Western Asset Management and others are part of large organizations primarily focused on investment management. Many of these organizations have extensive multi-product capabilities and have geographically dispersed operations, with offices in the United States, London, Tokyo and the Caribbean.

Deutsche Asset Management, Goldman Sachs Asset Management, State Street Global Advisors, Northern Trust Global Investments and others are parts of organizations that are primarily banking enterprises. Particular care needs to be taken with managers falling in this category that all transactions made with an affiliate of theirs (such as a bank or securities dealer part of the group) has been transacted on a fully arms-length basis.

GR-NEAM, PIMCO, AllianceBernstein, ING Investment Management, Aviva Investors and others are parts of larger insurance focused enterprises. Each of these companies manages assets of affiliated insurers, as well as assets of non-affiliated insurers. In these cases, care must be taken to see that the investment manager treats all clients consistently and fairly, and that the affiliated insurers are not supplied more favorable treatment than non-affiliated insurers.

Conning Asset Management, Delaware Investments, PineBridge Investments, AAM Investment Management and others are independent investment managers. These managers might be less exposed to conflicts, but care should still be taken to ensure that each insurance client is treated equitably.

Figure 1:

Source: IFI Insurance Asset Manager: Annual Survey 2010, World Trade Executive in affiliation with Patpatia & Associates, Inc.