NAIC Capital Markets Special Report

Post on: 6 Апрель, 2015 No Comment

Insurance Company Investment in Money Market Funds

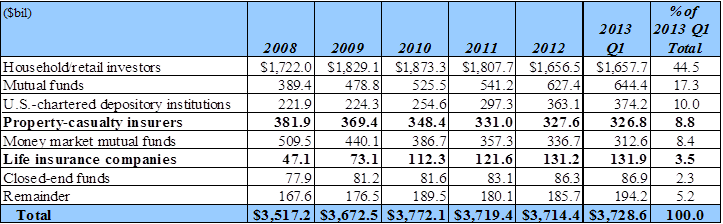

As of year-end 2010, the insurance industry had approximately $62 billion in book/adjusted carrying value (BACV) invested in money market funds as reported in Schedule DA. This represents almost 45% of total Schedule DA assets as of year-end 2010. Money market funds are a type of mutual fund that is required by law to invest in low credit-risk securities. The goal of these funds is primarily to generate current income while maintaining principal stability, or capital preservation. They pay investors a dividend that resembles short-term interest rates and strive to maintain a net asset value (NAV, or total value of the funds securities divided by the total number of fund shares) at $1 per share. While yield on the investments may move up and down, the NAV will only decrease if the underlying investments default. Like most other types of funds, they are exposed to interest rate risk, credit risk and liquidity risk.

As the table below shows, the majority of money market fund investments within the insurance industry were held by property/casualty companies. This reflects in part the nature of the liabilities of this company type in terms of liquidity needs, duration and risk tolerance.

Largest Money Market Fund Investments

Two notable observations within this list include the American International Group (AIG) Money Market Fund exposure, as well as the United Healthcare (UHC) Liquidity Pool exposure. The only investors in these two funds as of year-end 2010 were AIG and UHC companies, respectively. Therefore, we believe these funds represented part of the companies cash management systems. The AIG Money Market Fund is registered with the U.S. Securities and Exchange Commission (SEC). The UHC Liquidity Pool, however, while having some similarities to a money market fund and reported as such by UHC entities, is technically not a money market fund. According to notes to the financial statements for this pool, it is considered additional investments and UHC interest in the pool does not qualify as an admitted asset.

The AIG fund invests in a diversified portfolio of U.S. dollar-denominated short-term securities. While it is open to third-party investors, as of year-end 2010, only AIG affiliates were investors in the fund. The UHC fund represents a pooling agreement formed in 1997 between Travelers Asset Management International Corporation (TAMIC), State Street Bank and Trust Company and United Healthcare Services, Inc. (UHS), whereby TAMIC invests portions of UHS and affiliate assets in short-term investments that carry NAIC 1 or 2 designations. According to the pooling agreement, participants may withdraw funds from the pool on a pro-rata basis without penalty and at the discretion of TAMIC as pool manager.

Removing the AIG and UHC funds from the list results in total money market fund exposure of $25.2 billion, or 43% of total money market fund exposure, as of year-end 2010.

In the table below, we analyzed a breakdown of money market fund exposure by insurance company size. Companies with total cash and invested assets ranging between $10.1 billion to $20 billion had the highest percentage of money market fund investments, at almost 20% of total money market fund exposure as of year-end 2010. Excluding the AIG Money Market Fund and United Healthcare Liquidity Pool, the percentages listed below would not be substantially different; however, companies with total cash and invested assets between $10.1 billion to $20 billion were approximately 14% of total money market fund exposure without the two aforementioned funds. Companies with total cash and invested assets up to $3 billion comprised almost 50% of money market fund exposure; excluding the two funds, companies with total cash and invested assets up to $3 billion comprised about 55% of money market exposure.

Detailed Review of the Largest Money Market Fund Exposures

Given the current economic environment, in particular as it relates to continuing stress within the financial markets and the sovereign debt crisis, we analyzed more closely the fund exposures to these types of investments and found manageable risk. For the most part, eligible securities in these funds include short-term, high-quality, U.S. dollar-denominated investments in CDs, time deposits, repurchase agreements and commercial paper from both domestic and foreign issuers. Almost all of the funds may also invest at least 25% of their assets in banking or financial services, according to the respective prospectuses. One fund even allows for at least 25% of its assets in securities of any foreign government. Some funds may also include U.S. government agency-backed securities, as well as mortgage- and/or asset-backed securities and municipal securities.

Upon analyzing the actual investments held within the largest money market funds listed above (that is, for those seven funds where the schedule of holdings was available), none contained exposure to Greek sovereign or corporate debt. In addition, exposure to banking and finance-related industries, including both U.S. and foreign banks, was common and significant throughout, although it represented high-quality, short-term investments. Exposure to foreign banks included several French banks, in particular, BNP Paribas SA, Societe Generale and Credit Agricole, but exposure was limited to short-term and high-quality paper, such as CDs and commercial paper.

SEC Rule 2a-7 of the Investment Company Act of 1940

Money market funds are governed by Rule 2a-7 of the SECs Investment Company Act of 1940. Due in part to the financial crisis that emerged in late 2007, the SEC amended Rule 2a-7 in February 2010 in an effort to increase the resilience of these funds to economic stresses and reduce the risks of runs on the funds, as well as to improve liquidity, increase credit quality, and shorten maturity limits. As a result, minimum liquidity requirements were established for the funds, along with shorter weighted average maturities. Changes were also made to increase fund disclosure and promote transparency. In general, these changes encouraged more conservative investment strategies across the industry.

A funds eligible securities include those that are rated by an NRSRO to be either in the highest rating category (First Tier) or the second-highest rating category (Second Tier) or that are unrated (but are comparable in terms of credit quality to a rated security, as determined by a funds board of directors), whereby the maturity of the investment does not exceed 397 days at the time of acquisition. In addition, with the 2010 SEC amendment, funds are also required to designate four NRSROs that they will rely on to determine whether a security is eligible for investment. It has yet to be determined how Dodd-Frank Act provisions have affected money market funds reliance on/reference to NRSRO ratings.

In terms of maturity, the dollar-weighted average maturity should not exceed 60 calendar days (reduced from 90 days via the 2010 SEC amendment), and weighted average life must not exceed 120 calendar days (a new requirement with the 2010 SEC amendment). While duration is the measure of the price sensitivity to changes in interest rates, maturity for short-term investments is a reasonable proxy. New changes also include that at least 30% of a funds assets be held in cash or other short-term investments that could be liquidated within a week, and at least 10% of a funds assets be held in short-term assets that could be liquidated within one day. Illiquid securities are limited to 5% of the funds total assets. Rule 2a-7 also includes a maximum seven-day redemption period when investors request cash back on their investments.

Per the 2010 SEC amendment, funds are restricted to holding at most 3% of total assets in Second Tier securities (down from 5%) that may not have a remaining maturity, at the time of acquisition, in excess of 45 days. Not more than 0.5% of total assets may be held in any one Second Tier issuer.

The 2010 SEC amendment to Rule 2a-7 also requires periodic stress-testing relative to the funds ability to maintain a stable NAV, and it includes a revised treatment of repurchase agreements in terms of diversification. It also outlines recordkeeping and reporting requirements for money market funds that includes website disclosure of fund holdings on a monthly basis, as well as monthly disclosure of fund holdings, to the SEC.

The Fall of the Reserve Primary Fund

The Reserve Primary Fund was the first money market fund established in the United States in 1971 for investors interested in preserving cash while earning a small return. Since then, there had been only one or two incidences where a funds NAV dropped below the minimum $1 (also known as breaking the buck), causing investors to lose principal. However, it wasnt until September 2008, after Lehman Brothers Holdings Inc. (Lehman) declared bankruptcy, that the money market fund industry was severely impacted. The Reserve Primary Funds NAV decreased to $0.97 as a result of write-downs on Lehman debt holdings. After that, the financial crisis set in and investor anxiety spread throughout the money market industry, resulting in widespread redemptions and causing the U.S. Department of the Treasury to step in and provide assistance.

The Reserve Primary Fund broke the buck only one day after Lehman filed for bankruptcy protection. It had owned $785 million of Lehman debt, which was declared worthless and resulted in the funds NAV decrease. At the end of May 2008, the fund had almost $65 billion in assets, more than half of which was said to be in asset-backed securities (ABS; assets whose liquidity was questionable), including some issued by Lehman. The Reserve Primary Fund then ceased paying redemptions to its clients for up to seven days, as allowable by SEC Rule 2a-7, as heavy redemption demands exacerbated the impact of Lehmans losses to the fund.

Since their inception, money market funds had been considered a safe place to invest cash, similar to bank savings accounts; however, unlike bank savings accounts, money market funds are not insured by the Federal Deposit Insurance Corporation (FDIC). Investor panic followed the Reserve Primary Funds losses, as investors questioned the value of other money market funds falling below the $1 minimum NAV, which, in turn, increased market turmoil and added to liquidity constraints as investors began to withdraw cash.

In an attempt to restore confidence and alleviate concerns over the ability of money market funds to withstand losses, a few days after the Reserve Primary Funds NAV decline, the U.S. Treasury Department announced that it would temporarily guarantee money market funds for losses up to $50 billion. That is, it would insure the holdings of any publicly offered eligible money market fund that paid a fee to participate in the program. In addition, to ensure sufficient liquidity relative to redemption requirements, the Federal Reserve expanded its emergency lending program to help commercial banks finance the purchase of ABS from the funds. Basically, once the NAV of a fund dropped below $1, investors would be notified that the insurance program provided by the U.S. Treasury Department had been triggered. A week after this program was implemented, some of the largest mutual fund companies in the United States applied for coverage. Nevertheless, investors continued to withdraw cash out of money market funds, which shrank by $100 billion to $3.33 trillion over a three-week time period as of early October 2008.

As of October 2008, the Reserve Primary Fund had decreased to $20 billion and would be liquidated. In addition, in November 2008, the U.S. Treasury Department agreed to purchase at par any government securities held by the Reserve Primary Fund that were not sold by Jan. 3, 2009, and hold them to maturity, thereby avoiding any loss by the funds investors. Through several installments, investors received 99% of their money back by early 2010. In April 2010, the Reserve Primary Fund sold its Lehman debt for $0.22 on the dollar.

Fitch Ratings Reports that European Bank Exposure has Decreased

Fitch Ratings (Fitch) issued a report dated Oct. 20, 2011, citing that U.S. money market funds have decreased their exposure to European banks and, in particular, French banks. According to the report, as of Sept. 30, 2011, U.S. prime money market funds reduced total exposure to European banks by 14% on a dollar basis relative to the prior reporting period in August 2011. We view this as a positive trend, given European banks exposure to sovereign debt amid the current Eurozone debt crisis.