My New Passive Index ETF Portfolio

Post on: 21 Май, 2015 No Comment

Canadian Bond

Some of the things I did not like about my old portfolio are:

- High cost Too many mutual funds with high MERs. I checked all of these funds performance again and for the most part they didnt seem to be capable of beating their benchmarks in the past. The Growth Opportunities has not beaten the S&P/TSX Venture Composite Index in the range I looked at. CI Value Trust (clone of Legg Mason Value Trust) has not been impressive of late, but even worse, it has assumed far more risk than an index, with its investments in Google and other high-tech stocks. The Templeton International Index fund (last time I checked) had not beaten the MSCI EAFE index over the long term. Also, the TD Canadian Bond fund is not all that spectacular compared to ETFs like XSB.

- No emerging markets I wanted some emerging markets to provide increased diversification and greater risk-adjusted return due to their low correlation with other markets. The fact that emerging markets have done very well of late is of no concern to me, I realize if I buy emerging markets equities now I might suffer a bit in the near future.

- No real return bonds, or inflation-sensitive assets I looked at the Ontario Teachers Pension Plan and the CPP Investment Board and both have significant real return bond holdings. The former has 11.1% and the latter has 3.5% in real return bonds.

- Huge domestic bias Although I had originally wanted 25% in Canadian equities my advisor had me at 40% because he had concerns about the US dollar, so we weighted Canadian equities more. This is way too much allocated to a handful of Canadian companies that make up a large part of the TSX/S&P 60 Index.

- No foreign currency exposure Foreign currency exposure can be a good thing. If inflation is high in Canada, our dollar will decrease in value relative to other currencies. More importantly, some of my investments, such as the CI Value Trust were hedged versions of USD mutual funds so I was paying extra management expense when I could have just owned the USD version and possibly reduced my total risk at lower cost.

- Lack of US exposure I only had something like 11% of my assets in US equities. This is extremely underweight for such a large market like the US. My advisor was planning to ease in to US equities (he had some issue with the falling US dollar) but I would prefer to just go with some desired allocation and re-balance when necessary rather than thinking one can be smarter than the market.

- Lack of broad US exposure Bill Millers Value Trust is invested in relatively few investments compared to the size of the US market. He also invested a lot in high tech companies like Google, Yahoo, Amazon, eBay, etc I wanted to own more blue chips/boring companies, mid-caps, small-caps, etc

Canadian Equity

Now Ill expand on some of the reasons why I chose the above asset allocation as well as the reasons why I chose each investment in my new portfolio. This portfolio is inspired primarily by Martin Gale. Canadian Capitalist. Dan Solin (author of The Smartest Investment Book You’ll Ever Read ), and Burton Malkiel (only part way through his book right now).

NOTE: I am under 30, I am looking for long term growth only, I am not planning to take out any of this money until I retire at age 55-65, and I can handle some short-term swings in the market.

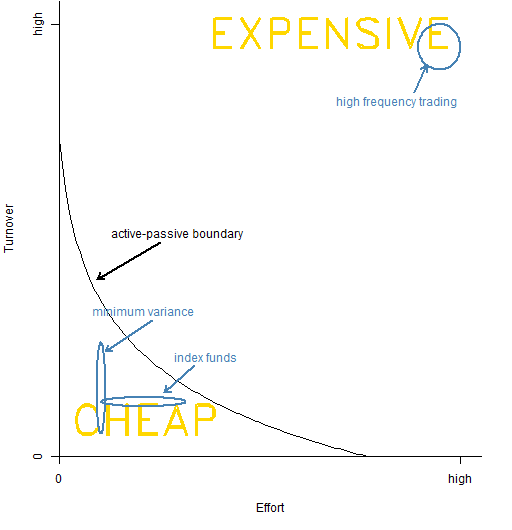

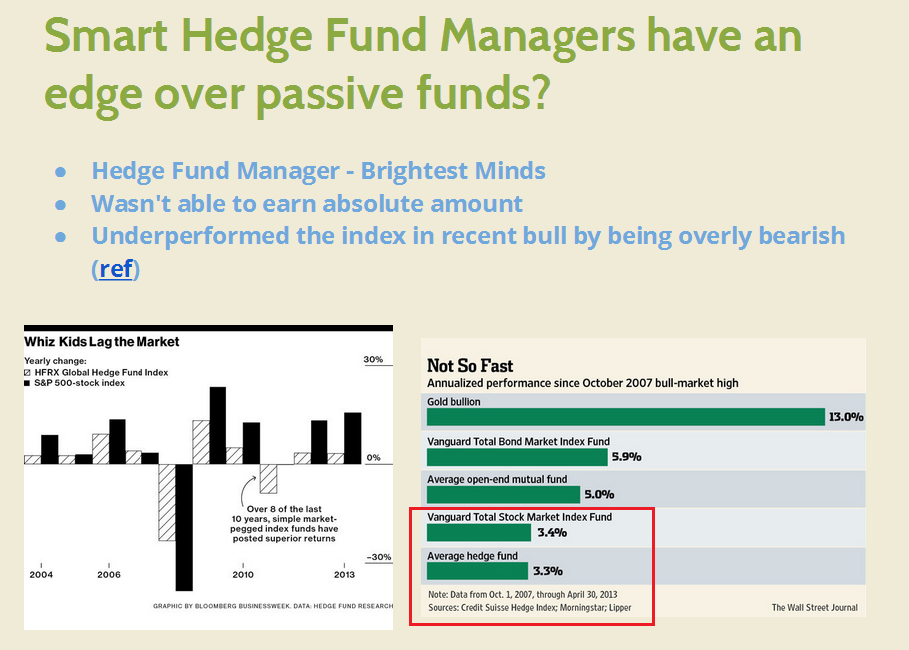

ETFs vs. mutual funds

Using ETFs instead of mutual funds was a no-brainer for me. I have come to the realization that beating the market is virtually impossible for all but a few very talented people, and that passive investing can yield greater returns with less risk due to its lower costs. For more information, read my recent blog post Malkiel, Bogle Argue Against Non-Market Capitalization Weighted ETFs or read A Random Walk Down Wall Street . I can also give credit to the Canadian Capitalist and his blog for convincing me of this fact. He has been tracking a sleepy portfolio for a while now, consisting of a few ETFs and it seems to do pretty well.

It was clear to me that I was not going to have a 100% bonds portfolio, nor was I going to have a 100% equities (as my advisor wanted me to have last year). Benjamin Graham is very clear in The Intelligently Investor page 56-57 about his opinion on this issue when he says just because of the uncertainties of the future the investor cannot afford to put all his funds into one basketneither in the bond basket, despite the unprecedentedly high returns that bonds have recently offered; nor in the stock basket, despite the prospect of continuing inflation. There is much more discussion about this in the book. Martin Gale also has an excellent article about stocks vs. bonds. He says,

Many investors make the mistake of thinking that the least risky portfolio is one containing just cash and short-term bonds; or that the most aggressive portfolio is one containing only equities. Somewhat surprisingly, that is false. The safest portfolio contains a mix of stocks and bonds, as does the most aggressive. For any portfolio containing all bonds there is a less risky portfolio with a better return that contains some stocks. This is counter-intuitive because in and of themselves bonds are safer than stocks.

I saw some similar arguments in a Powerpoint presentation from an investment advisor recently, that basically said, no matter how risky you want to be, at least hold some bonds (like at least 10%). It is pretty widely accepted that you should have some bonds and some equities. How much of each is up to you. I followed Martin Gales advice on short vs long term bonds. and decided to stick to buying short-term bonds, because whatever risk/return ratio you achieved by buying longer duration bonds, you could achieve by holding fewer bonds and more equities. In general I think the equities have the better risk/return ratio. That could always changebut at least historically, its been the case that equities have been a better investment than long-term bonds. This backs up what I was told by my ex-advisor at Clearsight; stick with short duration bonds and avoid long duration bonds.

So, to minimize cost I see only two options. Buying iShares Short-term Bond Index Fund (XSB), or buying individual bonds and making my own bond ladder. I decided to buy XSB since the commission costs of making my own bond ladder would be prohibitive at this point, although when my nest egg is larger this might be more cost-effective because it would eliminate the MER.

Real-Return Bonds

As I said above, one of the disadvantages of my old portfolio was that I had no real-return bond component. Real return bonds are resistant to inflation because the interest is set to be x number of points above the inflation rate. I looked at the Ontario Teachers Pension Plan and the CPP Investment Board and both have significant real return bond holdings. The former has 11.1% and the latter has 3.5% in real return bonds. I decided to have 1/4 of my bond portfolio invested in real-return bonds which amounts to 5%. I might re-evalute this allocation later (in about 5 years).