My Current Asset Allocation

Post on: 25 Июнь, 2015 No Comment

A reader recently commented that she would be interested in seeing my investment asset allocation. Since I want Wealth Lion to offer more of what Im doing financially, I thought it was a great idea for a post.

Asset Allocation Defined

For those of you who may not know what asset allocation is, its basically how you divide up your investments to balance risk, return, safety, and the like.

Heres a brief definition from Wikipedia if you want more:

Asset allocation is an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to the investors risk tolerance, goals and investment time frame.

Many financial experts say that asset allocation is an important factor in determining returns for an investment portfolio. Asset allocation is based on the principle that different assets perform differently in different market and economic conditions.

A fundamental justification for asset allocation is the notion that different asset classes offer returns that are not perfectly correlated, hence diversification reduces the overall risk in terms of the variability of returns for a given level of expected return. Asset diversification has been described as the only free lunch you will find in the investment game. Academic research has painstakingly explained the importance of asset allocation.

My Overall Asset Allocation

Now that were all on the same page, heres a quick summary of my overall asset allocation as of the middle of June (this is the big picture allocation for now well dig into details in a minute):

- Taxable and Retirement Investments (mostly index mutual funds): 62.78%

- Real Estate: 26.91%

- Cash: 10.31%

A few comments to add perspective to these numbers:

wealthlion.com/my-retirement-plan-the-numbers-and-options/, I want the real estate percentage to eventually be 33.3% without counting the value of my house.

Stocks/Bonds Investment Allocation

Digging a bit deeper, if you just look at the splits from my stocks/bond investments (the 62.78% above), heres how they break down:

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX): 46.76%

- John Hancock Lifestyle Fund Growth Portfolio: 28.95%

- Vanguard Small-Cap Index Fund Admiral Shares (VSMAX): 12.54%

- Vanguard Total International Stock Index Fund Admiral Shares (VTIAX): 11.75%

A couple comments on these:

- The Vanguard funds are in both taxable and tax deferred (rollover IRAs from past 401ks) accounts. They have very low expense ratios.

- The John Hancock fund is the best choice I have from my current 401k. Its not great (high expenses), but I use it to cover my bond allocation (20% of it is invested in bonds). We have a proprietary version of this fund in our 401k, so the fund ticker thats public does not apply to our account (and thats why I havent listed it.)

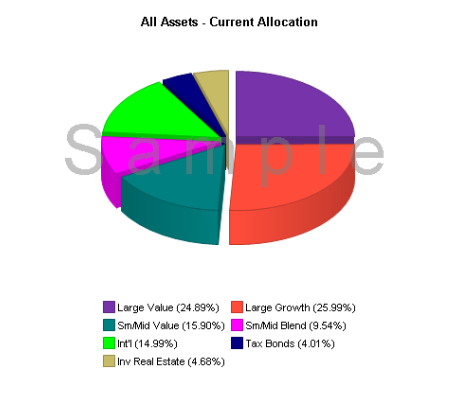

Overall Allocation by Investment Class

If you break down all my investments into their various asset classes and split the John Hancock fund between stocks and bonds, heres the final allocation:

- US Stocks: 43.90%

- Real Estate: 26.91%

- Cash: 10.31%

- Small Cap Stocks: 7.87%

- International Stocks: 7.38%

- Bonds: 3.63%

A few comments here:

- I have been drawing down (selling) my position in US Stocks to fund my real estate purchases. As you might imagine, Ive had some good gains with these over the past year or so, and I was ready to cash out some. Ive also donated some to charity to avoid the capital gains taxes. I may sell some more, but at this point Id prefer not to (besides, most is in retirement accounts that I wont have access to for a decade).

- Small cap and international stocks are about where I want them.

- Bonds are admittedly low. I think they are going to take a big hit when (and we know it will happen eventually) interest rates start to rise. So Im intentionally keeping them low at this point.

So thats my current asset allocation. It will change over the years (of course) as different asset classes perform differently, but for now, this is an accurate snapshot of my holdings.