My Best Idea For 2014 Newcastle Investment An Aging REIT Newcastle Investment Corp (NYSE NCT)

Post on: 16 Март, 2015 No Comment

Introduction

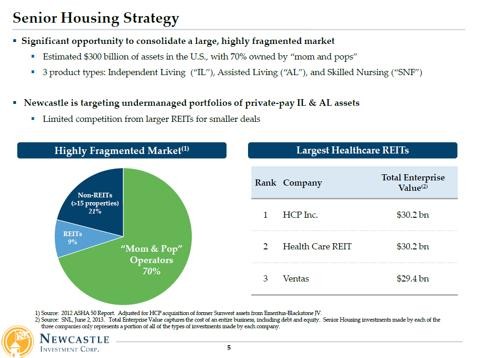

Newcastle Investment Corp. (NYSE:NCT ) is a real estate investment trust (REIT) with a bit of an identity crisis. It’s in the midst of transitioning from a commercial REIT (think CDOs and other forms of r eal estate debt) into a senior living healthcare REIT. For NCT investors this is big news. Not only is the income generated by healthcare assets more stable and consistent, but the market rightfully places a higher multiple on REITs of this character. Because the market has yet to fully grasp the caliber of this transition — and price it accordingly — an incredibly attractive risk-reward exists at current levels. Should the thesis play out correctly, NCT could see prices upwards of $11 (+100%) within 12 months. The best part is that, while you wait, you can continue to collect NCT’s 7.5% yield, significantly limiting your downside. Maybe taking care of grandpa isn’t so bad after all.

Historical Background

Newcastle Investment is an externally-managed REIT (managed by Fortress Investment Group — FIG ) that has been nothing short of a juggernaut for shareholders in recent years. Through financial engineering and prudent investing strategies, NCT has consistently delivered above-market returns for its investors. Here’s a two-year chart (spin-off adjusted, but not including dividends):

New Residential Spin-Off

Earlier this year, on May 16, Newcastle completed the spinoff of its wholly owned subsidiary, New Residential. New Residential (NYSE:NRZ ) is primarily a mortgage servicing REIT, although it also holds some residential mortgage paper (agency and non-agency). As part of the spin-off, Newcastle shareholders received one share of NRZ for each share of NCT that they owned.

Up to this point, NRZ’s share price has largely disappointed, but its dividend has met or beaten exceptions in each quarter this year. I suspect that, as the market continues to get comfortable with the stability of NRZ’s dividend stream, its share price will find its footing and may even start to appreciate. Investors have also been incorrectly lumping it in with traditional mREITs, further adding to the frustrating price action. NRZ’s dividend for the last two quarters was $0.175, giving the stock a close to 11% yield. It also recently announced a special dividend of $.075, which predictably sent the stock higher. Here’s a YTD chart on NRZ:

New Media Spin-Off

Following its NRZ spin-off, Newcastle announced in September 2013 that it would also be spinning off its media division, New Media. The spinoff is expected to be completed in Q1 2013, meaning that, if you purchase shares today, you will still receive New Media shares when they begin trading. Newcastle shareholders will again receive one share of New Media for each share of NCT that they hold.

New Media is a collection of media assets, primarily newspapers. The division is composed of two media investments: Dow Jones Local Media Group and GateHouse Media, which each own several local newspapers and digital marketing servicers. Local media assets are actually in vogue with investors, including Warren Buffett, as they tend to be less prone to disruption by social media. In Buffett’s 2012 annual letter. he wrote [p]apers delivering comprehensive and reliable information to tightly-bound communities and having a sensible Internet strategy will remain viable for a long time. This makes sense; after all, you can’t go on Twitter and see who is holding a yard sale in your neighborhood.

The icing on the cake is that management seems content on using New Media as a cash cow for NCT shareholders, guiding towards a 20% dividend yield upon inception. I don’t care what the business is — if it yields 20%, I’m interested. The slide below from Newcastle’s New Media investor presentation gives you a better look into the business and projected dividend yield.

Coming up with a value for New Media, I arrive at a back of the envelope valuation of $230-690 million, which translates to a share price of $0.65-$1.3. This value is derived using NCT’s post-secondary share count of 351 million (remember NCT shareholders will receive one share of New Media for each NCT share they hold) and New Media’s projection of $46 million in annual dividends upon inception. This translates to dividends of $0.13/share per year and a share price of $0.65 at a 20% yield. The table below shows the valuation for New Media: