Mutual Funds V Estate

Post on: 12 Июль, 2015 No Comment

Investing in mutual funds and real estate can help the average working person increase his net worth. When you have enough investments generating capital gains and income, you’ll be able to live comfortably without working a job. Owning real estate, especially your own home, allows you to fix one of the largest expenses most people have, and may provide capital gains that can be used for retirement living expenses.

Other People Are Reading

Mutual Funds and Real Estate Can Make Retirement a Reality

Mutual funds are liquid assets. They can easily be turned into cash to pay for food, health care or other living expenses. A fund’s value is based on the value of its underlying assets and the number of the fund’s shares outstanding. If the value of the assets held by the fund increase, the owner’s balance increases. Most funds also collect dividends or interest payments that add to the account. They work a lot like a bank savings account but have the potential to earn a higher rate of return if the investments in the fund increase in value before they are sold. They also can lose value, unlike a bank savings account, because they are a group of publicly traded stocks, bonds or money market instruments.

Owning your own home, either outright or with a long-term mortgage, allows you to fix the majority of your shelter expense. When a 30-year fixed rate loan is made on a home, the borrowed amount, principal and the interest is paid back in 360 (12 months * 30 years) equal, fixed installments. At the end of the mortgage term, you own the home. This usually results in substantially reducing your monthly living expenses.

Mutual Fund Investing

There are two ways most people buy into mutual funds:

First you can be an after-tax investor. Open an account with a brokerage firm, pick which fund you want to buy shares of and send in the required minimum investment from your savings. After the initial investment, smaller amounts can be added periodically.

Many people invest through an employer-sponsored deferred compensation plan. These plans, called 401(k) in the United States, allow employees to divert money from their paycheck (sometimes augmented by the employer) into a professionally managed plan. The employee then chooses one or more mutual funds to place their savings in. You don’t have a choice about the plan management but you do usually have a reasonably wide selection of funds to choose from.

There are thousands of Mutual Funds and they fall into three broad types:

Equity funds are primarily invested in the stocks of publicly traded corporations.

Bond funds purchase the long-term debt instruments of corporations and collect the premiums (interest). They also trade bonds, creating capital gains and losses because the value of a bond fluctuates with interest rates.

Money market funds hold short-term debt of corporations and governments that also pay interest. These funds seek to keep the share value at $1 with the earnings they pay owners closely tied to short-term interest rates.

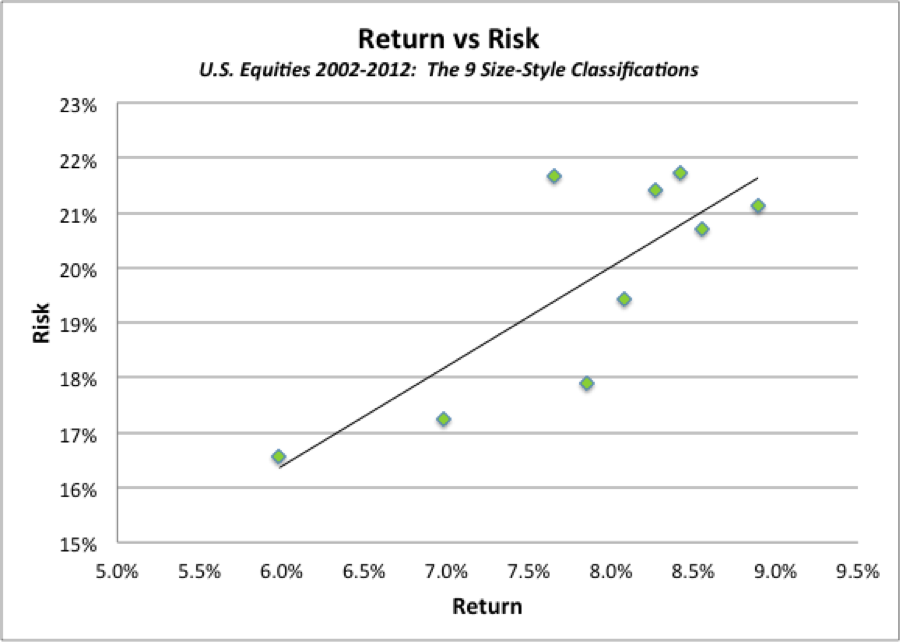

Mutual Fund Risks

If safety of principal is your main objective, mutual funds holding stocks and bonds may not be your best option. Because these funds buy and sell the shares and debts of publicly traded corporations, their value fluctuates daily. Over the long term, the stock market has earned investors a positive rate of return but on any given day the fund’s holdings may decline in value.

Real Estate Risks

Before the 2008 crash, many investors believed real estate prices always went up. Even though that wasn’t true before 2008, the risks associated with real estate are now more obvious. Economic upheavals like bank failures and increased unemployment cause buyers to reduce the price they’re willing and able to pay for property.

Real estate has always required a fairly long-term commitment to show significant appreciation. The costs of buying and selling real property are substantial, often amounting to 10 percent of the value. It’s a very illiquid asset. If you need to move to get a new job or want to get a larger or smaller home you must find someone else willing to buy your current property unless you can afford to pay for another house and rent yours out at a profit.

Many people believe that owning rental property is a good way to become rich; but owning and managing a rental house has its own set of unique risks. Tenants move out and the property is vacant (or worse, don’t leave and don’t pay the rent) but the mortgage and taxes must still be paid. Renters may vandalize the property requiring the landlord to make expensive repairs. Managing a rental property also has its own set of legal requirements.