Mutual Funds FAQ

Post on: 1 Июль, 2015 No Comment

1. Who can I contact to discuss the Mawer Mutual Funds?

Mawer mutual fund representatives can help with questions you may have pertaining to the funds. Please contact us by phone at 403-262-4673/Toll Free: 1-800-889-6248 or by email: funds@mawer.com

4. What is the difference between Series A & O units?

5. Is there a minimum investment amount required to open an account?

Non-Discretionary Accounts

British Columbia, Alberta, Saskatchewan, Manitoba and Ontario Residents: minimum investment requirement of $50,000 per account.

Broker/Dealer Accounts

Mawer Mutual Funds can also be purchased through discount brokers, mutual fund dealers and financial planners by residents of all Canadian provinces & territories with a minimum initial purchase of $5,000 per fund per account.

Beyond the initial minimum investment amounts, there are no minimums for additional contributions.

Discretionary Accounts

Mawer offers discretionary portfolio management as well. Please contact our Private Client group to discuss this option further.

6. Does Mawer offer automatic contribution/withdrawal plans?

Yes. Once the initial minimum contribution has been made, automatic contribution or withdrawal plans can be set up. There is no minimum amount required for automatic plans.

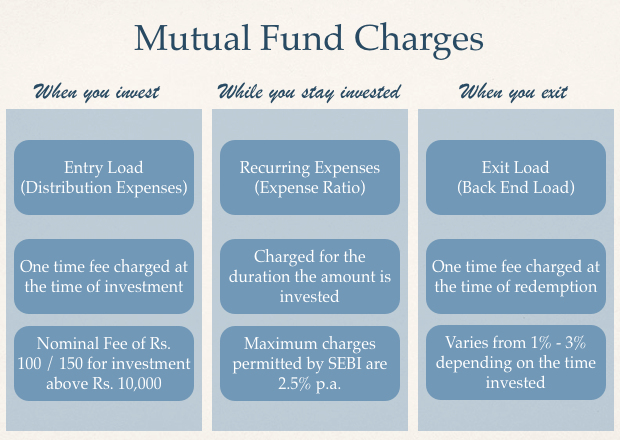

7. What are the costs to buy/sell Mawer Mutual Funds?

All Mawer Mutual Funds are NO LOAD – no set-up fees, no purchase, transfer, or redemption fees are charged by Mawer.

Fees may apply if purchased through an intermediary. Please contact your broker/dealer directly to inquire about any fees they may charge.

8. How do I invest in Mawer Mutual Funds?

Mawer Mutual Funds can be purchased directly from Mawer or through discount brokers, mutual fund dealers, financial planners, etc. Please see the Ways to Buy section for more details.

9. What is the difference between discretionary and non-discretionary management?

Discretionary Portfolio Management

Discretionary management is the delegation of daily management of an investment portfolio within the parameters previously established between the Portfolio Manager and the client and documented in a formal Investment Policy Statement. This frees clients from the need to make day-to-day decisions on security selection (buy and sell orders), portfolio structure, and asset mix.

Clear and comprehensive communication is provided through regular meetings and detailed quarterly reporting. Reports include an in-depth valuation statement, transaction report, and a personalized performance summary. Also included is Mawer’s quarterly Investment Newsletter providing market commentary and analysis for the past quarter.

Non-Discretionary Mutual Fund Accounts

Non-discretionary mutual fund accounts opened directly with Mawer are designed for individual investors who wish to manage their own investments using the Mawer Mutual Funds. Clients receive detailed quarterly reporting as well as Mawer’s quarterly Investment Newsletter providing market commentary and analysis for the past quarter.

10. What is your redemption fee schedule?

All Mawer Mutual Funds are NO LOAD — there are no redemption fees.

11. Why can’t I buy units of the Mawer New Canada Fund?

The Mawer New Canada Fund is capped to new and existing mutual fund investors. This has been done due to our concern that the amount of new money might exceed the available investment opportunities to the detriment of the performance of the fund and, in turn, our existing clients.

12. Why Mawer is not an MFDA member & does this impact investors in

Mawer Mutual Funds?

The MFDA Investor Protection Fund provides protection to eligible customers of MFDA members on a discretionary basis to prescribed limits of securities, cash or other property of the MFDA member that may be unavailable as a result of the member’s insolvency. The protection against insolvency applies primarily because mutual fund dealers accept deposits in their trust accounts before remitting the purchase proceeds to the fund company.

At Mawer, we do not hold client monies in a trust account – all cash and investments are held by a Canadian trust company which is protected under banking and trust laws to act as custodian for Mawer Mutual Funds. Since all assets of the Funds are at all times segregated from those of the Funds’ trustee, manager and custodian, they are not available for any use or purpose other than the investment objectives of the Funds. In accordance with provincial laws, a mutual fund’s assets belong to the fund and its investors, not to the dealer, manager, portfolio manager or trustee.

Mutual fund investments are not covered by deposit insurance (CDIC) because that insurance applies only to deposits and GICs of deposit-taking institutions such as banks and trust companies.