Mutual Funds

Post on: 10 Апрель, 2015 No Comment

- Principles

Submitted by Muslim Investor on Mon, 1999/11/22 — 07:29

Mutual Funds are groups of stocks and other investmentinstruments (Bonds, Certificate of deposits. etc.)managed by a professional and pooling money fromthousands of investors and leveraging the aggregatedamount of the pooled money in buying stocks and bonds.

Types of Mutual Funds

Any Mutual Fund falls roughly into one of two categories (as below).Before you invest in a fund, you have to know which type it is, andwhether that type is suitable for your goals:

These aim to provide the investor with a regular income (monthly/quarterly) by investing in securities that provide income (e.g. dividend paying stocks. etc.). The appreciation of capital is of secondary importance (if at all).

The main aim of this type of fund is to grow the capital invested by appreciation of the undelying securities, and not to provide any annual/quartely income.

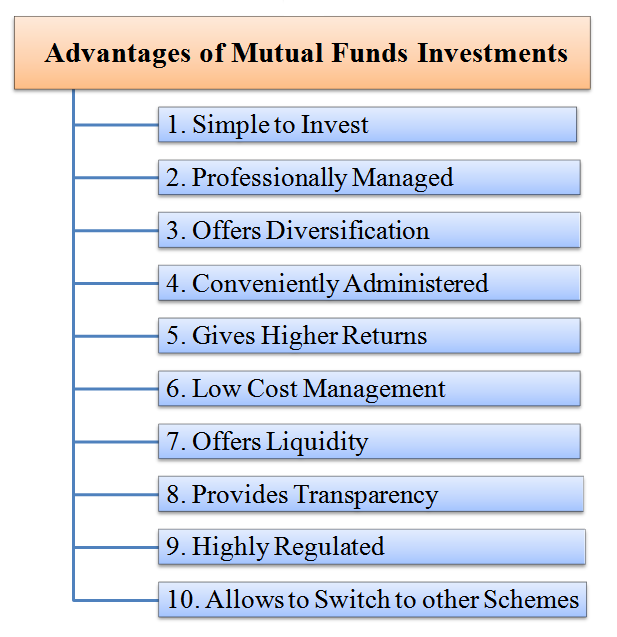

Advantages of Mutual Funds

The ideas behind Mutual Funds is very good indeed.

- Spread the risk by diversifying the portfolio. If one instrument (e.g. Stocks) or sector (e.g. Transportation) falters, then the hit to the overall portfolio is minimal.

Disadvantages of Mutual Funds

Despite their perceived benefits, Mutual Funds have severaldrawbacks.

- Can incurr huge costs in fees and commissions, unless you are buying a No-Load Mutual Fund.

- Historically, they have underperformed the stock market. The best strategy (for a non-Muslim) is to buy an Index Fund (one that tracks a major market index, such as the Dow Jones Industrial Average — DJIA or the Standard and Poor 500 — S&P 500 .

- You have no say in where your money is being invested. Some Islamically prohibited investments can be made without your knowledge. (Banks, Tobacco. etc.)

In addition to all the above, even if a fund starts out with all Islamically Correct ® components (very rare), the managers of the fund reserve the right to (and often do) change the fund components over time, as a response to market changes.

Islamic Index Funds

Historically, 80% of fund managers have underperformed the major marketindexes. This means that the average non-Muslim investor is better offbuying a no-load index fund, than chosing a more managed fund.

Muslims can now take advantage of this, since there are several IslamicIndexes, including the Dow Jones Islamic Markets. There are several companies planning to offer Mutual Funds that track the major Islamic Indexes. Check this MorningStar article titled: Profiting According to the Words of the Prophet.

One word of caution: it is not sufficient for a fund to track an Islamicindex to be 100% Islamically accepatble! It is a step in the right direction, but there are other considerations that need to be taken care of:

- Sharia Advisory Board

The fund must be overseen by a Sharia Advisory Board of reknown scholars that will advise the fund managers on Islamic Sharia rulings on various issues of investment and finance.

Any Mutual Fund (or even stock broker account) will have some cash reserves that will allow investors to withdraw their holdings completely or partially. This cash generates some interest, and has to be dealt with in a well defined Purification process.

Islamic Mutual Funds

The following Mutual Funds advertise that they operate according to Islamic Sharia principle. Most have a Sharia Advisory board that oversees its compliance with Islamic teachings:

- Azzad Asset Management is a financial services firm specialized in

providing ethical (halal only) financial solutions. The company offers

the Azzad Funds as well as an ethical (halal) separately managed

program using asset allocation. Clients can choose from a variety

of retirement, college savings, and managed investment accounts. In

addition, the company assists affluent investors with their estate

planning needs. Businesses and individuals depend on Azzad to help them turn their wealth into their goals by using ONLY halal investing.

They offer two Mutual Funds (Growth and Income) operating according to Islamic Principles, with an Islamic Advisory Board.

On their web site, you will find:

You can check their current price and last daily change, with links to further analysis:

These are a Islamic Mutual Fund that tracks the Dow Jones Islamic Markets USA (DJIM-US). The symbol is IMANX. More info can be found on their web site.

Their objective is to provide competitive Shari’ah compliant investment returns utilizing a globally diversified portfolio of high quality equity investments rigorously screened for Shari’ah compliance. The minimum account size is 500,000$, so they are geared more towards institutional investors or Very High Net worth individuals. They follow the Dow Jones Islamic Market Index principles and Sharia rules.

Is a Bermuda company, but based in U.K.

Based in Montreal, Quebec, Canada, with representatives in Dubai, U.A.E, and Jeddah, Saudi Arabia.

Based in Jeddah, Saudi Arabia, and a subsidiary of Al Baraka group of companies. They offer several mutual funds of various types.

Based in Canada, and offers Shariah compliant mutual funds. They have a Canada fund as well as a World fund.

Lists all the Islamic Mutual Funds worldwide. You may want to check this for funds not listed above, or ones that have no web presence, and operate in your city/country/region.

Islamic Mutual Fund Monitoring

In the U.S.A, Morning Star publishes performance data of the various Mutual Funds that are available for investors in the U.S.A. Their data is available on most investmentsites such as Quicken .

Failaka is a a Chicago, Illinois, U.S.A.company with an office in Kuwait. They monitors the performance of many Islamic MutualFunds worldwide.

Data for 1998 is also available, so you can check it if you are interestedin comparing year-to-year performance.

Other Social / Ethical Funds

You can also, further look into the Ethical / Social Funds which often have very good ethical causes, but most often would invest in Islamically prohibited components.