Mutual Fund Fees Are Declining but Still Vary Widely

Post on: 16 Март, 2015 No Comment

INVESTORS can’t count on very much these days. The economy remains troubled, the stock market is volatile and the bond market seems fraught with risk.

Overseas options aren’t much better. With Europe in a nasty recession and problems growing in China and the rest of Asia, emerging markets are as vulnerable as ever.

But one thing is quite predictable: the fees that investors pay in their individual mutual funds .

“Finding low-cost funds becomes more important than ever,” said Russel Kinnel, director of fund research at Morningstar. “If you’re going down in fees, you’re boosting your return.”

When it comes to mutual funds, fees have a huge range and vary across asset classes. Average annual fees are 1.44 percent on equity funds, 1.02 percent on bond funds and 0.24 percent on money market funds, according to the calculations of the Investment Company Institute, the mutual fund trade group. Fees for emerging-market funds or alternative-investment funds can be more than 2 percent.

Photo

Credit Minh Uong/The New York Times

But fees also vary widely within asset classes. For instance, about 1 in 10 equity funds charge fees of 0.78 percent or lower, while another 1 in 10 charge 2.2 percent or higher. At the same time, investors who buy funds through a financial adviser may have to pay a separate load, or fee to compensate the adviser.

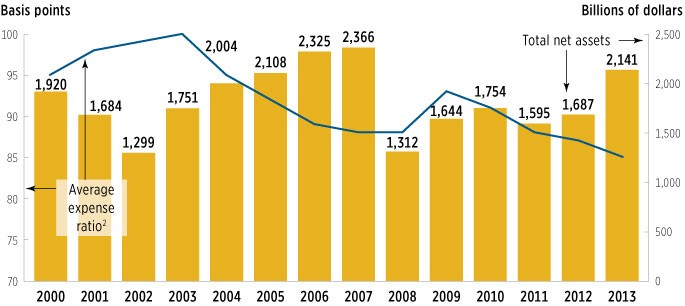

Clearly, though, fee-conscious investors have been putting pressure on fund companies, and many of those costs have been coming down.

The turning point came in 2002, during the bear market after the collapse of the Internet bubble. Until then, many new investors had piled into mutual funds without much experience of bear markets.

“What happened in the early 2000s is that sensitivity to fees increased,” said Brian Reid, the institute’s chief economist. “We particularly saw it among 401(k) plan sponsors and financial advisers, which has contributed to the significant downward trend in fees since then.”

Index funds tend to cost less than actively managed funds, which may require more — and more costly — labor. But there are also other reasons for the cost differences. Index funds tend to be far larger and thus better able to take advantage of economies of scale. Last year, the average equity index fund had assets of $1.6 billion under management, compared with $374 million for actively managed equity funds, according to the institute’s data.

Regardless of the differences, the costs of index funds and actively managed funds have fallen over time by roughly the same proportion. From 1997 to 2011, the average expense ratio of equity index funds fell 0.13 percentage points, or 13 basis points, while the average for actively managed equity funds dropped 11 basis points. At the same time, the average for bond index funds fell 8 basis points, compared with 16 basis points for actively managed bond funds.

Index funds are major beneficiaries of the increased focus on fees. Last year, $55 billion in net new cash flowed into index funds, bringing total net assets under management up to $1.1 trillion. In addition to traditional index funds, exchange-traded funds. which are typically also based on indexes and tend to have low costs, grew to $1 trillion total net assets.

That’s not to say that actively managed funds are going away. “It’s not that people want to abandon active management, but they’re looking for low-cost ways of doing that,” Mr. Reid said.

He said one trend he had seen was active management moving from the funds themselves to financial advisers. “Previously, financial advisers would invest a client’s portfolio in a group of actively managed funds with only an occasional adjustment,” he said. “Now we are seeing some advisers invest clients’ portfolio in a broad range of index funds, but the strategic investment decisions are now made by the financial adviser, who regularly adjusts allocations among the funds to actively manage these portfolios.”

Low-cost investing sounds attractive, but what exactly does “low cost” mean?

It’s a relative term. You might look at the fees of the cheapest 10 percent of funds across asset classes. According to the institute, they are 0.78 percent and below for equity funds, 0.5 percent and below for bond funds and 0.13 percent and below for money market funds.

But even within that frugal 10 percent, fees vary widely. Consider large-cap growth funds. The cheapest group of funds in that category may have fees lower than 0.1 percent or higher than 0.8 percent. The average large-cap growth fund charges 1.22 percent.

Virtually every asset class now has low-cost options. Categories like domestic large cap, intermediate bond and moderate allocation funds have a great number of low-cost alternatives.

Low-cost funds have also entered areas that have typically charged higher fees. For instance, the average emerging-market fund charges 1.61 percent, and the average alternative fund charges 2 percent. But investors can now find funds in these asset classes charging significantly less.

AND that’s exactly what many customers have been doing. For example, in 2011, the institute found that the simple average expense ratio of equity funds was 143 basis points, while the average expense ratio that equity fund shareholders actually paid was 79 basis points. In other words, the holdings of investors are more concentrated in low-cost funds.

While the companies that profit from fees don’t want clients to focus exclusively on them, taking advantage of low-cost options can be great for investors. Understanding the costs and the various options may be an essential part of saving for retirement, especially if we truly are entering an era of low returns.

Correction: October 14, 2012

An article in the Mutual Funds Report, Part 2 of this section last Sunday, about mutual fund fees misspelled the surname of the chief economist of the Investment Company Institute. He is Brian Reid, not Reed.