Musings on Markets Stock Buybacks They are big they are back and they scare some people!

Post on: 24 Май, 2015 No Comment

Stock Buybacks: They are big, they are back and they scare some people!

Dividends & Buybacks at all US firms (Source: Compustat)

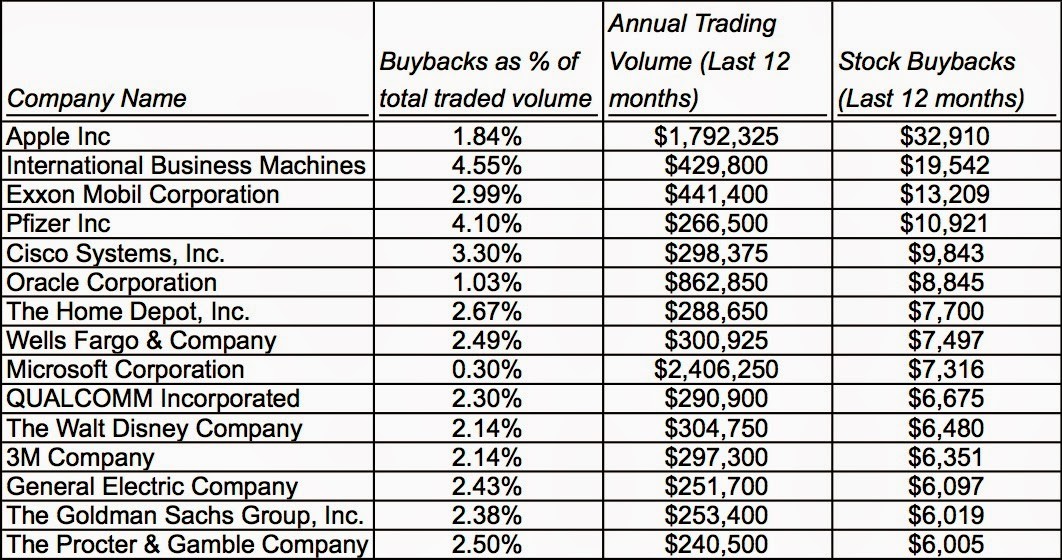

This graph backs up the oft-told story of the shift to buybacks occurring at US companies. While dividends represented the preponderance of cash returned to investors in the early 1980s, the move towards buybacks is clear in the 1990s, and the aggregate amount in buybacks has exceeded the aggregate dividends paid over the last ten years. In 2007, the aggregate amount in buybacks was 32% higher than the dividends paid in that year. The market crisis of 2008 did result in a sharp pullback in buybacks in 2009, and while dividends also fell, they did not fall by as much. While some analysts considered this the end of the buyback era, companies clearly are showing them otherwise, as they return with a vengeance to buy backs.

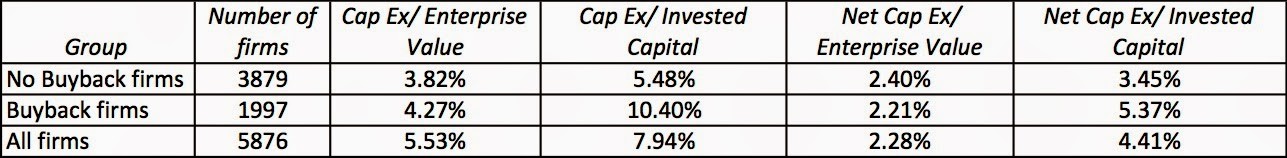

As a stockholder in any of these companies, can you honestly tell me that you would rather have had these companies reinvest back in their own businesses? Put differently, how many of you wish that Microsoft had not bought back $100 billion worth of shares over the last decade and instead pumped that money into more Zunes and Surfaces? Or that Hewlett Packard instead of paying out $60 billion to stockholders had bought three more companies like Autonomy (and written them off soon after)? Or that Cisco had spent the $70 billion in buyback money on a hundred small acquisitions? If, as the Economist labels them, these companies are cannibals for buying back their own stock, investors in these companies wish they had more voracious appetites and eaten themselves faster.

There are two other issues brought up by critics of stock buybacks. One is that there is firms may buy back stock ahead of positive information announcements. and those investors who tender their shares in the buy back will lose out to those who do not. The other is that there is a tie to management compensation, where managers who are compensated with options may find it in their best interests to buy back stock rather than pay dividends; the former pushes up stock prices while the latter lowers them. Note that doing a buyback ahead of material information releases is already illegal, and any firm that does it is already breaking the law. As for management compensation, I agree that there is a problem, but buybacks are again a symptom, not a cause of the problem. In my view, it is poor corporate governance practice on the part of boards of directors to grant huge option packages to managers and then vote for buybacks designed to make managers even better off. Again, fixing buybacks does nothing to solve the underlying problem.

Wrapping up

I think that both ends of the spectrum on buybacks are making too much of a simple cash-return phenomenon. To the boosters of buybacks as value creators, it is time for a reality check. Barring the one scenario where companies that buy back stock stop making value-destructive investments, almost every other positive story about buybacks is one about value transfers: from taxpayers to equity investors (when debt is used by an under levered firm to finance buybacks) and from one set of stockholders to another (when a company buys back under valued stock).

To those who argue that buybacks are destroying the US economy, I would suggest that you are using them as a vehicle for real concerns you have about the evolution of the US economy. Thus, if you are worried about insider trading, executive compensation, tax-motivated transactions and or under investment by the manufacturing sector, your fears may be well placed, but buybacks did not cause of these problems, and banning or regulating buybacks fall squarely in the feel-good but do-bad economic policy realm.

Is it possible that some companies that should not be buying back stock are doing so and potentially hurting investors? Of course! As someone who believes that corporate finance at many companies is governed by inertia (we buy back stock because that is what we have always done. ) and me-too-ism (we buy back stock because every one else is doing it. ), I agree that there are value destroying buybacks, but I also believe that collectively, buybacks make far more sense than dividends as a way of returning cash to equities. In the Economist article, I am quoted as saying that dividends are a throwback to the nineteenth century (not the twentieth), when stocks were offered as investment choices to investors who were more used to bonds and that fixed, regular dividends were designed to imitate coupons. Since equity is a residual claim, it is not only inconsistent to offer a fixed cash flow claim to its owners, but can lead (and has led) to unhealthy consequences for firms. In fact, I think firms are far more likely to become over levered and cut back on reinvestment, with regular dividends that they cannot afford to pay out, than with stock buybacks.