Musings on Markets Reversal in Risk Premiums (or premia) The 2010 story

Post on: 16 Март, 2015 No Comment

Saturday, January 9, 2010

Reversal in Risk Premiums (or premia): The 2010 story

The big story from the 2010 updates is that that risk premiums across the board have reversed the rise that we saw during the crisis. The broad based nature of the shift can be seen by looking at the following:

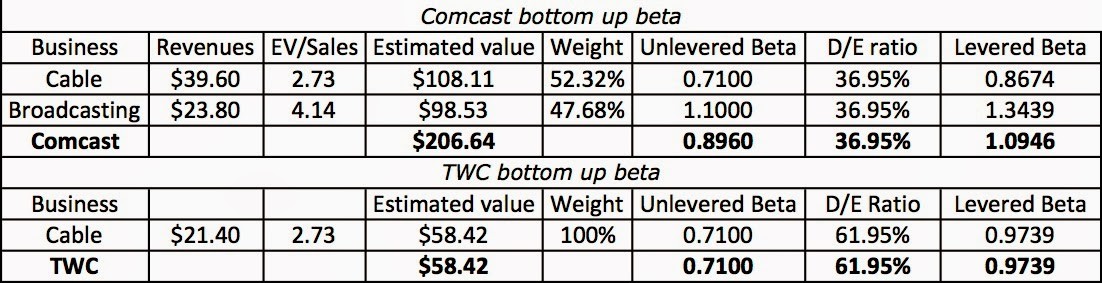

a. Equity Risk Premiums. I have been tracking the equity risk premium at the start of every month since the start of the market crisis on September 12, 2008. On that day, the equity risk premium for the US was 4.37%. That number exploded to almost 8% in November 2008 and settled in at 6.43% at the start of 2009. In the first three months of 2009, the equity risk premium continued to rise (to more than 7% in early April 2009). Since then, though, the equity risk premium has dropped dramatically. On January 1, 2010, the equity risk premium was down to 4.36%, roughly where it was at the start of the crisis. If you are interested in the computation, download the excel spreadsheet that I used (and feel free to modify and adapt it as you see fit)

b. Bond default spreads. The market crisis had its origins in easy lending, reflected in the low default spreads that we saw for different bond ratings classes in late 2007. Bond default spreads almost tripled during 2008, thus outstripping the change you saw in equity risk premiums. In 2009, however, bond default spreads returned to pre-crisis levels. You can get to my latest estimates of default spreads by clicking here .

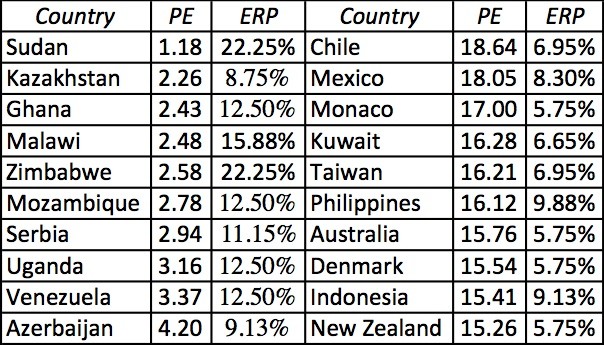

c. Sovereign spreads. When the market crisis unfolded, emerging markets were affected more adversely than developed markets, as manifested in collapsing stock prices and soaring sovereign default spreads. The default spread for Brazil in the Credit Default Swap mark rose to 7% in November 2008. Those spreads have decreased to pre-crisis levels (and below, for some markets). Brazil’s CDS spread in January 2010 was hovering at about 1.5%.

While I am not surprised that risk premiums have come down, I am surprised at how quickly they have reverted back to old levels. In early 2009, my prediction would have been that equity risk premiums by the end of the year would be down to about 5%. At one level, the speedy recovery in risk premiums can be considered to be evidence of mean reversion- that markets quickly revert back to historic norms even after major crisis. At another level, the quick adjustment can be viewed as a sign of a market that is in denial. My gut feeling is that the market has gone up too far, too fast and that equity risk premiums will correct themselves over this year and move back up towards 5%, but I may very well be wrong again.