Multiasset Fund I

Post on: 21 Июль, 2015 No Comment

Overview

About this fund

- The fund aims to provide growth on your original investment.

- The fund manager will reinvest any income as the fund only has accumulation shares at the moment.

- It invests in a broad range of global assets, such as equities, bonds, deposits, cash, property, commodities and derivatives.

- The fund typically invests in these assets by using other funds, but may invest directly

Who might this fund suit?

- This fund may be suitable for an investor looking for a low-medium risk fund

- Youre aiming for a return on your investment through both growth and income.

- You should be able to invest for the medium-to-long term (realistically five years or more). You understand the risks, investment objective and policy of the fund.

- You accept the risk that you may lose some or all of your money in return for the possibility of better returns than a UK bank or building society deposit account.

- You know it is easier to access money you place in a bank or building society account than money you invest in this fund.

- You accept that you wont receive interest on this investment as you would in a bank or building society account.

- You dont expect to see the levels of volatility or growth in the medium to long term normally associated with the other funds in the multi-asset fund range.

- You recognise your investment in this fund is at risk compared to the relative safety of bank and building society accounts.

- You know there is a possibility you could get back less than you invested.

Find out more about the fund

You should read this document before you decide whether it is suitable for you.

Fund factsheet This gives you the main points you need to know about the fund. It will help you assess whether this particular investment fund meets your needs.

Risk and reward

Risk and reward

Generally speaking, the more risk you take, the greater the potential for higher rewards. You also have a greater potential to lose money. The opposite is also true, with low risk usually generating lower returns alongside the reduced risk of losing money.

Because of this, you need to think about your own attitude to risk when youre choosing how and where to invest your money. To get a chance to achieve possible cash-beating returns, you must take some risk. The key is to find the right balance for you, where you feel comfortable with your investments.

Performance projection

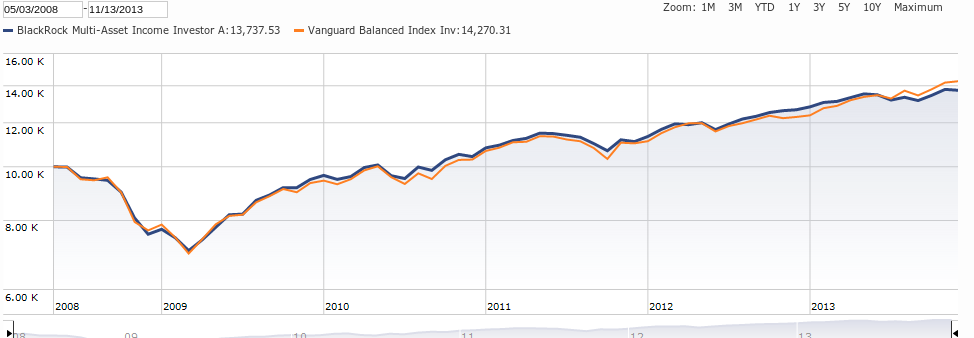

The graph shows a range of potential outcomes for a 10,000 investment at this risk level over 10 years. Weve based this on a typical asset mix (shares, property, bonds, and so on), which may be suitable for this risk level.

The final value of your pension fund will depend on other factors, including:

- the actual growth your funds achieve

- the amount paid in

- the charges

- the rate of inflation, and

- your age when you choose to retire.

Before you continue

- Please remember the projection given is an example only and doesnt represent the maximum or minimum amounts you may get back. You should use it as an aid to help you make your decision. It is not a guarantee of future performance. Please remember the value of your fund can go down as well as up. You may get back less than you invest.

How we calculated this projection and the assumptions we used

Calculating the projection

The values in this graph come from using historic and current data to create 1,000 different scenarios to show what might happen to investment performance in the future. We use Moodys Analytics UK, a leading supplier of financial planning tools and stochastic modelling to calculate the scenarios.

Moodys Analytics UK uses the information to estimate the future value of a typical investment for each scenario. This method of estimating values is known as stochastic modelling. The company reviews and updates its calculations each quarter, taking into account changing economic conditions. In the calculations shown here we have used the data from June 2014.

Each graph uses light to dark blue to show the range in which the 1,000 outcomes may lie. The most likely outcomes are in dark blue. The light blue sections show other possible but less likely outcomes.

If you decide to invest in this fund, well send you a personalised illustration. That uses fixed future rates of return and shows the actual funds youve chosen to invest in. It also includes all the charges on the Pension Portfolio. This stochastic projection is not personalised to your specific situation.

The figures shown in the graph have been adjusted to allow for future inflation. That means that they are shown in todays money which helps you to compare them with your current income and outgoings.

Its important to note that if the rate of growth on any savings or investment product is lower than inflation plus any charges, then the future values in todays money will be less than the original investment. This is the case even for secure products or funds; even though the original investment may not reduce over time, if any growth is lower than the rate that prices of goods and services are rising then the amount that can be purchased with the investment is reducing.

Assumptions

- Charges

Weve assumed total charges of 1.05% a year will be taken from the investment. The actual charges may be more or less than this, depending on things like the amount you invest and the fund(s) you choose.

Weve assumed a lump sum payment of 10,000 into Pension Portfolio at the beginning and no further payments are made.

Weve assumed a typical asset mix which may be suitable for this risk profile. Please bear in mind that these are only examples and dont represent the actual asset mix of any fund(s).

All the figures shown take account of inflation at 2.5% and show the buying power of the pension fund in todays money. This is an example only and not a personal illustration. Inflation could be higher or lower and will affect the worth of all savings and investments.

Based on the projection above, investing 10,000 for 10 years at this risk level could mean you: