Motley Fool Newsletter Reviews

Post on: 16 Март, 2015 No Comment

You are here: Home » Motley Fool Newsletter Reviews

Motley Fool puts out a couple of highly rated stock newsletters. Their Stock Advisor and Insider publications both garner our highest tier 1 classification rating with Stock Advisor again receiving our annual award for best growth stock newsletter .

Motley Fool Rule Breakers has also done quite well lately but thats partly due to the fact that the highly volatile small cap growth stocks have performed extremely well of late in this bull market. We don’t rate it as highly because the stock selections can be highly volatile and have suffered large losses when they are out of favor during market downturns. Until the newsletter can show a little more consistency in outperforming the small cap benchmarks we don’t rate it as a top pick.

Motley Fool Hidden Gems has lagged and not performed as well overall. The newest Supernova Portfolio offerings also got off to a rough start in 2012. We would advise caution on these products until they’re able to establish a successful track record.

1) David and Tom Gardner provide insightful stock analysis along with a sound investment philosophy to follow. Their success in helping and educating investors over the years is highly commendable.

2) They expect to hold stocks long-term which reduces capital gains taxes and minimize trading costs. You should expect to hold stocks for a minimum of 3-5 years on average

3) Large Number of Securities Held which increases diversification and decreases the amount of risk you’re taking on any one stock. Bad news in any one holding will not devastate your portfolio.

4) As a new subscriber they provide their list of best buys and core holdings to get you started in the right direction. This makes it easy to scale into a working portfolio following their best selections.

5) Most stocks are well known names with lots of liquidity. Psychologically this makes it easier for people to follow the stocks because they are invested in familiar companies that are making the news.

6) You gain access to the Motley Fool community of subscribers through a forum where you can post questions and get them answered. This eliminates much of the useless spam you find on the message boards such as Yahoo Finance.

1) The results of David Gardner lag that of Tom Gardner. If you stick with the stock picks of Tom Gardner you can potentially increase your returns substantially.

2) One or two stocks are selected each month regardless of current market conditions. This is in keeping with their investment philosophy of always being invested at all times in the best stocks that the market has to offer.

The problem with this philosophy is that it doesn’t take advantage of extreme market conditions. There’s a lot more value and upside potential in stocks after market downturns such as the years 2003 and 2009. Likewise your stock selections can become very overvalued during the later stages of bull markets like we saw in 1999 and 2007.

3) Because the Motley Fool has such a large following it’s often hard to replicate their stock newsletters published performance results. If you receive the newsletter after others many of their recommendations have already popped on a buy recommendation or dropped on a sell recommendation.

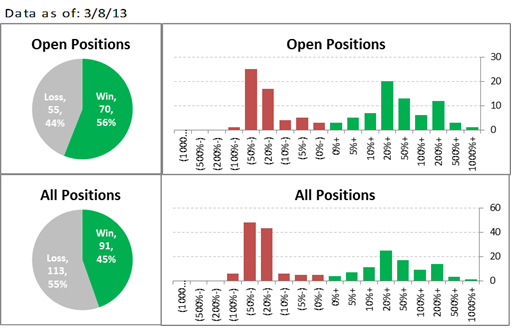

4) The number of winning stocks have average 55-65% over time depending on the newsletter. A few big winners account for the majority of their market beating gains. If you’re not in those stocks at the right time you can greatly under perform your expectations.

5) The Motley Fool newsletters are not valuation based. In other words they don’t tell you at what price to buy or sell a stock, only which ones to invest in. They do occasionally provide hold and sell recommendations but these are typically after a stock has already suffered a large loss. This is one of the main complaints of their subscribers.

Motley Fool Newsletter Reviews

The Motley Fool is an online multi-media financial investment and planning stock market newsletter giant. Their philosophy is simple: “To educate, amuse & enrich.” Their goal is to provide consumers valuable financial planning resources without boring them to distraction in the process.

Motley Fool follows a similar format for their Stock Adivsor, Rule Breakers, Insider and Hidden Gems newsletters. Each month you receive 1-2 stock recommendations, a list of 5-10 core stocks and 5-10 of the best stocks to buy now. In addition you receive email updates and access to their member’s only website.

All selections are deemed to be a buy at the current price. This is due to their investing philosophy. Because you can’t time the market it’s best to always be invested in the best companies that the market has to offer. Much like Warren Buffett you are investing for in good companies, solid management and a competitive edge for the long-term.

One of the chief complaints of Motley Fool subscribers is that they don’t provide guidance on when to buy or sell a stock recommendation. The biggest source of frustration is the lack of immediate guidance on what to do with a stock that runs into problems or suffers large losses.

They typically will take a day or two to digest what the news means and then provide a hold or sell recommendation. Although this can be frustrating to investors, it’s prudent because they don’t overreact to the bad news and make the mistake that hurt many investors.

On the other there’s nothing to prevent subscribers from investing in overvalued stocks or being fully invested during brutal market downturns and suffering large losses.

Additional Resources

The Motley Fool features page after page of valuable financial insights. This is one of the quirkier stock market newsletters, but that shouldnt throw off visitors. In fact, it is quite refreshing. The information is well organized into clickable links and presented in a way that anyone can understand it, even if they are clueless about investing.

In addition to stock advice, users will enjoy access to several financial planning tools that will calculate everything from figuring out how much you need in savings to deciding if it makes better financial sense for a college student to live at home, on campus, or rent an apartment.

Getting back to the heart of their stock investment newsletters, Motley Fool offers everything investors need to make and monitor their investments. News stories that affect stocks are presented in a very readable format along with tips about how this current event could affect investments. You’ll learn the basics of investing including how to invest, when to invest, and why to invest. Every stock investment option available is presented at this stock market newsletter’s website.

What Do Subscribers Think?

Judging from the looks of it, Motley Fool is one of the most loved online stock market newsletters, if for nothing other than their fun attitude toward trading. Motley Fool receives a 4 out of 5 star rating by its users with many of them expressing their joy over finally being able to understand the complex world of stock trading. One testament after another tells about their excellent performance. Just take a look at some of these quotes:

• “Reassuring and welcoming to the first-timer!”

• “If you know a company’s stock symbol, there’s very little reason you’ll ever have to leave the Fool to do research. You can find balance sheets, cash flow and income statements, and Security and Exchange Commission filings, as well as recent news.”

• “The Fool is about educating people in how to properly manage their whole financial lives, not just stocks.”

• “Here’s the Motley Fools (good) advice in a nutshell – 1.Save money. 2.Avoid taxes. 3.Look out for fees. 4.Don’t try to beat the market, since you probably can’t.”

It looks like that of all the stock market newsletters out there, Motley Fool may be the best place for investors new to the world of stock trading who also want to take hold of the rest of their financial situation.