MortgageBacked Securities ETFs and QE3

Post on: 24 Август, 2015 No Comment

Bond ETFs News:

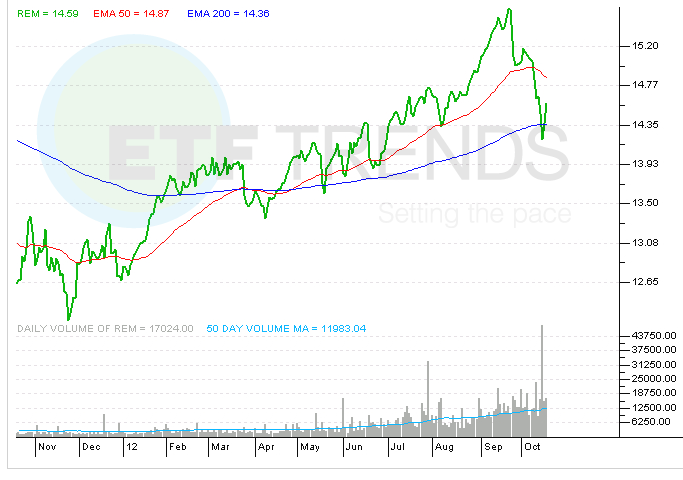

ETFs that invest in mortgage-backed securities rallied immediately following the Federal Reserve’s QE3 announcement although some analysts doubt whether the latest round of central bank bond buying will be enough to drive more upside.

Last week, the Fed said it will purchase more agency mortgage-backed securities at a pace of $40 billion a month.

Beneficiaries of the Fed’s accommodative policy in the fixed income sector include both agency and non-agency MBS and asset-backed securities, said Sterne Agee chief market strategist Sharon Stark in a note. The Fed’s plans to add to its existing holdings of $843 billion Fannie Mae, Freddie Mac and Ginnie Mac MBS comes at a time when supply is sparse and demand from financial institutions insatiable.

The iShares Barclays MBS Bond Fund (NYSEArca: MBB) posted its biggest one-day price gain in 13 months last Thursday after the Fed announcement, reports Investors’ Business Daily.

The ETF tracks an index of U.S. investment grade agency mortgage-backed securities and offers a 30-day SEC yield of 3.2%, according to manager BlackRock.

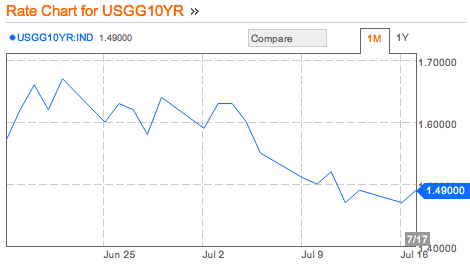

Government-sponsored mortgage bonds typically pay more interest than do comparable U.S. Treasury bonds. However, because homeowners can refinance or sell their homes at any time, mortgage-bond cash flows are very unpredictable. This prepayment risk is why the bonds pay higher interest rates, investment researcher Morningstar says in a profile of MBB.

Other ETFs that invest in the sector include SPDR Barclays Capital Mortgage Backed Bond ETF (NYSEArca: MBG), Vanguard Mortgage-Backed Securities ETF (NYSEArca: VMBS), iShares Barclays CMBS Bond Fund (NYSEArca: CMBS) and iShares Barclays GNMA Bond Fund (NYSEArca: GNMA).

The Fed’s expanded bond buying amounts to unprecedented support of the mortgage market, said Todd Abraham, co-head of government and mortgage bonds at Federated Investors, in a Dow Jones Newswires report. [PIMCO ETF ‘Well Positioned’ for Fed’s Mortgage Buying]

“But some market strategists doubt MBS ETFs have much upside potential and say the Feds impact will be marginal,” Investors’ Business Daily reported.

The mortgage-related portion of the U.S Investment Grade Bond Index is just over $8.0 trillion, said Wayne Schmidt, chief investment officer at Gradient Investments, in the story. The Fed program is targeting 0.5% of the total pool of agency mortgage-backed securities. If the program continued for one year, their purchases would equate to about 6% of the total market.

iShares Barclays MBS Bond Fund

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.