Mortgage REITs High Yield But Very High Risk NLY CYS CLNY ARI PMT Investing Daily

Post on: 2 Апрель, 2015 No Comment

By Jim Fink on August 18, 2011

Weve never been fans of yield-chasing. Every high-yield investment we buy is backed by a healthy and growing business.

In a low-yield world of near zero percent short-term rates and a record-low 2% ten-year U.S. Treasury note. Im always on the lookout for stocks that pay more. If you rely on dividend income for living expenses, finding higher yields is imperative to a comfortable lifestyle. So, when I discovered that mortgage REITs topped the list of high-yielding investments on tickerspy.com, I decided to do more research. It turns out that mortgage REITs are very different from the equity REITs most investors are familiar with.

As I explained in Canadian REITs Keep Their Tax Benefits in 2011 . equity REITs are companies that own and manage income-producing real estate properties. They make money by purchasing and selling property and charging their tenants rent. Equity REITs benefit from inflation, which increases rents and property values. In contrast, mortgage REITs purchase or originate mortgages on properties, not the properties themselves. Mortgage REITs make money on the interest they earn from the mortgages, as well as through buying and selling them.

How Mortgage REITs Make Money

As owners of debt instead of property, mortgage REITs benefit from reductions in interest rates that increase mortgage values. This is especially true for mortgage REITs that invest in commercial mortgages because commercial mortgages impose pre-payment penalties on borrowers that pay back the principal too quickly. In contrast, mortgage REITs focused on residential mortgages suffer from pre-payment risk as residential mortgages allow borrowers to refinance at lower rates without penalty. On the flip side, commercial mortgages, especially the construction type, are much more likely to default than residential mortgages.

Those mortgage REITs that engage in leverage (i.e. borrowing money to magnify returns) also benefit from a steepening of the yield curve which can increase profit margins by widening the spread between the interest cost of borrowings and the interest income from the mortgages themselves. Interest rates are typically much more volatile than real estate prices, so mortgage REIT investors experience a bumpier ride than equity REIT investors.

All REITs both equity and mortgage are pass-through entities that dont get taxed at the entity level but only at the investor level. By avoiding the double-taxation inherent in regular corporations, REITs can distribute more cash to unit holders. Of the roughly 170 REITs trading in the U.S. a little less than 25% are mortgage REITs. Of these, more than 60% invest in residential mortgages and the rest invest in commercial mortgages.

There are three types of mortgage REITs. (1) those that use leverage to trade high-quality, government-backed (i.e. Ginnie Mae, Fannie Mae, Freddie Mac) residential mortgages; (2) those that act like a bank by originating private-label (i.e. non-government backed) mortgage loans that are non-conforming (i.e. jumbo, Alt-A, subprime); and (3) those that purchase high-risk distressed mortgage loans at cheap prices and work with the debtor to improve the chances of repayment.

Mortgage REIT Examples

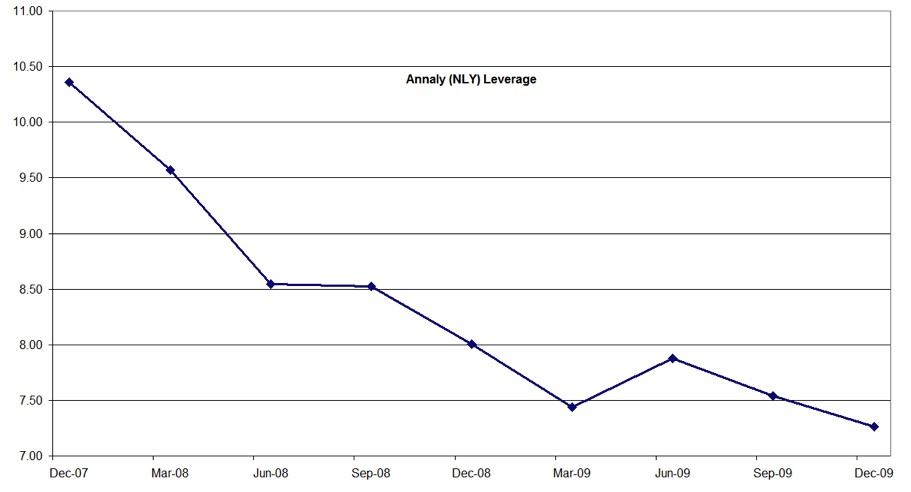

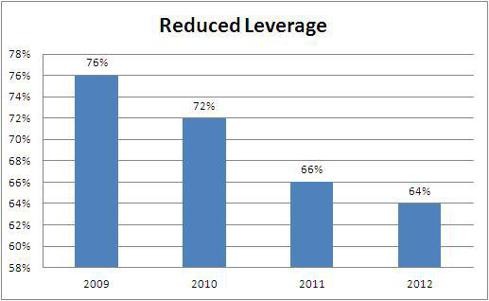

Examples of mortgage REITs engaged in high-quality leverage are Annaly Capital Management (NYSE: NLY) and Cypress Sharpridge Investments (NYSE: CYS). Credit risk is nil since the mortgages are government-backed. The main risks here are margin calls caused by over-leverage and rising short-term interest rates that flatten the yield curve and squeeze profit margins.

Examples of bank-like mortgage REITs engaged in the origination of private-label mortgages are Colony Financial (NYSE: CLNY) and Apollo Commercial Real Estate Finance (NYSE: ARI). Credit risk based on poor underwriting standards is substantial.

Examples of vulture mortgage REITs engaged in workouts of distressed mortgages are PennyMac Mortgage Investment Trust (NYSE: PMT) and Chimera Investment Corp. (NYSE: CIM). Credit risk is a given, so diversification and buying these mortgages at a sufficient discount is crucial.

Below is a list of nine mortgage REITs that currently sport a dividend yield in double digits: