Morningstar Broadens Style Box Methodology

Post on: 16 Март, 2015 No Comment

Morningstar, the Chicago-headquartered fund tracker, said it is updating the methodology it uses to pigeonhole mutual funds in its popular style boxes. Like passive index funds, style boxes are a tool long favored by institutional investors that have gone mainstream with retail investors.

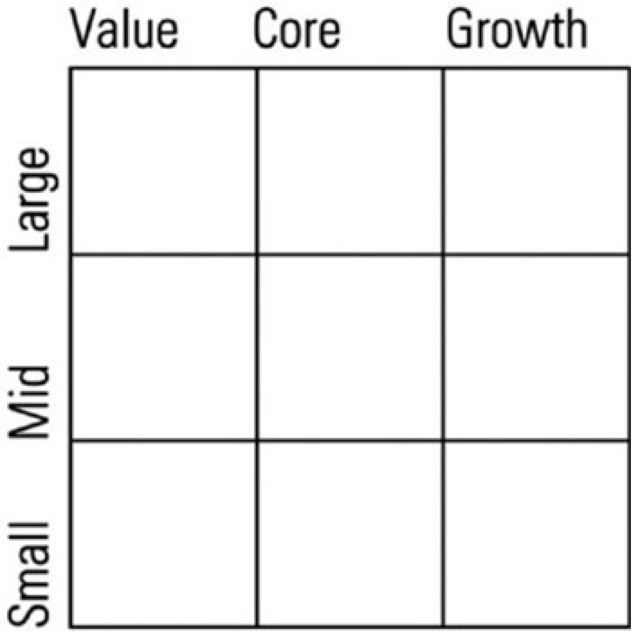

The overall layout of the nine-box grid will remain unchanged, but Morningstar will use more factors to determine where a fund ends up. Previously, only two data points were employed to determine valuation: price to earnings ratio (p/e) and price to book ratio (p/b). Morningstar said it will add eight new factors when determining style: price/projected earnings, price/book, price/sales, price/cash flow, dividend yield, long-term projected earnings growth, historical earnings growth, sales growth, cash-flow growth, and book-value growth.

Many in the investment industry have been critical of style boxes in the past, claiming funds are oftentimes unfairly grouped together.

Hundreds of funds reside within a single style box, yet the risk/return profiles of these funds often show wide dispersion, says Gavin Quill, an analyst at Boston-based Financial Research Corporation (FRC). Much of this variance is due to the fact that numerous different investment processes are employed to manage these funds. They may be relatively similar in terms of capitalization and valuation parameters, but they arrive at these ends through very different means.

Quill says investment processes can be defined as any system designed to allow an investment manager to capitalize on identified inefficiencies in the market.

Paul Kaplan, director of research at Morningstar, said the new methodology addresses this issue and helps provide a clearer definition of value and growth.

The new methodology allows you to dig deeper and look at how funds got to be labeled growth or value, said Kaplan. You’re able to make a clearer distinction between fund management strategies.

Kaplan pointed specifically to many of the Janus offerings as examples of funds that may have been mislabeled under the old two-factor system. Many of the Janus funds are clearly growth funds, but some ended up in Morningstar’s value camp when valuations fell.

Morningstar said the new methodology is the result of consultation and feedback from fund managers and institutional investors. In recent years, the Chicago firm that started out as an impartial fund rating service for retail investors has evolved into a separate account advisor, mutual fund picker, and index licenser. Morningstar has indicated that it plans to enter the index business with 16 proprietary indexes.

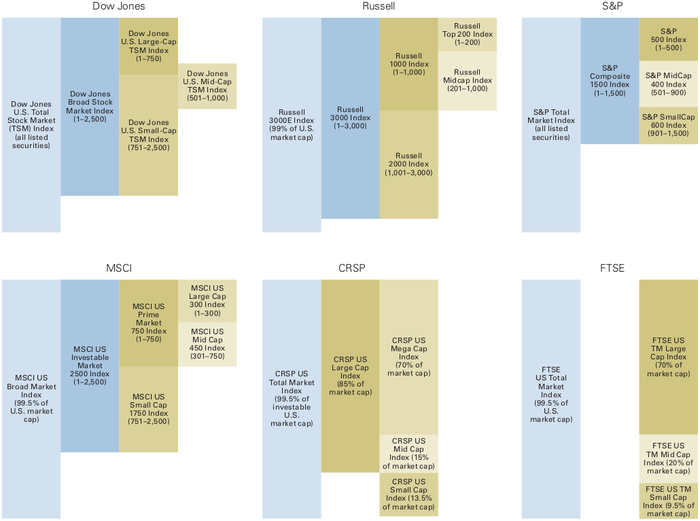

Most existing indexes are not specifically constructed for use in building a diversified portfolio, said Kaplan.

A Morningstar spokeswoman declined to comment on possible negotiations with fund companies to license the benchmarks. However, this potential service and others could lead to Morningstar receiving considerable compensation from financial institutions.

The brand that has emerged as dominant in the 1990s is not Fidelity, Putnam, or even Merrill Lynch — but instead is Morningstar, wrote the authors of the 1998 book The Mutual Fund Business .