MORE VOLATILITY AHEAD for SHARES and BONDS

Post on: 30 Июнь, 2015 No Comment

THE AUSTRALIAN OCTOBER 28, 2014 12:00AM

FROM early this year until early this month, a recurring theme in investment markets was the pronounced sense of calm. That placid mood couldn’t be expected to last — and, just as the low volatility in shares and bonds around the world had been US-led, the big reversal in market sentiment, when it came, was likely to be initiated in the US.

And that’s what happened. In the US trading day of October 15 — and while most Australians were asleep — the weathervane of market sentiment shifted from relative calm to full-on panic; the resulting gyrations in bond and share prices will be talked about for many years. And, since then, views on investment prospects, especially on the outlook for shares, have diverged.

At one extreme are investors who expect the recent turbulence in investment markets will seriously harm business and consumer confidence, restrict credit flows, and bring about lower share prices. Those of us who experienced the financial panics of 1987 and 1994, which upturned investment markets but did little damage to real economies, wouldn’t put a high probability on a dire outcome this time around.

A less bearish view on the outlook for shares sees the very low yields on government bonds since October 15 as a sign of heightened risk aversion. These investors say the preservation of capital is now all important, the hunt for yield is over, and argue allocations to shares should be significantly reduced.

A third response, which I favour, allows that the recent surge in market volatility is unlikely to have lasting effects on real economies — and that share valuations, on average, were not all that expensive when sharemarkets started to become jittery in mid-September. As a result, investors should consider using opportunities provided by the weaker sharemarkets to pick up selected shares at lower prices.

There’s also a view that recent financial wobbles could prolong and strengthen the bull market in shares — because they will delay the start of the Fed’s moves to normalise the US cash rate and force the European Central

Bank to get on with its much-promised quantitative easing (last week, the ECB announced it would purchase bank-issued bonds and media reports suggested it will also buy highly rated corporate bonds).

The turbulence in investment markets occurred when US companies were about to announce their September quarter results. Revenues, profits and dividends were, in aggregate, a notch or two above expectations. This is helping to rebuild sharemarket confidence — and is a powerful reminder of how important improving earnings are at this phase of the investment cycle.

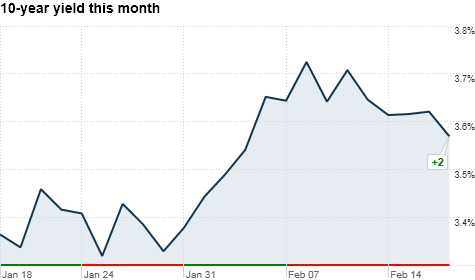

Looking ahead, investors should expect further spikes in volatility in shares and bonds — associated, in particular, with shifts in market expectations about what the US central bank has in mind for its cash rate, but for other reasons too.

Monthly and quarterly releases of economic information sometimes paint a confusing picture of what’s happening to economic activity. Even if, as seems most likely, global growth continues at a moderate pace, there will be particular pieces of information that bring a return of market jitters. This happened in October, with the reports that US monthly retail sales had contracted by 0.3 per cent (mainly, it turned out, because of cheaper energy), and that monthly industrial production and exports in Germany had by about 5 per cent (in part because of a shift in timing of annual holidays).

Since the global financial crisis, many major investors have followed broadly similar investment strategies — including building up their holdings of bonds — while expecting they’ll be able to exit these positions as and when the outlook for bonds sours. But will there be enough buyers at that time to cushion the impact on yields — or will market ructions result?

Don Stammer chairs QV Equities, is a director of IPE, and is an adviser to the Third Link Growth Fund, Altius Asset Management, Philo Capital and Centric Wealth. The views are his alone.

MORE ARTICLES BY Don Stammer