More tech companies have cash to pay dividends

Post on: 1 Август, 2015 No Comment

RexCrum

SAN FRANCISCO (MarketWatch) — Some might soon call them cash machines.

With many large-cap technology companies sitting on piles of cash, and the stock prices of several of those sector giants stagnant, pressure has risen on those firms to reward investors’ loyalty by doing something that is still an exception rather than the rule in the tech industry: pay a dividend.

There’s no question about the ability for both of these companies to pay dividends; Microsoft and Cisco each have about $40 billion in cash on hand. Yet typically many of the biggest tech companies prefer to hoard cash to use for acquisitions, research and development, or share buybacks.

Revenue warnings hit chip stocks

Losses in the chip-equipment industry keep gains in the technology sector in check on Friday after Kulicke & Soffa Industries issues a revenue warning. MarketWatchs Rex Crum reports.

Yet whether paying dividends is a long-term positive for a company’s stock is open to debate. Microsoft announced its first dividend on Jan. 16, 2003. The next day, the company’s shares fell 7% to $20.73, adjusting for stock splits and dividend payments. The stock now trades at around $24.50 a share.

But the changing nature of today’s market and the uncertain economy have led many investors to seek out dividends as a benefit for sticking with tech companies that have matured into operations with slower growth and measured stock performance.

“More and more large-cap tech companies have seen their valuations come down over the last decade,” said Bryan Keane, technology analyst with Alpine Funds. “They are getting a different kind of shareholder to look at them. Many of these companies have the opportunity to return some money in the form of a dividend, and if they pay that, they are going to attract a more income-oriented investor.”

Jonathan Greenberg, Chief Executive of New York-based OCE Interactive, a stock-market research and analysis company, says that companies tend to issue dividends when their earnings growth slows to about 12% to 15% annually.

While Google Inc. GOOG, +0.79% isn’t at that point yet, the case can be made for the Internet’s biggest search company to offer shareholders a dividend.

Over the past year, Google’s stock has risen 7% compared with the Standard & Poor’s 500 Index’s SPX, +1.26% gain of 10%. In the last three years, Google’s shares are down 10%, while the S&P 500 has lost 25% of its value. For its current fiscal year, ending in December, analysts estimate Goolgle’s earnings-per-share will rise 18% over 2009 results.

“Google is viewed as a huge innovator, but the pipeline and the business they are in hasn’t turned into a lot of products,” Greenberg said. “And long-term growth expectations have slowed.”

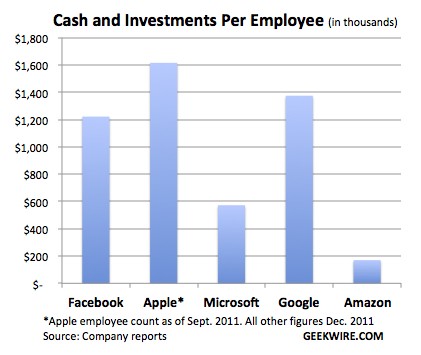

With a market cap of about $130 billion, and a bankroll worth close to $30 billion, Google fits some of thee criteria Greenberg said typifies that of dividend payers. “Nearly 20% of the company’s valuation is balance sheet cash,” he noted. “Google has considerable free cash flow even as its growth slows, meaning it will continue to accrue a lot of cash.”

If Google were to issue a dividend, Greenberg says it would send a strong signal to the market.

“Companies usually only initiate dividends if they think they can sustain them,” Greenberg said. “It’s a strong indication that a company’s cash is stable and they can maintain financial flexibility.”

Another tech company seen as a dividend-paying candidate is Dell Inc. DELL Investors haven’t had much to cheer about with Dell of late, as the computer-industry giant’s shares have fallen 14% over the last year and are down 52% since October 2007.