Money Supply (M1) and the Stock Market CXO Advisory

Post on: 6 Май, 2015 No Comment

A reader wrote:

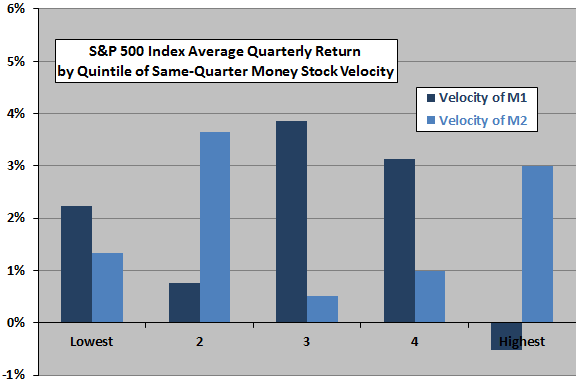

I couldnt find an analysis for the M1 money supply similar to the one for M2. How about it? M2 cannot be an accurate money supply measure because it includes non-cash investments such as money market mutual funds. When the stock market corrects and people are exchanging stocks for say, money market mutual fund shares, the M2 figure will actually increase. The money supply is not literally increasing in such cases as no new cash is being created; there is merely an exchange of existing assets. Technically, only increasing the monetary base would increase the money supply, but M1 is a reasonable substitute for that as it includes the cash part of bank reserves.

The M1 money stock consists of funds that are readily accessible for spending: currency in circulation, travelers checks, demand deposits and other checkable deposits. Is there a reliable relationship between historical variation in M1 and stock market returns? Using weekly data for seasonally adjusted M1 and the S&P 500 Index during January 1975 through October 2011 (1,923 weeks), we find that:

The following chart depicts M1 and the S&P 500 Index over the entire sample period. Both series have generally risen as the economy grows (and inflates), but the stock market is more volatile than M1. Visual inspection is not helpful in discovering any relationship between the two series.

To dig deeper, we relate changes in the two series.

The following scatter plot relates weekly change in the S&P 500 Index to same-week change in M1 over the entire sample period. One of the observations in September 2001 is a two-week relationship because U.S. stock markets were closed. The Pearson correlation between the two series is -0.08, and the R-squared statistic is 0.01, indicating that weekly variation in M1 explains 1% of the variation in concurrent stock market movements.

This conclusion is not very stable. Removing the single observation (the two-week observation noted above) to the lower right changes R-squared to 0.00.

Might the effect of money supply be evident only over longer intervals?

The following table presents Pearson correlations for four measurement intervals and both concurrent and next-interval S&P 500 Index returns (M1 Leading) over the entire sample period. Correlations are generally small, and the signs are not consistent. Most of the associated R-squared statistics are 0.00.

Might there be a non-linear but reliable effect of M1 variations on stock market returns?

The next chart summarizes average S&P 500 Index returns across quintiles of ranked changes in M1 over intervals of one, four and 13 weeks during the entire sample period. Results are fairly inconsistent, suggesting randomness rather than any systematic relationship. There is some indication that strong growth in M1 over 13-week intervals indicates strong stock market returns (but quintile subsamples have only 32 observations, and removing a single observation can change the conclusion).

Might changes in M1 convincingly lead stock market returns at some longer horizon?

The final three charts explore potential M1-stock market lead-lag relationships for non-overlapping intervals of one, four and 13 weeks over the entire sample period by offsetting changes in M1 relative to S&P 500 Index returns. Specifically,

The top chart relates weekly change in M1 to weekly S&P 500 Index return for offsets ranging from the stock market leads M1 by 13 weeks (-13) to M1 leads the stock market by 13 weeks (13).

The middle chart relates 4-week change in M1 to 4-week S&P 500 Index return for offsets ranging from the stock market leads M1 by six months (-6) to M1 leads the stock market by six months (6).

The bottom chart relates 13-week change in M1 to 13-week S&P 500 Index return for offsets ranging from the stock market leads M1 by four quarters (-4) to M1 leads the stock market by four quarters (4).

Correlations are generally small, and the lead-lag variations appear to be mostly noise.

Given the several-week delay in availability of M1 data, it appears very unlikely that M1 changes are useful trading signals.

In summary, evidence from several simple tests does not support a belief that M1 money stock is a useful predictor of short-term or intermediate-term stock market behavior.

Cautions regarding findings include:

- Sample size is not large for the longer measurement intervals, especially for the quintile breakdown.

- Effects of M1 changes on the stock market may derive from level of surprise rather than level of change. However, determining level of surprise is problematic.

Why not subscribe to our premium content?

It costs less than a single trading commission. Learn more here.