Money Market Mutual Funds_1

Post on: 30 Июнь, 2015 No Comment

One subject Ive never covered here on the blog is money market mutual funds. I really dont use them, so I never had a reason before. But a lot is changing in the money market fund world, so I thought Id share some information about them.

Money Market Mutual Fund vs Money Market Account

Money market mutual funds, or money market funds, are different than money market accounts. A money market fund is a type of mutual fund that invests in non long-term, liquid assets like US T-bills, which provide a safer, more-stable investment. The goal of the fund is to maintain a price per share of $1. Money market accounts are a short-term savings product offered by banks that are FDIC insured.

Who Uses Money Market Mutual Funds?

Money market mutual funds are typically where investors keep the funds that they want in cash. So, when you see an asset allocation pie chart, and see the small portion for cash, this is typically where those funds are kept. Most mutual fund companies (places where youd typically have your 401k or IRA) like Fidelity and Vanguard have money market mutual funds as the safe haven account.

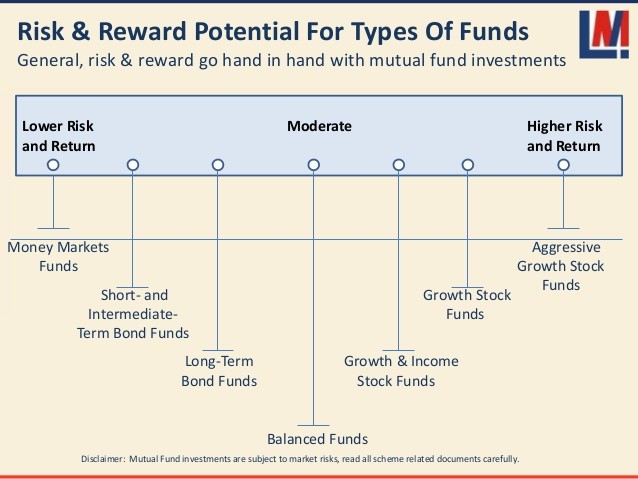

And even at the best online stock brokers. active traders move their funds in and out of money market funds to go from a safe investment, low-reward investment to a more volatile, potentially more rewarding investment.

Are Money Market Mutual Funds Safe?

While they arent insured by the FDIC like the money market account, money market mutual funds are regulated by the SEC against breaking the buck (i.e. dropping value below $1). And Congress is currently in the process of trying to legislate a way to strengthen consumer confidence in these funds. There is a debate as to how that can best be accomplished.

Why Not Just Use a High-Yield Savings Account?

So why are these funds used over money market account and online savings account? It used to be that money market funds could provide a better return for your cash that savings accounts. True. But nowadays, the high-interest online savings accounts provide equal returns for your cash.

So whats keeping investors from moving all their cash into these savings account? The main reason is flexibility. The money market mutual fund is housed under the same roof as the other mutual funds they are invested in. Moving money between accounts (even within an IRA or 401K) is a snap. Also, online savings accounts have limits on the number of monthly transfers you can make in and out of the account. Thus, the money market mutual fund is still around.

The Best Money Market Mutual Funds

So how do you find the best money market mutual fund? Well, my own opinion is that youd be short-sighted by picking a mutual fund company based on how good their money market mutual fund is. Youre with a mutual fund company because you like their stock funds, not money market funds. But, if you have to make that decision, Id let expense ratio be the deciding factor. Luckily, you can typically find low-expense money market funds at places where you find low-expense stock mutual funds. Id start with Vanguard and Fidelity. Here are a couple of their top performing, low-cost money market mutual funds:

- Vanguard Prime Money Market Fund (VMMXX) $3,000 Minimum, Expense Ratio 0.25%, 5-Year Return 3.14%

- Select Money Market Portfolio (FSLXX) $2,500 Minimum, Expense Ratio 0.33%, 5-Year Return 3.11%

If youre strictly looking for a high return on your cash (you dont need to move the money a lot), while maintaining the top notch security that the FDIC provides, just go with a high-yield savings account or money market account .