Money Market Fund Regulation SEC Approves Rule Amendments Affecting Money Market Funds

Post on: 6 Апрель, 2015 No Comment

Sullivan & Cromwell LLP — March 3, 2010

The Securities and Exchange Commission has adopted various amendments to rule 2a-7 and other rules relating to money market funds under the Investment Company Act of 1940. These amendments are the result in part of a run on a number of institutional taxable prime money market funds in September 2008 following the inability of the Primary Fund of The Reserve Fund to redeem its shares at $1.00 per share and credit issues experienced by some money market funds in 2007-2008. These final amendments are similar in many respects to the money market fund rule proposals issued for comment by the SEC in June 2009.

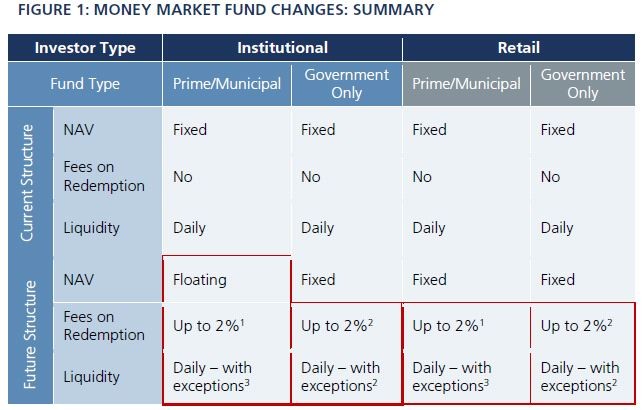

The amendments (i) tighten the risk-limiting conditions of rule 2a-7, (ii) require money market funds to report their portfolio holdings and other information to the Commission on a monthly basis and (iii) permit a distressed money market fund to suspend redemptions in order to allow for the orderly liquidation of fund assets. The principal elements of the amendments are the following:

- New liquidity requirements. Money market funds are prohibited from acquiring illiquid securities if, at the time acquired, the fund would have more than 5% of its total assets invested in illiquid securities. Taxable money market funds must maintain at least 10% of their assets in cash, demand deposits, U.S. Treasury securities, or assets readily convertible into cash within one day. All money market funds must maintain at least 30% of their assets in cash, demand deposits, U.S. Treasury securities, agency discount notes with remaining maturities of 60 days or less, or assets readily convertible into cash within five days.

- Repurchase agreements. Money market funds benefit from look through treatment when investing in repurchase agreements only if they are collateralized by cash items or Government securities, and the creditworthiness of repurchase agreement counterparties must be evaluated by the funds board of directors (or its delegate).

- Shortened maturity limits. The amendments impose a maximum 120-day weighted average life maturity limit on a money market funds portfolio, and reduce the maximum weighted average maturity of a money market funds portfolio from 90 to 60 days.

- Lower limits on acquisition of second tier security investments. Money market funds may invest only 3% of their total assets in second tier securities and may not invest more than 0.5% of their total assets in second tier securities of a single issuer.

- NRSRO designation. A money market funds board of directors must designate at least four nationally recognized statistical rating organizations (NRSROs) that the fund will use in determining whether the security is an eligible security, a rated security, a first tier security and a second tier security.

- Increased reporting requirements. Money market funds must submit to the SEC new detailed monthly reports in addition to the current quarterly reports, and the SEC will make such reports available to the public 60 days after the end of the month to which the information relates. Additionally, money market funds are required to post their portfolio holdings on their websites within five days of the end of each month.

- Permission to suspend redemptions. In the event that a money market fund breaks the buck, or is at imminent risk of breaking the buck, its board of directors may suspend redemptions in order to allow for an orderly liquidation.

- Transaction processing. A money market funds transaction system must be able to process purchases and redemptions at a price other than one dollar per share.

- Purchases by affiliates. Affiliates of money market funds have expanded opportunities to purchase distressed securities from the funds without the need to obtain SEC staff no-action letters.

Unless otherwise noted in the attached publication, the amendments to the rules are effective May 5, 2010.