Money Market Account vs Savings Account

Post on: 30 Июнь, 2015 No Comment

Either Way, Earn a Great Rate with No Monthly Maintenance Fees.

When people have some cash on hand, they may consider either a money market savings account or a more traditional savings account. These two types of accounts are quite similar, but understanding some slight differences can help you decide which is right for you.

Both types of accounts pay interest on deposits, and your funds in both are insured by the Federal Deposit Insurance Corporation (FDIC ) to the maximum extent allowed by law. In addition, both allow you to make as many deposits as you want.

However, for both accounts there is a limit of six withdrawals or transfers per statement cycle a limit set by federal law. It’s important to note that the limit does not apply to ATM withdrawals.

The primary difference between a money market account and a savings account is how you can access your funds. Today, it’s not uncommon to find money market accounts that allow users to write checks, make electronic transfers and use ATM and debit cards. With a savings account, on the other hand, you may need to take money out via electronic transfer or by calling the bank.

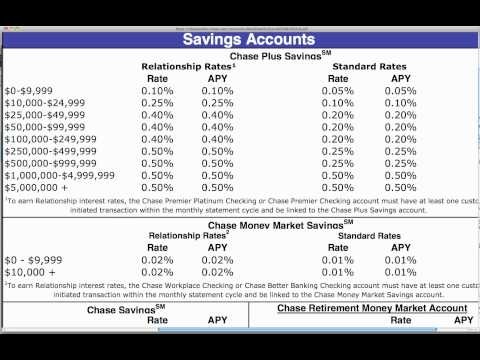

Also, there usually is a difference in interest rates when looking at a money market account vs. a savings account but not always. Sometimes savings accounts offer a slightly higher rate than money-market accounts a tradeoff for the greater flexibility in accessing money market accounts.

With all of that in mind, then, a savings account might be appropriate when you want to put cash away for larger emergencies or future major purchases when you want to be able to access your money, but not regularly.

A money market account might make sense when you want to write checks on an account, but not too many. I had a client who put their money in an online money market account to save when they were buying a house, said Erin Baehr, president of Baehr Financial in Stroudsburg, Pennsylvania. In her recent conversation with Ally Bank, she added, They were able to just write the check with their offer when they wanted to, right from their account without having to worry about transferring money.

In weighing a money market account vs. a savings account, shop around. Some banks require you to maintain minimum balances for accounts, while others don’t.

A final note: Sometimes, people get confused by a third, similar-sounding type of account. It is important to point out there are money market accounts and money market funds, says Andy Tilp, president of Trillium Valley Financial Planning in Sherwood, Oregon.

In a recent interview with Ally Bank, Tilp pointed out that money market accounts typically are found at banks, while money market funds are often offered by mutual funds or brokers. A key distinction, said Tilp: Accounts are FDIC-insured [when opened at an FDIC-member bank], but funds are not.

At Ally Bank, there is no minimum deposit to open either a money-market account or a traditional savings account. Plus, there are no monthly maintenance fees. Both accounts earn a variable rate of interest that is among the most competitive available in the country based on rates published by Bankrate.com .

Learn more and open an account today at Allybank.com or call live, 24/7 customer care at 877-247-ALLY (2559).