MLP Exposure ETF or ETN

Post on: 9 Май, 2015 No Comment

The ALPS Alerian MLP ETF (NYSEARCA:AMLP ) has been one of the most successful new products to hit the market in recent months, accumulating assets of more than $350 million in less than three months of operation. While the tremendous cash inflows reflect an overwhelmingly positive reception to AMLP, the new fund has also started a debate over the merits of various product structures through which exposure to the MLP sector can be achieved. Some of the discussions on the MLP space have been constructive, creating a better understanding of the impact that different structures can have on total returns. But some of whats been written about the MLP space and AMLP in particular has been misleading or just plain wrong.

Background

AMLP is the first exchange-traded fund to invest exclusively in Master Limited Partnerships (MLPs), seeking to replicate the performance of the Alerian MLP Infrastructure Index. That benchmark includes about 25 securities engaged primarily in ownership of energy infrastructure assets, including pipelines that transport crude oil, natural gas, and other energy commodities. AMLP is not, however, the first investment vehicle to focus exclusively on the MLP sector. JPMorgan introduced the Alerian MLP Infrastructure ETN (NYSEARCA:AMJ ) in early 2009, and since then multiple issuers including UBS and Credit Suisse have launched ETNs linked to the MLP sector. Moreover, there are currently more than a dozen MLP-focused mutual funds.

Some investors give little consideration to the vehicle used to achieve exposure to a certain asset class. But the decision can potentially have a material impact on various components of bottom line returns, influencing effective tax rates, current yields, and risk exposure. The most frequently highlighted difference between ETFs and ETNs relates to credit risk ETNs expose investors to it, while ETFs dont. But thanks to certain nuances surrounding the taxation of MLP investments, several other distinguishing factors between these vehicles are magnified in this particular asset class. Much of the analysis surrounding exchange-traded MLP products concludes that investors would be better served by accessing this corner of the domestic energy market through an ETN. For some investors, in some environments, that is certainly the case. But concluding that the ETN structure is the universally superior mechanism for accessing MLPs is just plain wrong.

Tax Issues Front and Center

MLPs have attracted significant interest for two primary reasons: (1) required quarterly distributions provide a steady stream of current income, and (2) because they are partnerships, MLPs avoid corporate income taxes at both the federal and state level the tax liability is passed through to the individual partners.

The tax benefits of MLPs complicate the construction of an ETF offering exposure to this sector. Because a Regulated Investment Company cannot have more than 25% of its portfolio in MLP investments, AMLP is required to be structured as a C Corporation as are all MLP-focused mutual funds on the market today. This allows the IRS to receive tax revenues from MLPs, and limits the use of these securities in investment vehicles.

The C Corporation election makes AMLP unlike most ETFs on the market today, and can potentially have a major impact on bottom line returns. As noted in the ETFs prospectus:

AMLP is taxed as a regular corporation for federal income tax purposes and as such is obligated to pay federal and applicable state and foreign corporate taxes on its taxable income.

That means that AMLP will accrue a deferred tax liability in the event that the underlying securities appreciate in value, and that the NAV of the fund will be reduced by such an accrual.

Because the Alerian MLP Infrastructure Index is computed without considering the tax ramifications of the ETF structure, tracking error is likely even if the replication of the benchmark is perfect. According to the prospectus:

The Funds after tax performance could differ significantly from the Index even if the pretax performance of the Fund and the performance of the Index are closely correlated.

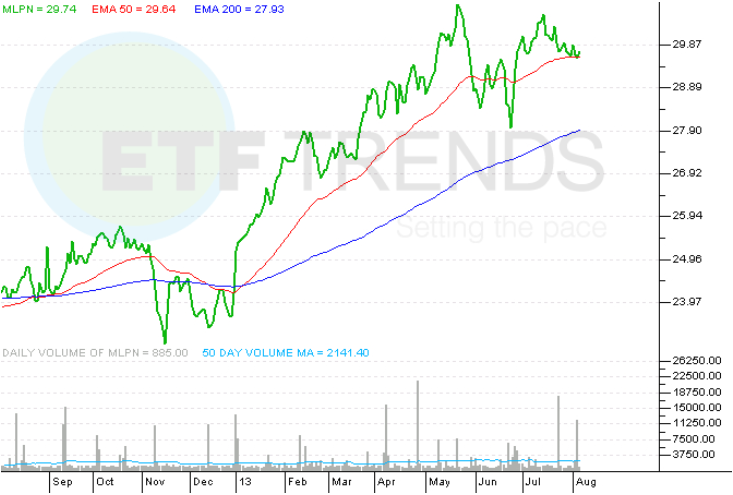

But the disconnect isnt only between the price of the ETF and the index it purports to track. Because exchange-traded notes are debt securities that deliver returns linked to the performance of an index, they arent forced to accrue a deferred tax liability as the underlying securities appreciate. That creates a scenario in which the returns delivered by an ETF and ETN linked to the same benchmark can deliver very different results to investors. Since its inception AMLP has lagged behind the UBS ETN that also offers exposure to the Alerian MLP Infrastructure ETN (NYSEARCA:MLPI ), with the performance gap attributable to the tax treatment of these securities:

(Click to enlarge)

More to the Story

Since inception, AMLP has underperformed MLPI by close to 450 basis points, a gap that is sure to raise some red flags among investors. But the picture above only tells a part of the story, and there are some other factors that should be considered before declaring the ETN structure the winner.

The first relates to distributions. ETNs are debt instruments, and they are taxed as such meaning that distributions are taxed as interest payments. Distributions from AMLP, on the other hand, are treated initially as return of capital and then as qualified dividends resulting in a considerably lower tax burden (and no tax burden at all on some distributions). Historically a significant portion of total returns delivered by MLPs has come from distributions, meaning that the advantageous tax treatment for ETFs relative to ETNs can be significant over the long run. The current post-expense ratio yield on the Alerian MLP Infrastructure index is close to 6%, meaning that the impact of a tax discrepancy on this source of return can be material. For investors focused on after-tax distribution yields, the ETF structure has a definite advantage.

The gap between AMLP and MLPI arose because as the securities appreciated in valuethe period in question coincided with a market rally the ETF accrued a deferred tax liability that the ETN did not. During bull markets, the C Corporation status will cause AMLPs NAV to increase at a slower rate than the NAV of MLPI. But there is another side to that coin as well. If the underlying securities (i.e. the MLPs that make up the Alerian MLP Infrastructure Index) depreciate in value, AMLP will accrue a deferred tax asset that MLPI wont.

So when the MLP market is flat, the ETF will generally outperform the ETN thanks to the preferable treatment of distributions. If the market is down, the ETF will again perform better than the ETNthanks to the combination of the deferred tax asset and the advantage in distributions. When MLPs are rallying, the ETN may deliver a better return thanks to the advantage related to the treatment of capital appreciation. This third scenario is the one that has played out since AMLP launched, accounting for the gap in return.

Its also worth noting that there appears to be some degree of risk surrounding the current tax treatment afforded to MLP ETNs. The IRS hasnt yet issued an opinion on the validity of MLP ETNs and the manner in which they avoid the accrual of a deferred tax liability.

Pros and Cons

Some investors have proposed that one structure is universally superior for achieving MLP exposure. In reality, however, there are pros and cons to both the ETF and ETN approach, and different vehicles will make more sense for different investors. For investors focusing on after-tax yield, the ETF structure will generally be more appealing because of the favorable treatment of dividends. Moreover, for those who believe that the majority of returns from an MLP investment will be generated by distributionsas opposed to capital appreciation the ETF will probably be a better choice. Finally, any investors concerned about credit risk should go with an ETF, which offers a fractional interest in the underlying securities. Because exchange-traded notes are debt instruments whose return is linked to an index, they exposure investors to the credit risk of the issuing institution.

But some investors may be better served by accessing MLPs through an ETN. Those concerned about tracking error will prefer the features of the ETN, as will tax deferred investors. And when a significant portion of the returns to generated come in the form of capital appreciation, the ETN will generally deliver better performance (as evidenced by the performance gap over the last month or so).

Finally, it should be noted that the structure selected can have an impact on the risk/return profile established. Due to the creation of deferred tax assets and liabilities, investors in the ETF essentially give up some upside potential in return for enhanced protection on the downside. By comparison, an ETN linked to the same MLP index will provide greater potential return on both the upside and the downside.

Disclosure: No positions

Disclaimer: ETF Database is not an investment advisor, and any content published by ETF Database does not constitute individual investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. All content on ETF Database is produced independently of any advertising relationships.