Minneapolis House Flippers Become Landlords

Post on: 15 Май, 2015 No Comment

Home Destination

If you or someone you know is ready to buy a home and would like to engage a local Twin Cities real estate agent, please fill out our Home Buyers Quote. and I will respond to your request on a priority basis. The best home buyer opportunities in the Twin Cities go quickly. Call 612-396-7832.

Minneapolis house flippers trend toward high-end homes — House Flipping Investors Flip Luxury Homes — profit is key.

Minneapolis house flippers are successfully flipping homes and building equity. Residential real estate investors know it takes more than just buying a Minneapolis home . fixing it up and putting it up for sale. With the right know-how, savvy house flippers in the Twin Cities are ready for Minneapolis real estate buyers who are seeking new home listings in the Twin Cities market.

House flippers seek to buy houses in disrepair, fix them up, and turn around and sell them again as quickly as possible with the intention of making a profit in newly gained home equity. Many have been wary that flipped houses look bright and new, but without the owners intention of homesteading them, underneath all the new carpet, and paint are lingering problems. RealtyTrac’s housing data suggests that today’s trends in flipping homes shows better stewardships of flipped home improvements. Flippers are taking a basic home and adding up-grade features to draw and please high-ended renters. House flipping requires deep pockets unless you plan to do much of the work yourself; and that means plenty of time put into the hard work.

House flipping done right can increase the value of a Minneapolis residential neighborhood since flippers fix up yards and both a home’s interior and exterior.

House Flippers That Buy, Rehab, Hold, & Rent

More house flippers are moving from the buy, rehab and sell idea to buy, fix, hold and rent. Once the investment home is bringing in rental income, the holder can begin to lock in profits. Many have already learned that carrying costs of house flipping can accumulate over time. Also recognized as the soft costs of house flipping, they can include monthly bills, monthly financing charges, property taxes, condo fees (if applicable), utilities and any other maintenance bills required to reach habitability and to keep the house in good financial standing.

Minneapolis Home Buyers Who Seek to Flip Houses

As rent and home prices climb and the number of available Real Estate Owned homes (REO) continue to drop there are fewer Twin Cities home buyers who are buying homes to flip. Families that lost their homes to foreclosure were forced into rental homes, making the Minneapolis rental market became more competitive. As Minneapolis house prices continue upward, the ready ability to snap up homes at a reasonable price is likely going to decrease. It may become harder to renovate to rent and require more ingenuity.

House Flippers Dip Activity by 13%

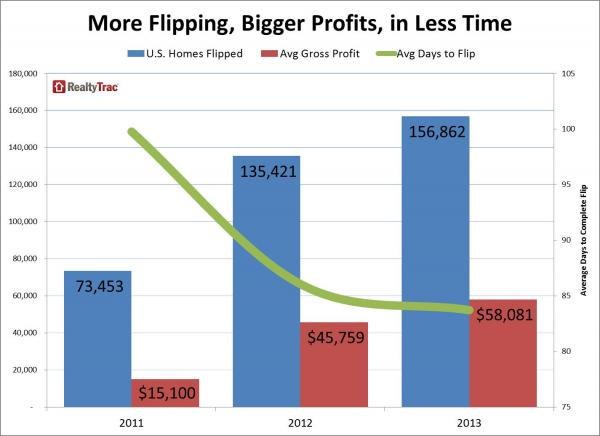

House flipping activity dipped 13% from the same period a year ago, with 32,993 single-family home flips recorded in the third quarter of 2013, RealtyTrac reported Thursday. Increasing home prices over the past 18 months combined with decreasing foreclosures have created a market less favorable to the high quantity of middle- to low-end bread-and-butter flips that we saw late last year and early this year, said Daren Blomquist, vice president of RealtyTrac. Real estate investors made an average gross profit of $54,927 on single-family home flips in the third quarter, up 12% compared to an average gross return of $48,893 last year.

The jump in gross profit can be attributed to an increase in house flippers opting to choose high-end flips. RealtyTrac says flippers are selling more home for $750,000 and upwards. A total of 968 high-end homes were flipped in the third quarter, up 34% from a year ago. The sharp rise in high-end flipping indicates there is still good money to be made for flippers willing and able to take on the additional risk of buying and rehabbing more expensive homes. With that higher risk also comes the potential for higher reward. The average gross profit on each high-end flip equals more than four times the average gross profit on each flipped home in the lower price ranges, stated Blomquist.

Words of Advice From Expert House Flippers

* Doug Clark, co-host of Spike TV’s Flip Men, believes that what makes his house flipping work well is creative thinking and doing things that other house flippers aren’t doing in the market. His success would indicate that his investment logic is making the needed difference for him between a buying exercise and house flipping profits .

* Sheldon Detrick, CEO of Prudential Detrick/Alliance Realty. Being a house flipper meant buy it, paint it, sell it. Now it’s turned into buy it, paint it, rent it, and hold it. House flippers are kind of a misnomer as they’ve turned into what I like to call ‘holders’.

* Before venturing into house flipping be sure have access to cash; it may be necessary to hold on to the house for a minimum of three months because of Federal Housing Administration (FHA) anti-flipping regulations. Houses sold within 30 days of being purchased formerly weren’t eligible for FHA mortgage insurance; those sold between 91 and 180 days are acceptable but require an additional, independent appraisal to make sure the sales price is justified, according to Bankrate.

* According to BiggerPockets.com, house flippers may encounter landlord and tenant issues. Being a landlord is legislated by state and can get sticky without experience. Typically in the geographic areas where real estate is the cheapest, there’s a greater potential for damages, eviction and chasing tenants for rent collection. To buy a house for investment purposes and rental income, you will need to managed it well to avoid tenant management issues. Rental homes have the potential to eat up lots of time, money, and can create high amounts of stress without training.

* Before you flip, find a mentor, stated Scott Yancy in a recent RealtyTrac Webinar. Don’t jump right in without getting advice first! Learn how to do title searches, lien searches, and monitor the housing auctions before you purchase. Ask your mentor how they make flipping purchases. Then you are more ready and should purchase something cheaper than you can afford to leave room for error.

* One other point to consider: As far as the IRS is concerned, buying and selling real estate as an investment strategy and doing it as a business are two very different things. If you buy a house, fix it up and resell it while you’re working another full-time job that provides the bulk of your income, that’s an investment and the proceeds will be taxed as short-term capital gains (if you own it for a year or less) or long-term capital gains (if you own it for more than a year). A short-term capital gain is taxed at the same rate as your ordinary income. A long-term capital gain currently is taxed at 15% of the gain. But if you’re doing it year-round and it pretty much pays all your bills, that’s a business and the IRS might consider you a dealer-trader, says Los Angeles-based CPA and tax attorney Bill Abrams. Then your gain will be taxed as ordinary income no matter how long you own it, the real estate taxes and interest will be regarded as an expense and you’ll have to pay self-employment tax of 15.3%.

House Flippers Target Luxury Homes in the Twin Cities

RealtyTrac summed up the experiences of many flippers after interviewing the CEO of an Oklahoma area real estate firm. Flips on luxury homes priced between $1 million and $2 million climbed 42% year-over-year, while home flipped in priced between $2 million and $5 million jumped 350% year-over-year.

Anti-Flipping Regulation Encourages Investors

In January 2013, the Federal Housing Administration (FHA) waived an anti-flipping regulation which had prevented the agency from insuring mortgages on properties sold within 90 days of acquisition. The waiver, first implemented in 2010 to bolster the flagging housing market is now extended through 2014. FHA hopes to to make it easier for investors to buy and quickly rehab properties as boost the real estate market recovery.

Strategy for Buying a Flipped House

If you are buying a flipped house, be sure the heating system has a good life expectancy left in it. The flipper may offer documentation of a furnace tune-up and inspection. insuring the heating system is safe. It is not being too suspicious to double check with your gas company. It is not that hard to put a heating safety check form on paper, while they are meaningless. Zillow offers a complete list of what to check for when buying a flipped home.

We put in them (houses we flip) granite countertops. Maybe the total cost was an extra thousand dollars in these tiny kitchens. But the difference was this, I had something in my house that no other house in that market or price range had. I got the offer before anyone else did. A little attention to detail, and a few little points that is important to somebody. That is all we changed. I put into them pennies on the dollar; My houses sell fast.

The Minneapolis real estate market is showings strong and sustained housing improvements, encouraging many to buy investment homes. We welcome the opportunity to be your guide. Call 612-396-7832 and we’ll help you enjoy the benefits of our market improvements first-hand.

Additional Reading Resources

Download RealtyTracs Report on House Flippers and House Flipping Activity Levels

Download the IRS rules that apply when buying, selling and flipping a house.