Michigan Property Taxes A Primer

Post on: 7 Апрель, 2015 No Comment

Michigan Property Taxes: A Primer

While showing homes to clients the most prevalent questions have to do with property taxes. Very often my clients will comment that one neighborhood has higher taxes than another or that the taxes in one community is higher than another. Unfortunately its not that simple. Very often the tax rate in one neighborhood versus another in that same municipality are the same. Also I have found that the community that my client claims to have the higher taxes is actually the one that has the lower tax rate. Its for this reason that I have chosen to present this topic.

The Math Portion of the Test

Everyones property tax bill in the state of Michigan is based on two things-the local millage rate and the propertys value. A mill is roughly defined as $1.00 per thousand dollars of the propertys taxable value. Therefore, if the millage rate for a particular community is 40 and the propertys taxable value is $100,000.00 then the tax bill for the entire year will be $4,000.00:

Millage Rate (40) x Taxable Value ($100,000.00/1,000) = Yearly Tax Bill ($4,000.00)

Therefore, in general terms, if there are two properties in the same community with the same value then the tax bills should be the same.

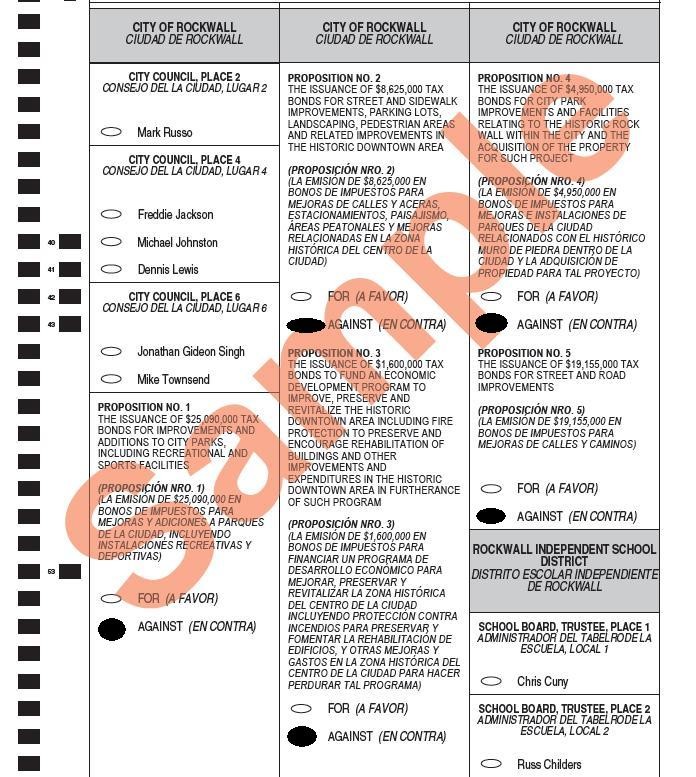

How does the assessor come up with the millage rate? The voters in your area decide the millage rate, but your area is not simply your city or township, it also includes your county and school district. People who live in the same city but a different school district will have a different millage rate. In Livonia, there are 2 different school districts, Livonia Public Schools (LPS) and Clarenceville Schools and so those that live in LPS will have a different millage rate than those who live in the Clarenceville Schools area. The same is true for those unique municipalities located in two different counties like Northville. Those people who live in the Oakland county portion of Northville will have a different millage rate than those in the Wayne county portion. Each of those three entities (municipality, county, school district) get their cut from each tax bill based on their portion of the millage rate.

Principal Residence Exemption (PRE)

Another factor in determining a particular propertys millage rate is whether it is owner occupied. If it is, then the owner has the option of claiming that property as his principal residence provided he is not claiming that on another property. A Principal Residence Exemption (or Homestead Exemption) carries with it a large discount for property taxes. It is usually around a 17 or 18 mill difference which is quite substantial considering that the exempted millage rate in many communities is in the 30s!

Whats in a Value?

The other part of the property tax equation is the value. This is where things really get complicated. There are actually three different values that come into play when determining the value for taxation purposes. The first one is the True Cash Value (TCV). Quite simply that is the market value for the property. The 2nd value is the State Equalized Value (SEV) which is merely half of the above TCV. In general terms, property taxes in the state of Michigan are based on the propertys SEV. The last value though is really the one that your homes taxes are based on and the number that can be inserted in the above property taxes equation. That value is called the Taxable Value. I have not seen it referred to by its initials and so Im not going to attempt to start a trend! Anyway, it is necessary to have this separate value because in the state of Michigan, provided the homeowner continues to live in the same residence, his taxable value is capped at an annual increase of no more than 5%. In times when property values have increased greater than 5% a year (see the first 6 years of 2000s) then the taxable value and thus the property tax bill will only gone up 5% each year. Conversely, when a property is sold the taxes are un-capped and revert to that years SEV. Therefore, in times of appreciating property values, new homeowners were stuck with a higher tax bill than what the previous owner had. This is affectionately called a Pop-up Tax.Nowadays property values are decreasing which means SEVs are decreasing and we very seldom have any issues with the Pop-up Tax. In some instances, purchasers of homes owned by homeowners who lived in their home a long time and who had seen drastic increases in value may still see this Pop-up Tax but are very few and far between and the Pop-up is much less.

Administration

Your local municipality is responsible for assessing properties and collecting taxes. These municipalities assess every home in the community once a year and send out notices of assessment in February or March. It is at this time homeowners are given a small window of time to challenge their assessment if they believe it to be inaccurate. Also, the state mandates that the deadline for filing a Principal Residence Exemption is May 1st of each year. This is a hard deadline and if a purchaser were to buy an un-exempted home that closed just after that date, she would be required to pay taxes for that entire year at the un-exempted rate. But, if she made sure that she filed her principal residence exemption by the following May 1st then she would enjoy the lower exempted rate the following year.

Yes I know what youre saying, why the heck is this stuff so complicated. Simply put: I dont know. It was supposed to decrease our property taxes and I suppose it has but at what cost? Anyway, this is the type of stuff that experienced real estate agents know and is one of the many reasons why any prospective purchaser should be sure to consult an agent when buying a home and make sure that agent knows his stuff!

Want to know your millage rate? Click here !

Want the whole story about property taxes in Michigan straight from the legislatures mouth? Click here !