Metric Price to Book

Post on: 16 Март, 2015 No Comment

The Price to Book Ratio (alternately Price to Book, Price to Book Value, Price/Book, P/B, or P to B) is a financial metric used to compare a company’s book value to the share price at which it is currently trading. It is generally calculated by dividing the share price by the book value per share. though it can also be calculated by dividing the company’s market capitalization by the total book value listed on the balance sheet.

The Price to Book Ratio varies dramatically between industries. A company that requires more assets (e.g. a manufacturing company with factory space and machinery) will generally post a drastically lower price to book than a company whose earnings come from the provision of a service (e.g. a consulting firm).

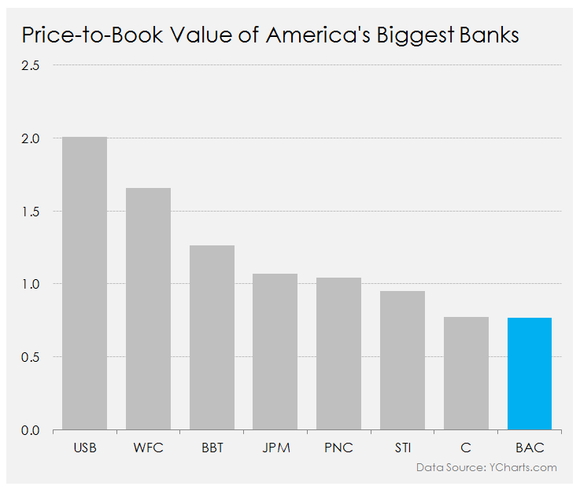

Price to Book is often used to gauge a stock’s relative value. A company trading at a low price to book, particularly when compared to other companies in its industry, is thought to be undervalued relative to its share price. However, a low price to book could also be an indication of negative forward looking investor confidence (e.g. poor earnings projections) or a disproportionate amount of Intangible assets on the books, depending on which version of the calculation is used (see below section on tangible vs intangible). As such, when used for security analysis, price to book is often coupled with metrics such as P/E. PEG. Return on Equity. and the Current Ratio to get a better snapshot of the company as a whole.

Tangible vs. Intangible Assets

Generally speaking, P/B is a measure of the share price relative to the value of the company’s total assets minus liabilities, per share. However, in some calculations intangible assets and goodwill are removed from the equation as their value is significantly more subjective and often has no resale value. In this case, the ratio may be reffered to as Price to Tangible Book Value.

Examples

- Company XYZ is trading at $10 per share, with a book value per share of $5.50. The company is said to have a price to book of 1.82 (10 ÷ 5.50).

- Company ABC has a market capitalization of $100 million and lists total book value of $69 million, for a price to book of 1.45 (100 ÷ 69).

- Company LMN has a market capitalization of $1 billion and lists total book value at $500 million, but $225 million of that is in goodwill and intangible assets. While the price to book value may be listed as 2.00 (1 billion / 500 million), the price to tangible book value is 3.64 (1 billion / (500 — 225 million) ).