Methods for Measuring Intangible Assets

Post on: 8 Июнь, 2015 No Comment

The research into measuring the Intangible Assets or the Intellectual Capital of companies has produced a plethora of proposed methods and theories over the last few years. In this latest update of the Paper I provide a brief overview of approaches that I have come across with links to more information. The list is an ever-expanding community effort, so if you are aware of a method that I have missed, please notify me!

Measure for Value Creation — not for Control or PR!

Rarely is the question asked, why measure intangibles. The answer is not self-evident. Intangibles are difficult and expensive to measure and the results are so uncertain, so the reason had better be a good one.

The Fundamental dilemma

The main problem with measurement systems is that it is not possible to measure social phenomena with anything close to scientific accuracy . All measurement systems, including traditional accounting, have to rely on proxies, such as dollars, euros, and indicators that are far removed from the actual event or action that caused the phenomenon. This creates a basic inconsistency between managers’ expectations, the promises made by the method developers and what the systems can actually achieve and makes all these systems very fragile and open to manipulation. Therefore, the first question for any one embarking on a measurement initiative must be: What is the purpose of our measuring initiative?

Management Control purpose – Don’t!

The most common reason for measuring and reporting is to improve internal performance, i.e. management control . It is so common that the purpose is generally not even stated explicitly. The idea is founded on one of the most quoted management slogans; “you can only manage what you measure”. It is a simple slogan and unfortunately completely erroneous.

The trouble is that people don’t like being measured upon. I don’t. Do you? Or are the measuring systems only for measuring the others? We find all kinds of ways to evade and obstruct the systems. Then add an individual reward system tied to the measurement system and we have an explosive concoction. The temptations to manipulate the system become overwhelming! And, who controls the controller? Consider Shell Oil’s management control failure:

Oil and gas reserves are very important of an oil company like Shell. The trouble is that Shell in the late 1990’s made oil reserves a target with a reward tied to it for the managers if they succeeded in increasing them. Guess what, the Shell oil reserves displayed a healthy development since 1998. Everything seemed to go well, until the end of 2003. I n January 2004 a deeply embarrassed Shell board had to confess that they had overstated the reserves by 4 ,4 billon oil equivalents, or 23% of the total reserves and the abuse had been going on for at least five years. The managers were fired of course, but the problem is in the system.

Oil and gas reserves cannot be measured exactly since estimation of reserves involves subjective judgment. If this can happen with physical resources, what do you suspect can happen with valuing intangible assets? Is your company immune? If this could happen in Shell, what do you imagine might going on in your own company? The traditional accounting system that is heavily regulated by governing bodies and audit and with heavy penalties imposed on offenders suffers from regular manipulation. Imagine the abuse an intangibles measurement system is open to; there is no standard, no audit and it is voluntary only.

PR purpose – Watch out!

W hy are the oil and gas companies pioneers in reporting their environmental impact? Why is there a surge in triple-bottom line reporting? The majority of the companies that have been the pioneers in reporting intangibles externally, have done so for one major reason; PR. The PR reason seems to hold true for most of the stakeholder reporting, triple-bottom line reporting and also the IC scorecards pioneered by companies such as Skandia and Celemi.

We need not suspect more sinister ‘Enron’ motives, just because the purpose is PR, but we, as readers, must be prepared to ask the why. when we judge the validity of the numbers reported.

It seems that Skandia’s share price, for a while at least, benefited from the company being one of the pioneers in IC reporting according to presentations made by Skandia managers during the boom years in 1999 — 2000. However, t hose who bought Skandia shares based on their IC supplements back then were looking at losses amounting to 90% in 2002! So unless shareholders are prepared to ask the why, the costs for intangibles reporting may come out of the their own pockets in the end.

Learning Motive – Why so few ?

So entrenched are the traditional measuring paradigms that executives and researchers have not even started to explore the most interesting reason for measuring intangibles; the learning motive . Measuring can be used to uncover costs or to explore value creation opportunities otherwise hidden in the traditional accounts. What is the trend of cost of staff turnover? What is the value of the learning that takes place when staff interact with customers? What is the value creation opportunity lost in having inadequate processes?

The learning motive promises the highest long-term benefits. First; the learning motive offers the best way around the manipulation issue. If the purpose is learning, not control or reward, the employees and managers can relax. Second, a learning purpose allows more creativity in the design of metrics, a more process-oriented bottom-up approach and less of top-down commands.

But where does the fine line go? When is a system control and when is it learning? When does learning become control? Admittedly, this is not easy, but here are a few pointers. First; the process of developing the metrics is different. The metrics are produced bottom-up, with heavy involvement from all relevant groups. No trumpets from the accountants’ ivory tower! Secondly, the indicators are used by the same people who produce them and they use them to improve their own processes, not somebody else’s. Third, the indicators are reported openly to everyone. Fourth; when the indicators suggest a difference between say, a high-performing and a low-performing unit, the units in question are required to meet and the difference becomes the starting point of a dialogue to discover hidden value; are we measuring the same thing? What is it that we can do better? Fifth; the indicators are never the basis of a reward system. If rewards are to be distributed at all they should be group-based and allocated to those, who make the highest value improvement, i.e. possibly the previous low-performing unit!

The Four Approaches for Measuring Intangibles

T he suggested measuring approaches for intangibles fall into at least four categories of measurement approaches. The categories are an extension of the classifications suggested by Luthy (1998) and Williams (2000).

· Direct Intellectual Capital methods (DIC). Estimate the $-value of intangible assets by identifying its various components. Once these components are identified, they can be directly evaluated, either individually or as an aggregated coefficient.

· Market Capitalization Methods (MCM). Calculate the difference between a company’s market capitalization and its stockholders’ equity as the value of its intellectual capital or intangible assets.

· Return on Assets methods (ROA). Average pre-tax earnings of a company for a period of time are divided by the average tangible assets of the company. The result is a company ROA that is then compared with its industry average. The difference is multiplied by the company’s average tangible assets to calculate an average annual earning from the Intangibles. Dividing the above-average earnings by the company’s average cost of capital or an interest rate, one can derive an estimate of the value of its intangible assets or intellectual capital.

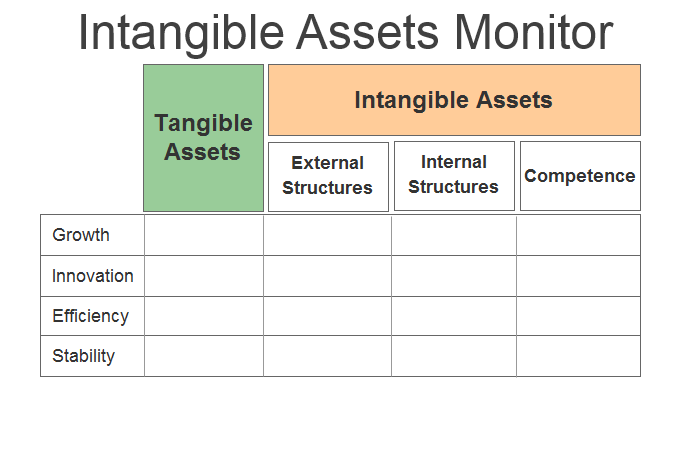

· Scorecard Methods (SC). The various components of intangible assets or intellectual capital are identified and indicators and indices are generated and reported in scorecards or as graphs. SC methods are similar to DIS methods, expect that no estimate is made of the $-value of the Intangible assets. A composite index may or may not be produced.

The methods offer different advantages. The methods offering $-valuations, such as ROA and MCM methods are useful in merger & acquisition situations and for stock market valuations. They can also be used for comparisons between companies within the same industry and they are good for illustrating the financial value of Intangible assets, a feature, which tends to get the attention of the CEOs. Finally, because they build on long established accounting rules they are easily communicated in the accounting profession. Their disadvantages are that by translating everything into money terms they can be superficial. The ROA methods are very sensitive to interest rate and discounting rate assumptions and the methods that measure only on the organisation level are of limited use for management purposes below board level. Several of them are of no use for non-profit organisations, internal departments and public sector organisations; this is particularly true of the MCM methods.

The advantages of the DIS and SC methods are that they can create a more comprehensive picture of an organisation’s health than financial metrics and that they can be easily applied at any level of an organisation. They measure closer to an event and reporting can therefore be faster and more accurate than pure financial measures. Since they do not need to measure in financial terms they are very useful for non-profit organisations, internal departments and public sector organisations and for environmental and social purposes. Their disadvantages are that the indicators are contextual and have to be customised for each organisation and each purpose, which makes comparisons very difficult. The methods are also new and not easily accepted by societies and managers who are used to see everything from a pure financial perspective. The comprehensive approaches can generate oceans of data, which are hard to analyse and to communicate.

The intangibles measuring approaches best suited for the measuring motives are:

1.Monitor Performance (Control). Best are Baldrige award-type of performance indicators and KPIs.

2.Acquire /Sell Business (Valuation). Best are Industry rules-of-thumb ($ per click, $ per client, brand valuation).

3.Report to Stakeholders (Justification, PR). Best are IC supplements, EVA, Triple-bottom line.

4.Guide Investment (Decision). No ne of the intangibles approaches can beat traditional Discounted Cash Flow.

5.Uncover Hidden Value (Learning). Best are s core cards and Direct IC methods.

N o one method can fulfil all purposes; One must select method depending on purpose, situation and audience.