Merger Arbitrage Trading Strategy Explained

Post on: 16 Март, 2015 No Comment

What Is Merger Arbitrage?

Mergers and acquisitionsotherwise known as M&Aoccur when a company purchases another company. Often times, companies make acquisitions in order to grow their revenue or diversify into different businesses. Most acquisitions also take advantage of synergies between the buyer and seller’s businesses, such as economies of scale dynamics that can immediately improve profitability.

Merger arbitrage strategies are designed to profit from these M&A transactions and they come in various forms:

- Pure Merger Arbitrage – Traders buy the target and short the acquirer in order to profit from the difference between the acquisition price (in either cash or stock) and the market price assigned to the target.

- Speculative Merger Arbitrage – Traders buy potential targets in order to profit from an upcoming merger announcement without knowing for certain that such an announcement will ever materialize.

In general, large institutional traders use pure merger arbitrage as a way to generate relatively risk-free profits, while smaller traders use speculative merger arbitrage as a way to identify relatively low-risk, high-reward opportunities. Pure merger arbitrage may require significant leverage to be truly profitable, while speculative merger arbitrage often makes use of leverage for diversification.

Why Use Merger Arbitrage?

Merger arbitrage strategies have a number of unique benefits compared to traditional trading strategies. In particular, traders can use the strategy in nearly any market condition. which makes it a nice alternative to have on-hand. The strategy’s unique risk-reward profile may also make it compelling to many different types of traders looking to balance out their portfolio risk levels.

The core benefits of merger arbitrage include:

- Low-Risk. Pure merger arbitrage involves relatively low risk since an acquisition has already been consummated, although the potential profit is limited to the difference between the market and acquisition price.

- High-Reward. Speculative merger arbitrage involves significant potential upside if an M&A announcement is made, although there’s no guarantee that such an announcement will ever be made.

- Market Neutral. Merger arbitrage strategies are market neutral since they involve a long and short position, which means that a trader’s exposure to the overall market is relatively limited compared to other strategies.

Mechanics of Merger Arbitrage

The mechanics of merger arbitrage strategies depend on the type of strategy being implemented. In general, merger arbitrage involves betting on the price differences between the buyer and target stocks, which means that the position will involve the purchase of the target and the short selling of the buyer to maintain a market neutral position that eliminates larger industry or macro risks.

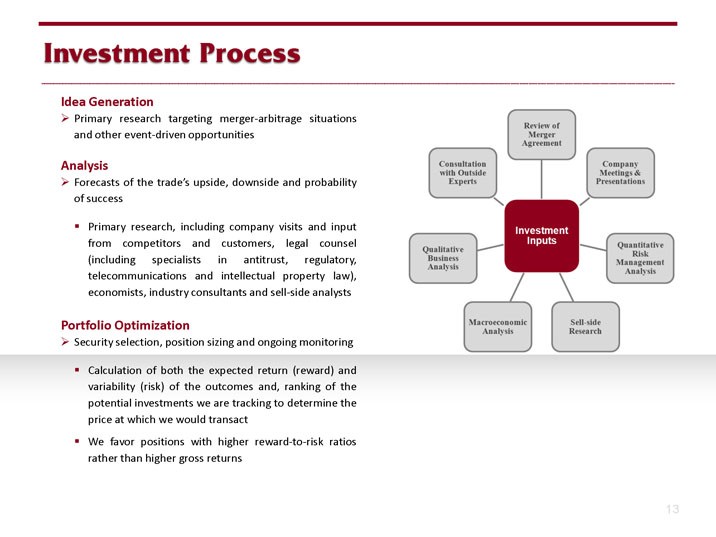

Pure merger arbitrage strategies:

- Identify existing M&A opportunities with a focus on large percentage spreads between the proposed purchase price and the target stock price.

- Analyze potential reasons for the spread between the two, including the possibility that the merger will fall through and be unsuccessful.

- Purchase stock in the target company and short stock in the acquirer in order to profit from the gap in a market neutral way.

- Monitor the trade over time for any changes that could impact the odds of success and adjust the trade accordingly.

Speculative merger arbitrage strategies:

- Identify potential M&A targets by looking for stocks trading below book value, having unused leverage, or operating within consolidating industries.

- Analyze similar transactions in the industry to determine a likely buyout multiple and use that to calculate a target price for the stock.

- Purchase the stock or use stock options to buy a levered position and optionally short-sell larger potential acquirers in the industry.

- Monitor the trade over time for any changes that could impact the odds of success and adjust the trade accordingly.

20Shot%202014-09-25%20at%2011.39.14%20AM.jpg /% COV Stock Chart After Buyout (Source: StockCharts.com)

Risk Factors to Consider

Merger arbitrage strategies are designed to mitigate many types of risks, but there are still many important considerations for traders. Most traders should consider using merger arbitrage as only one of a set of strategies in their arsenal instead of using it exclusively, although many institutional investors still use pure merger arbitrage strategies to capture small low-risk movements.

Some important risks to consider include:

- Event Risk. The largest risk for pure merger arbitrage is the merger falling through and becoming unsuccessful, which can result in rapid steep losses.

- Inverse Risk. Merger arbitrage removes macro risk factors, but some dynamics could lead to a buyer’s stock appreciating and hurting a short.

- Liquidity Risk. Mergers tend to reduce trading in a stock once the price rises, which means that it could be difficult to enter or exit a position .

The Bottom Line

Merger arbitrage strategies are an excellent addition to any trader’s arsenal, given their market neutral approach applicable in any conditions. Before placing any trades, traders should be aware of the many nuances and risks associated with the strategy, including event, inverse, and liquidity risk.

If you’ve enjoyed this article, sign up for the free TraderHQ newsletter ; we’ll send you similar content weekly.