Merger and Acquisition Blog

Post on: 17 Июль, 2015 No Comment

Sun Acquisitions Facilitates Sale of Trade Show Firm

February 27, 2014

FOR IMMEDIATE RELEASE

Attention: Sun Acquisitions facilitates sale of Trade Show Services Firm

Contact: Domenic Rinaldi, Managing Director

Address: 8735 W. Higgins Road, Suite 160, Chicago, IL 60631

Phone: 773-243-1603

Email: drinaldi@sunacquisitions.com

URL: www.sunacquisitions.com

Chicago, IL

sunacquisitions.com/), announces the completed the sale of a multi-media trade show services provider. The company provides video and photography services to trade show organizers and attendees.

The company possessed attributes that are very attractive to individual and strategic buyers: B2B sales, no customer concentration, multi-year customer contracts, and a fifty plus year reputation for excellent service. There were over 100 inquiries on the business, 50 showings and multiple offers. The deal package included bank financing.

Domenic Rinaldi, Managing Director of Sun Acquisitions and the lead on this transaction stated “We knew we were representing a unique business. Our proprietary marketing model can generate buyer interest from the entire USA, and in this case, internationally. Strong buyer interest leads to a seller getting top dollar for their business.”

Buyers also were attracted by the business’ infrastructure, trained staff, and excellent brand name in the industry. The company has kept current with technology and expanded their offerings without sacrificing margins or taking on significant debt.

About Domenic Rinaldi

Domenic Rinaldi is the President and Managing Director of Sun Acquisitions. He was awarded the professional designation of Certified Business Intermediary from the International Business Brokers Association and is considered an expert in the field of business brokerage. He is a seasoned executive who brings over 24 years of proven experience in merger/acquisition, sales, service, marketing and operations to the business brokerage arena.

About Sun Acquisitions

sunacquisitions.com/

###

Selling Your Business: Beware of Competitors

Selling your business can be the most significant opportunity and challenge you face as a business owner. Many sellers struggle to find the right buyer—and to determine whether an interested party is a qualified lead or a poor investment of time.

Many business owners plan to sell their business alone. They may have received interest from a competitor or other buyer and decide to pursue the opportunity at hand. What they may not realize is that negotiating with one party—especially when that party is a competitor—is not always in the seller’s best interest.

Negotiating with a Competitor

Before we discuss the drawbacks of selling your business to a competitor, it’s important to understand the distinction between a direct competitor and a strategic acquirer. A direct competitor produces a product or service that is virtually identical to yours and competes for the same customers in your target market. A strategic acquirer, on the other hand, may operate in the same market or even call on the same customers, but their products or services are not the same as yours. Other times, a strategic acquirer may offer an identical product but does not operate in the same market space.

Direct competitors have a working knowledge of your industry and a transferable understanding of your products or services and your customers. They know your business and understand the market you serve, what it takes to run smoothly, and which investments of resources and capital to make. They also have their infrastructure, workforce, and operations in place. For this reason, they tend to pay significantly less for the acquisition of your business.

Time and again I have seen buyers pay a premium to knowledge they don’t currently possess. If they don’t require your business knowledge, your business has less value to them. Strategic acquirers, on the other hand, will likely require that knowledge to operate the acquired business successfully. They may also be using this strategic acquisition to augment their existing business, enter into a new market, discover process improvements, and of course, gain clients. Similarly, financial buyers or buyers with no previous experience within your market or industry will absolutely require your knowledge, client list, vendor list, and processes to continue a successful operation. In either case, the buyer has a greater need than your direct competitor and will consider the sale at a higher value. And while a higher value is important, also consider that these buyers pose little to no risk of potential damage to your company should the deal fall through.

Risk Exposure

In addition to short-changing the value of your business, you also open your business to significant risk by selecting a buyer that is a direct competitor. As the deal progresses and you enter further into the due diligence process, your competitor will have access to more and more proprietary information about your business, clients, and operations. And if the deal falls through, that competitor not only has the knowledge that you are for sale but also has unique insights to your business.

While there may have been a confidentiality agreement in place, you are still at risk of a breach or the competitor acting with bad intentions. Consider that a leak of information might be heard by your employees, vendors, and other competitors. Through the due diligence process, you may have disclosed critical information about pricing methodology, client lists, contracts and vendors, management processes, Customer Relationship Management (CRM) systems, marketing strategy, and more. Whether or not you had an operations plan in place before selling your business (and it’s highly recommended that you do), the buyer will likely have figured out these important details.

Negotiating with a Single Buyer or an Employee

There is one key problem when negotiating with a single buyer and that’s the obvious lack of options. While it’s good to have an interested party and worthwhile to pursue it, it’s impossible to know you are getting the best deal when there is only one option on the table.

In some cases, an employee may offer interest in purchasing the company. The challenges with considering an employee buyer are similar to those that arise with a direct competitor. If the deal falls through, the employee may leak proprietary information about the business or announce to others that the business is for sale. They may also become upset with the failed deal and begin exploring other career options. But perhaps even more importantly, the employee may not have the capital to offer the best price, causing you to compromise the value of your business.

Maximizing Your Opportunity

As you consider a buyer for your business, you have to maximize the value that you have worked so hard to create. In most cases, a business with a good reputation and solid financials does not need to sell to a competitor or negotiate with a single buyer. There are almost always other opportunities that an owner may overlook and other potential buyers or private equity firms that may be interested. In order to maximize and understand the true value of your business, you should go to the open market.

A well positioned intermediary or broker who has a deep understanding of the marketplace, business valuations, and deal structures should be able to guide you in the right direction. These professionals can help you navigate all of the opportunities and challenges you face as a business owner and seller and ensure you get the best deal and the best selling price.

Securing Bank Lending A Seller’s Perspective

In last month’s issue of Smart Business, I wrote an article entitled “Securing Bank Lending – A Buyer’s Perspective,” in which I discussed improvements in the business acquisition market. I also laid out important criteria for buyers seeking bank loans to help them make the most of every purchasing opportunity.

As transaction volumes continue to grow, banks continue to seek out quality business transactions to underwrite, creating opportunities for buyers and sellers alike. In this issue, I’ll be reviewing the advantages of securing bank lending from the seller’s perspective as well as providing tips for getting the most out of the sale of your business.

Before the Sale

Our firm has had the opportunity to broker many deals with the help of Steve Lasiewicz, Vice President of SBA Lending at US Bank, and local loan broker, Doug Adams of Emerson Capital. They are experts at structuring finance packages with terms that will ensure a successful outcome for both buyers and sellers. I recently spoke with each of them and asked them to share their best practices for securing acquisition loans.

With a proactive approach to understanding sell-side engagements, banks and lenders are key partners in helping our clients understand how best to qualify for lending. And because lending can be equally important for sellers as it is for buyers, this article provides important insights into the ways that sellers can prepare their businesses for sale to ensure that bank financing is possible.

First, it’s important to limit the amount of personal expenses run through the business. While this may help ease your tax burden, it can cause your company to return a lower value.

Ensuring that your tax returns and interim statements accurately reflect the net profit and cash flows of your business is critical in order to maximize the price of your business, but also to align your company with lender requirements. By keeping all of your records detailed and complete and taking care of all accounting and legal housecleaning, you present a more organized picture to potential lenders and buyers.

Balance Sheet & Inventory

In addition to managing expenses and financial records, you should take the time to clean up your balance sheet. Many owners put all of their energy into managing the profit and loss statements and ignore the significance of the balance sheet and inventory. A properly prepared balance sheet allows the bank and a potential buyer to see the true health of a business, the working capital required and the amount of leverage. A company that has little to no significant debt on their recent statements will be significantly more attractive to lenders and buyers.

Consider your inventory as well; it should exist at a level that supports the sales volume of the business. Inventory can be a cumbersome part of a business, especially if there is not an inventory management or control system in place. If this is the case, it is important to clean up the inventory prior to presenting the business to a bank so they can understand the levels truly necessary for operation.

Contracts & Agreements

The legal due diligence of a business is typically one of the last things to occur in a transaction and is perhaps one of the most problematic. Many factors will affect this process, such as liens on the business, client and vendor contracts transferrable without written consent, regulatory issues to be considered, or litigation. These are just a few examples of things that require upfront analysis, and it’s important that the bank and potential buyers can understand the complexities and likelihood of a business transfer. Also, spending some time to clean up any legal issues can have a big impact on the value and creditworthiness of your business.

Goodwill & Managing Expectations

In our service-based economy, more businesses than ever have a high percentage of their value in the form of goodwill. This means that lenders will not have hard assets available to collateralize a loan and thus need to be convinced that the business is on solid footing.

In addition to the bank being comfortable with the health of the business, many lenders will look for the current owners to have “skin in the game” in the form of a secondary seller note. In this case, the seller would be asked to carry 10 to 15 percent of the purchase price in a secondary secured note that may even be subject to standby provisions. An example of a standby provision might be that the sellers will not be eligible to receive any payments for one to three years. The banks typically add this type of provision to ensure that the seller is motivated to help the buyer easily transition into the business and help ensure the success of the new owner.

When it comes time to sell, it is prudent to consider a third party, independent valuation or value opinion from a business broker to help you determine an asking price. Many sellers have expectations that are either too low or too high, while a neutral professional understands the marketplace and can most accurately measure your company’s value. To ensure you are getting an accurate value opinion on your business make sure that the third party valuation company is accredited by one of the major valuation bodies, and if the opinion is coming from a business broker, make sure that either he or the managing broker of the office is a Certified Business Intermediary (CBI).

Many owners make the mistake of waiting too long to sell. You should be prepared to sell when the business is doing well—when it’s financially sound and ideally in an upward trend. Any downturn in revenues or cash flows could prevent you from obtaining bank financing, not to mention making it more difficult to find a buyer. This is one of the most difficult things for an owner to time. We strongly recommend that the seller develops a target selling price, and once the value of the business reaches that point, consider the time to list very carefully.

Benefits of Lending for Sellers

There are many positive effects of knowing that your business qualifies for bank lending. The first and most obvious is that the owner will get to walk away at the closing table with the lion’s share of the purchase price. If your business is not bank financeable, then you need to be prepared to either run the business until it is, or provide seller financing and walk away with much less money. The second major benefit is that buyers covet those businesses that are pre-qualified for bank financing. It is a sort of market endorsement of that business, and it also provides the buyer the ability to acquire a much larger business by being able to leverage their capital. Lastly, bank pre-qualified deals tend to increase the buyer pool, which gives the seller more leverage in the negotiating process and typically ensures the best price and terms.

Securing Bank Lending A Buyer’s Perspective

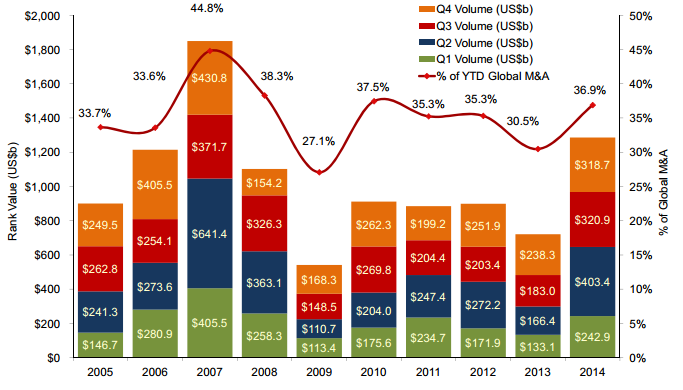

The business acquisition market has been steadily improving since the middle of 2011, with transaction volumes continuing to grow. This resurgence is being driven by a combination of factors that includes significant buyer demand, a growing number of businesses recovering from the recession and posting solid financial performance, and banks’ willingness to provide acquisition capital.

In fact, some banks are actively seeking quality business transactions to underwrite, creating a unique opportunity for both buyers and sellers. If both parties can demonstrate that they are worthy of the leverage and liquidity that a bank can bring to a deal, there are significant benefits to securing lending.

This article is the first of a two-part series and will focus on what a buyer should expect in order to secure bank financing for an acquisition. In the next article, we will discuss how sellers can best prepare their businesses so that bank financing is possible.

Criteria for Buyers Seeking Bank Loans

Steve Lasiewicz, Vice President of SBA Lending at US Bank, and local loan broker, Doug Adams of Emerson Capital, are experts at structuring finance packages with terms that will ensure a successful outcome for both buyers and sellers. They take a proactive approach to understanding our firm’s portfolio of sell-side engagements and are also key partners in helping our clients understand how best to qualify for lending.

There are five key criteria that they cite for buyers to consider when applying for a business acquisition loan: industry experience, cash equity, salary, personal guaranty, and credit history. By understanding the lender’s perspective, buyers can improve their chances of securing financing.

The first—and perhaps most important—criteria is whether or not the buyer has direct or related experience in the same industry as the company being purchased. When the buyer or other principals have relevant experience, the bank will expect that they know how to manage the business and its financial challenges. In this case, experience may be your biggest asset in securing a loan.

If you do not have industry experience, you should promote other transferable experiences that qualify you. This might include your previous work as a manager, owner, or in a related industry. You may also consider engaging others to participate in the business that have the industry experience you lack.

Lenders will also consider the buyer’s cash equity in the business they are purchasing. Investing in your own business will show your confidence in the venture and increase your chances of being approved for a loan. Buyers should be prepared and able to inject a minimum of 15% to 25% of the acquisition price in equity from their own funds—this amount cannot be borrowed.

In addition, the buyer must have at least three months of working capital on reserve. Depending on the cash flow of the business, the banks can’t inject the company with working capital unless the buyer can prove that his cash reserves are sufficient.

It is important that buyers account for their personal financial needs when purchasing a business. A buyer must factor in a salary that covers his or her living expenses as an adjustment to the cash flow of the business. The remaining cash flow must support the amount of bank debt.

Personal Guaranty and Collateral

Buyers should expect to provide a personal guaranty, which is a promise to repay the company debts in the event of default by the business and hard asset collateral. Just as investing cash equity in the business illustrates the buyer’s financial commitment, so does the guaranty and collateral.

The loan does not need to fully collateralized but the bank will need to get comfortable that the combination of personal guaranty and the collateral pledged are representative of deals in that size range and complexity.

With all types of loans, credit history plays a large role in the ability to qualify. A buyer must have a good credit score and a solid credit history to obtain financing to purchase a business. Credit history illustrates the buyer’s ability to pay debts and provides another data point to increase the bank’s confidence in the venture.

Benefits of Lending for Buyers

Access to bank lending can give buyers significant leverage in a business acquisition deal. With the bank’s financing, buyers can often purchase a larger business with more cash flows than what they would otherwise be able to afford, improving their chance at long-term success. Plus, they gain access to working capital lines to support their ongoing operations.

Low interest rates and amortizations of 10 or more years also mean lower payments. For a typical acquisition loan that is backed by the Small Business Administration (SBA), a borrower can secure a loan for up to $5 million at prime plus two points amortized over 10 years, and the amortization can be extended beyond 10 years if there is a transfer of real property with the business assets. A loan with this structure might require as little as a 25 percent equity infusion from the borrower.

Beyond the financial benefits of securing lending, a bank’s endorsement lends credibility to the business. When a bank is willing to lend, it means the business’s fundamentals are solid. This third party endorsement will be an asset as the new owner builds his or her business.

With so many benefits to securing financing, it should be a consideration for every potential business buyer. Improvements in the marketplace have created a growing number of opportunities for lending, and with the right fundamentals in your business plan, you could start your new venture on the right track.

Are you Emotionally and Financially Ready to Sell?

How to evaluate if you are really ready to turn over the reins

Walking away from your lifes work is a big step that doesnt come without its obstacles.

Determining your readiness to sell your business sans any pressing circumstances to do so largely comes down to two factors: 1) your financial readiness to sell a company, and 2) your emotional readiness to sell a company.

Assessing Your Financial Readiness to Sell a Company

Your financial situation, the easier of the two factors to consider, is oftentimes the one most overlooked by sellers.

The key question is whether the proceeds you will receive from selling your business will give you the financial means to leave the business.

For most business owners, the value of their business is a large chunk of their net worth. Unleashing that value is critical to reaching their post-sale goals. Youre one of the lucky ones if the proceeds of your sale are not required for you to retire or move on.

On the flip side, selling a business involves cutting off your access to the money youve been drawing out of the business every year. Ideally, the proceeds from the sale of your business will be large enough to cover your obligations going forward.

How much money do you need and what sale price will give you what you need? Can your business command that price or anything close to it? If not, now may not be the right time to list your business for sale.

To best assess your financial readiness to sell a company, its often a good idea to engage the services of a reputable wealth manager, an individual who can analyze your entire portfolio and calculate your post-sale needs.

One of the key steps in completing this financial analysis is engaging with a knowledgeable independent third party to value your business. As business valuation is a complex matter, it should only be undertaken by professionals with the appropriate certifications, years of experience and access to a database of comparable transactions. Most business intermediaries will have a handful of appraisal and valuation firms that they work with on a regular basis, and can offer a recommendation.

After receiving a completed business valuation, your wealth manager can now appropriately analyze your portfolio and understand whether or not a sale will yield enough money to fund your projected retirement and allow you to sustain the lifestyle you want post-sale.

If the proceeds from the business sale are not enough to allow you to leave the business, you may need to focus on spending a few years to build up the value before you sell, or you might consider lowering your targeted financial spend after the sale. Alternatively, you might need to come up with a way to supplement your income and bridge the gap.

Assessing Your Emotional Readiness to Sell a Company

The more elusive part of evaluating your readiness to sell is your emotional readiness. Can you really walk away from the business you built for so many years?

While most transitions will require the seller to stay in touch with the new owners for some period of time, there is still that moment when your services will no longer be needed. What are your plans for when that day arrives?

Its best if, as a business owner, you can detail exactly how you are going to spend your days after the sale. This gives a clear indication of whether or not you are ready to sell. For instance, will you plan trips and activities with friends, kids and/or grandkids? Will you pursue a hobby? Or perhaps even run a smaller business in a completely different field? If you cannot describe post-sale life, you should question your sale decision.

While there might be some legitimate reasons an owner has not planned this next phase – burnout, a partnership break-up or an illness – a sellers motivations matter in so many ways.

Knowing the sellers next steps, and motivations for selling, can be extremely important in the actual transaction process. It can be an indication of how they will handle a business negotiation, their willingness to provide the necessary training and transition to a new owner, their flexibility and patience with a deal, and most importantly, their receptivity to heeding the advice of any professionals helping to manage the transaction.

The story of a seller who owned a niche manufacturing business illustrates the importance of assessing emotional readiness to sell.

The sellers business was very unique and had great fundamentals. It was in a great position to attract multiple buyers and, in fact, six very substantial offers were made to the owner shortly after it was listed for sale.

Unfortunately, none of those deals were consummated. Why? It really came down to the fact that the owner was just not emotionally ready to walk away unless he received an exorbitant and unrealistically high offer. He had engaged the expertise of a business intermediary, took the time to meet with many different prospective buyers, and appeared to be committed to selling. Yet when the moment arrived, he could not disengage from the business and he created veiled objections that boiled down to the fact that he just wasnt ready to sell. The net result was that the time, energy and capital of many involved parties was wasted.

To this end, its really important to ask yourself the tough questions before pursuing the difficult and long task of marketing your business for sale. Will you have the necessary funds for your desired post-sale lifestyle, and are you emotionally ready to pursue a life after business ownership? If you cannot develop a post-sale picture of your life, you may need to keep running the business assuming you have the will and drive to remain competitive and relevant.

DOMENIC RINALDI is the Managing Director of Sun Acquisitions which is a lower middle market M&A firm focused on sell-side and buy-side transactions. He was awarded the professional designation of Certified Business Intermediary from the International Business Brokers Association, and is considered an expert in the field of mergers and acquisitions. He is a seasoned executive who brings over 24 years of proven experience in merger/acquisition, sales, service, marketing and operations to his clients.

The M&A Market

A recent article that appeared in the Wall Street Journal ‘Sold! More Small Businesses Exchanged Hands Last Year’ is reflective of the business for sale activity we are seeing here in the Chicago market. Our firm has seen a steady increase in business acquisition activity that is rooted in several market forces and, sans a double dip recession or major world event, we believe is a trend that is likely to continue for the next 7 to 10 years.

One of the primary driving forces has been the steadily improving financial performance of many businesses since early 2010. This is the result of significant expense elimination and reduction combined with a steady recovery in top line revenues. In any given year our firm reviews the financials of approximately 450 businesses; the bottom line of many of these businesses is healthier than even their pre-recession performance. This has enabled owners who couldn’t or wouldn’t sell because of depressed valuations to dip their toes back in the business for sale market.

The other trend fueling this rebound is the large numbers of individual and corporate buyers who are seeking acquisition opportunities. Individual buyers have been largely comprised of people who are in a job transition or fearful that they could be a casualty of corporate downsizing. They are motivated to seek an acquisition as an alternative to the traditional job search. Many of the corporate buyers we work with have seen their cash positions stabilize and grow, and see growth thru acquisition as a potentially safer bet versus growing organically in this uncertain economic climate. The combination of high unemployment rates and corporate growth initiatives has resulted in increased demand for quality business acquisitions.

No real recovery in business transactions can possibly take place without bank lending. The Wall Street article cited the improved lending environment as a factor in transaction volume increases and our firm has definitely seen that trend here in Chicago. There has been a steady and concerted effort on the part of several banks to provide acquisition lending. This is good news for all parties in the transaction – Sellers can hope to secure the majority of the selling price at the closing table and buyers can gain maximum leverage by keeping equity infusions to under 30 percent of the total acquisition price. Access to bank lending is hard work and requires that the company have stable financials with solid fundamentals, and the acquirer must have a great credit history with relevant experience. Our firm alone has had over 40 companies pre-qualified by various banks for lending and we just closed our 9th bank financed deal in 4 months – a trend confirmed by other M&A firms. To put this activity into perspective, we only completed 2 bank deals in the previous two years.

Presidential elections typically split the business for sale market into those owners who take a wait and see approach and hope for an improved economic climate post-election, and those who believe they should get out while the getting is good. This election cycle appears to be no different; however we do see one factor this year that is causing owners to go to market now – the expiration of the bush era tax cuts on December 31, 2012. Given the large government deficits, most of the tax professionals we speak with believe that the current tax rates will likely expire and that there will be an increase in both the capital gains and ordinary income rates. Thus, owners who wait until 2013 or beyond will see their net proceeds from a sale decrease if congress allows the current tax law to expire.

Probably the most compelling trend pointing to increases in the business transaction marketplace is the sheer number of baby boomers who own businesses and will be seeking an exit as they approach retirement. This macro trend is well documented but was temporarily sidetracked by the recession. There is no denying, however, that this wave of retiring baby boomer business owners is barreling down the track and the only question is when, not if, they will pull the trigger. Since May 2011, many business advisory firms have experienced a steady increase in the number of baby boomers seeking exit planning advice – the wave is coming. Boomers should pay attention to the timing of their exit as this wave will likely result in a very large supply of businesses coming on the market which will have the effect of driving business values down. Hard to know when this inflection point will occur but when it does buyers will have many more options and a business will need to stand out to maintain value in a flooded market.

We believe the rebound in transactions is here for the foreseeable future, but like the daily roller-coaster in the financial markets the business for sale market will have many of the same maddening aspects.