Merchant Rate and Exchange Margin in Foreign Exchange Markets

Post on: 26 Август, 2015 No Comment

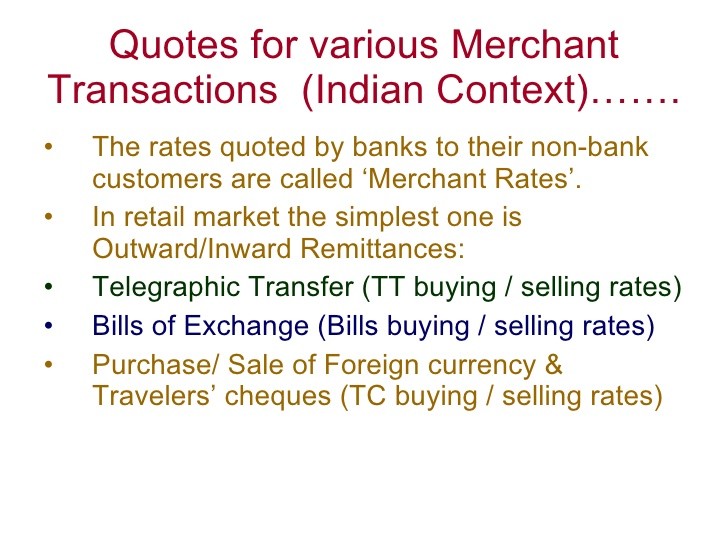

Merchant Rate

The foreign exchange dealing of a bank with its customer is known as merchant business and the exchange rate at which the transaction takes place is the merchant rate. The merchant business in which the contract with the customer to buy or sell foreign exchange is agreed to and executed on the same day is known as ready transaction or cash transaction. As in the case of interbank transactions a value next day contract is deliverable on the next business day and a spot contract is deliverable on the second succeeding business day following the date of the contract. Most of the transactions with customers are on ready basis. In practice, the term ready and spot are used synonymously to refer to transactions concluded and executed on the same day.

Basis for Merchant Rates

When the bank buys foreign exchange from the customer, it expects to sell the same in the interbank market at a better rate and thus make a profit out of the deal. In the interbank market, the bank will accept the rate as dictated by the market. It can, therefore, sell foreign exchange in the market at the market buying rate for the currency concerned. Thus the interbank buying rate forms the basis for quotation of buying rate by the bank to its customer.

Similarly, when the bank sells foreign exchange to the customer, it meets the commitment by purchasing the required foreign exchange from the interbank market. It can acquire foreign exchange from the market at the market selling rate. Therefore the interbank selling rate forms the basis for quotation of selling rate to the customer buy the bank. The interbank rate on the basis of which the bank quotes its merchant rate is known as the base rate.

Exchange Margin

If the bank quotes the base rate to the customer, it makes no profit. On the other hand, there are administrative costs involved. Further the deal with the customer takes place first. Only after acquiring or selling the foreign exchange from to the customer, the bank goes to the interbank market to sell or acquire the foreign exchange required to cover the deal with the customer. An hour or two might have lapsed by this time. The exchange rates are fluctuating constantly and by the time the deal with the market is concluded, the exchange rate might have turned adverse to the bank. Therefore sufficient margin should be built into the rate to cover the administrative cost, cover the exchange fluctuation and provide some profit on the transaction to the bank. This is done by loading exchange margin to the base rate. The quantum of margin that is built into the rate is determined by the bank concerned, keeping with the market trend.