Measuring Volatility with Average True Range (ATR) Financial Web

Post on: 16 Март, 2015 No Comment

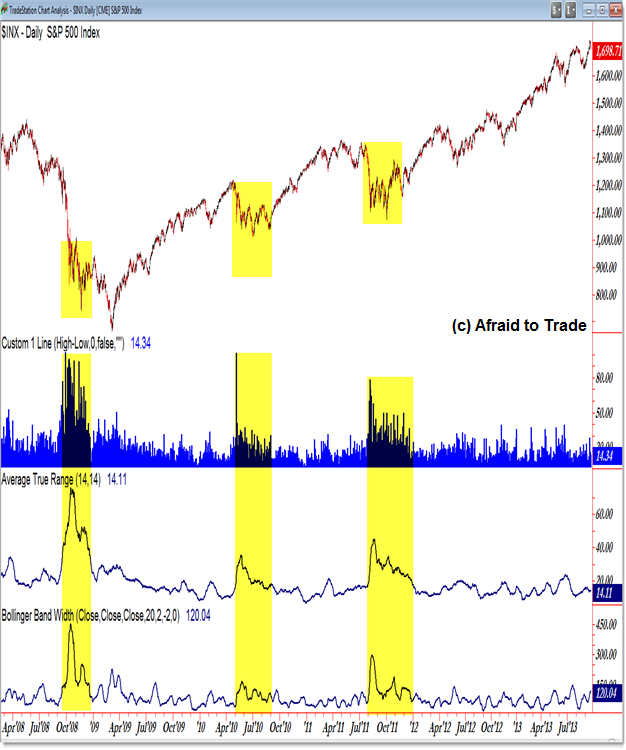

Average True Range (ATR ) is a measure of volatility proposed by Welles Wilder, a technical analyst and trader who introduced the term in his 1978 book, New Concepts. ATR is measured by determining a range based on highs and lows over a current trading cycle. The ATR is always the greatest of three measures:

- Current high less current low

- Absolute value of current high less previous close

- Absolute value of current low less previous close

Terms and Definitions

To understand these three ranges, it is first necessary to understand the terms used. Often, two ranges of securities are used in analysis; there is a short range and a long range. The point where the two crossover is a critical measure of whether the security will trend upward or downward. The current high and current low of a security are the high and low point during the short term range. For example, the range may be one day or 14 days, and the formula is measuring the volatility in that period. Previous close is the security’s closing price on the preceding day of trading. The final term used is absolute value. This means the same thing in finance as it does in math. It is a measure of how far a number strayed from the norm, and whether the move was up or down does not matter.

Current High Less Current Low

Of the three possible ranges used to calculate ATR, current high less current low is perhaps the easiest to understand. The range of prices of a security during a given time will have a high point and a low point. For example, Stock XYZ has been priced between $7 per share and $12 per share in the past 14 days. The value of current high less current low is $5.

Absolute Value of Current High Less Previous Close

To compare this second measure of range, start by simply calculating the current high less previous close. In the scenario above, the current high is $12. The security closed at $10 yesterday. The difference is $2. Since we are only concerned with the size of the movement and not the direction, it does not matter if the security closed down yesterday or up yesterday. The range according to this portion of the measurement is $2.

Absolute Value of Current Low Less Previous Close

Over the same 14-day cycle, the lowest Stock XYZ has fallen is $4. The difference between this currently low and the previous close of $10 is $6. Again, we are measuring in absolute value, so it does not matter whether the stock closed down or up. We are left with a range of $6. According to ATR calculations, we compare all three measurements to determine the true range. Since this last measurement gives us the greatest range, $6, we determine $6 is the average true range for the stock over the 14-day period. If you compare this to another stock with an ATR of $3 over the same period, Stock XYZ can be said to be more volatile. Therefore, it is a riskier investment and should only be pursued if potential profits compensate for potential risks.

$7 Online Trading. Fast executions. Only at Scottrade