Measuring the Performance of the Ivy Portfolio

Post on: 28 Июнь, 2015 No Comment

by Doug Short

I’ve been posting a monthly moving average update for the five ETFs in featured in Mebane Faber and Eric Richardson’s Ivy Portfolio since the spring of 2009, when I featured my review of the book.

In addition to the these monthly updates, a couple of years ago I made a some generic studies of momentum investing with moving averages.

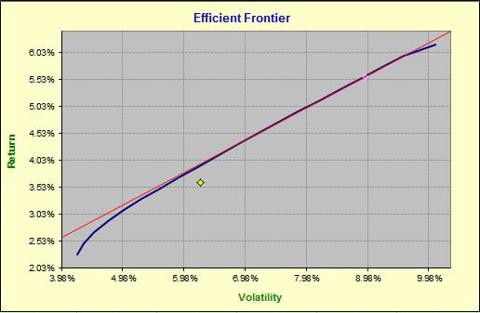

Investing strategies are not the primary focus of my research, and I don’t personally track the performance of the Ivy Portfolio other than to highlight the monthly signals. For ETF performance tracking and backtesting, I use ETFReplay.com. an excellent website for analyzing the performance of individual ETFs and ETF portfolios based on customized moving-average strategies. There are many free tools on ETFReplay.com. However performance backtesting of portfolios does require a paid subscription.

The image below illustrates my research on the Ivy Portfolio since 2007. If you click the image, you’ll open a HUGE version that also shows the monthly performance over the complete range as compared to SPY (SPDR S&P 500 Index). For cash, I’ve used SHY (Barclays Low Duration Treasury (2-yr).

Now, the portfolio in this illustration doesn’t *exactly* match the Ivy five. I picked 2007 as my starting point to show the performance from before the market peak in the Fall of that year. Thus I was forced to make one substitution for the Ivy ETFs EFA (iShares MSCI EAFE Index Fund) in place of VEU (Vanguard FTSE All-World ex-US ETF), which was launched in early 2007 and didn’t produce a 10-month signal until December of that year. But the substitution presumably understates the all-Vanguard IVY portfolio: I make this assumption because VEU monthly has clearly outperformed EFA since March 2009 (99.8% versus 87.2%).

For anyone interested in researching momentum investing with ETFs, the ETFReplay.com website is an outstanding resource, one that I’m pleased to include in my dshort Favorites .

ETFreplay.com is a comprehensive, visually appealing website with an excellent layout and graphics that is coupled with extensive etf performance, portfolio comparisons, basic charting, and superb backtesting capabilities using relative strength and moving averages. Some of the site’s features are available without charge, while most features require a subscription. This review did not contain all the possible screens with examples because of publishing space limitations. For self-directed investors who are swing or position traders, this ETF site offers a solid and quick backtesting capability.